Is Petty Cash An Expense Account Or An Asset Account?

A good question, well its answer is quite simple. In this article, I tried to clarify what exactly is petty cash, and is petty cash an expense account or an asset account?

Woo ready, let’s unlock this answer.

What Is Petty Cash?

In This Article

ToggleFirst, make sure you better understand the term “ petty cash”. In a running business, keeping a proper record of all cash inflows and outflows is quite difficult there are too many transactions- small or large.

For example, if you purchase any inventory by issuing the check, you can easily record it by debiting the inventory account and crediting the cash or bank account in the general journal because it is a large cash amount. But what if you have to record a small cash amount expense? Like because of the late sitting of your staff, you purchase a pizza for your staff amounting to $24. Where to record this amount? In which account? Will you create a pizza expense account for recording this small expense? Or will you pay it by cheque? A Big No.

To record a such type of small expenses, companies create a petty cash fund. That is some amount set aside for spending on small expenses. The amount depends on the size of the company and might range between $30 to $300. So, petty cash is a physical on-hand available cash that a company uses for its small expenses.

Another related term is the Petty Cash Book. Now, what is the purpose of the petty cash book? Companies maintained Petty Cash Book mainly for recording minor cash expenditure, which occurs frequently.

- Petty cash is the small cash amount available for a company to pay its small expenses without issuing any check.

Rules of Preparing Petty Cash Book

Without rules, nothing works better. There is always a need for rules to work appropriately. Let’s discuss some rules that are necessary for maintaining a petty cash account.

1. Amount set in the petty cash account can not use for the payment of salaries or wages.

2. You can’t make advances or loans with this amount.

3. The fund in a petty cash account and receipts for payment should always be equal. For instance, if you have $100 in your petty cash account, the receipt of payment should also be equal to it.

Petty Cash Expenses List

- Postage expense

- Bus fare expense

- Pizza account.

- Supplies expense

- Shipping expense

- Employee reimbursements

Petty Cash Journal Entry

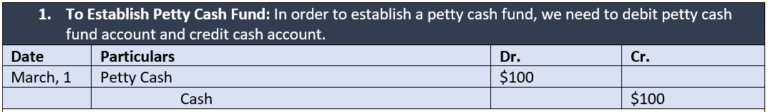

Maintaining petty cash involves three journal entries.

Now, the petty cash fund account has 100 for small purchases.

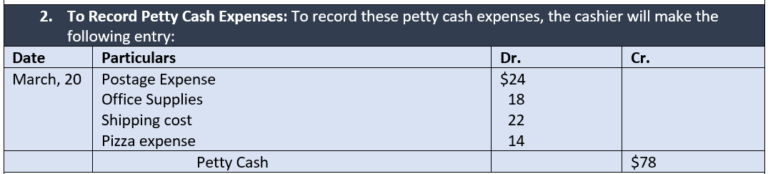

Petty Cash Example: The company had the following expenses during the month of March. Postage $24, Supplies $18, Shipping $22, & Pizza $14.

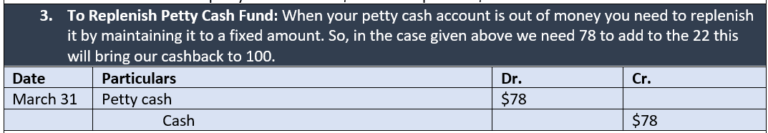

At the end of the month, the petty cash box had $78 of receipts and $22 cash left.

In the end, now the petty cash account balance is again $100.

Is Petty Cash an Expense Account or An Asset Account? Justification.

Before answering this question, another question emerges what is an asset? An asset is anything that a company owns and will give a benefit after a certain period of time.

The petty cash book is no doubt an asset or in other words a current asset. Cash is an asset? Yes, of course then why do we need to think that amount lying in the petty cash fund account is not an asset?

The petty cash fund is used to meet day-to-day expenses. Petty cash in itself isn’t an expense, the amount in the petty cash is actually spent on expenses. For example, you have $100 that $100 is an asset but you use it to pay for your expenses.

What is Petty Cash Used for?

Another evidence of petty cash as an asset is that when an asset increases, we debit it, and when it decreases, we credit it. Similarly, when you establish a petty cash fund account, you record the journal entry as a debit to the petty cash fund account and a credit to the cash account.

As we all know that a petty cash account is just like a cash book both work the same. If a cash book is an asset, then why there would be a question that petty cash is not an asset?

There are two systems under which the petty cash account works:

The Imprest System:

In this system, the main cashier gives some amount to the petty cashier at the beginning or at the end of a specific period. For instance, the main cashier gave $100 at the start of the month of January by the end of the month they spent $80. Now, the main cashier will replenish the petty cash fund account. He will do a journal entry by debiting petty cash with $80 and crediting the cash account with $80. This is the replenishment of cash and thus will bring our cashback to $100.

The Fixed System:

In this system, companies give a fixed amount to the petty cashier for a fixed period. Instead of replenishing the account and examining the amount spent, the main cashier just gives fixed amount to the petty cashier for the company’s day-to-day expenditure.

Why Petty Cash Book?

Where are all the cash-related transactions recorded? In cash book? Yes! Then why do we need another book for recording cash transactions? If you are thinking the same? Don’t think just read! And you are just a step away from the right answer.

In the cash book, large amount expenditures and expenses that don’t occur so frequently are recorded. For example, the purchase of raw material is a costly matter and requires a large amount. Unlike, the petty cash book that keeps records of purchases of milk for tea, pizza for a pizza party, yes, we have a pizza party at our office, and other mischievous expenses.

In other words, by maintaining the petty cash book, they divided the main cashier work for its convenience. Petty cashiers record all the small expenses such as bus fare, payment for a pizza party at the office, or flowers for clients. As opposed to it, the main cashier records transactions that involve large sums of money in the cash book.

It is easy to understand why there is a need for a petty cash book. If you record all these small expenses in the cash book it will make a fuss for the cashier. It will also lengthen the size of the cash book. Therefore, it will become a hard task for the cashier to record and analyze them thoroughly. Hence, the petty cashier records all minor expenses.

So, after getting insight into how a petty cash account works, its rules, and about journal entries there are, I hope, no questions left that whether petty cash is an asset or an expense.

Key Points

- Petty Cash is not an expense account, it is an asset account.

- It is the amount physically available on hand to pay small business expenses.

- The petty cash fund amount can’t use for the payment of large expenses, such as wages and salaries.

- The account works under two systems: Imprest and Fixed System.