Working capital management is very important for any business’s progress because it shows a business’s short-term liquidity and operational efficiency. So, in this post, I have explained the 5 best working capital management strategies that will help you effectively manage working capital.

An effective working capital management strategy must balance current assets against its current liabilities. Ooh! Are you stuck here?……. effective working capital management ensures the availability of enough cash resources to meet your day-to-day business obligations and expenses.

No worries, What you need…. is to manage the two major components of working capital proficiently.

- Current Assets

- Current Liabilities

- A business strategy or a set of strategic business decisions designed to effectively manage and monitor components of working capital (current assets and current liabilities) to ensure the availability of enough cash resources to meet day-to-day business obligations and expenses.

Focused attention and monitoring will protect the company and also ensure to operate business operations effectively. Whereas, the mismanagement will cause liquidity shocks, shortage of cash resources, uncontrolled inventory levels, and eventually a business failure.

Every business needs a different amount of working capital depending on the size and structure of the business. Some companies require to maintain a positive working capital position in order to meet their day-to-day business operations. While some giant companies such as Walmart, Microsoft, and Amazon are maintaining negative working capital positions by using effective working capital management strategies to ensure smooth cash inflows and outflows. However, excessive negative or positive working capital may cause severe financial harm and lead to business failure.

Now, let’s explore the effective working capital management strategies that enhance the business profitability and help to optimize operational efficiency.

Let’s dive straight into it.

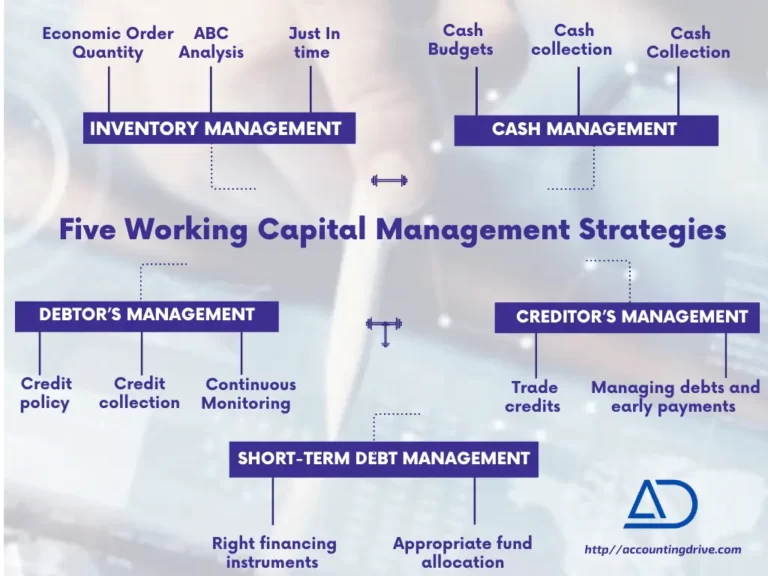

Working Capital Management Strategies

For managing working capital effectively, an entrepreneur should consider two main perspectives:

- First: What should be the amount of working capital or net current assets required to manage business operations effectively?

- Second: What method they should follow for financing working capital?

Here, the question arises, positive or negative working capital, which is better? It’s quite simple. Both are good! companies should make decisions based on their growth strategy and the level of sales with effective management. Thus, to manage your working capital effectively, you need to follow these five effective working capital strategies and techniques.

Get Free access to the AD's working capital cheat sheet

Grab your cheat sheet now by clicking the button !!

1. Cash Management

Let’s first talk about the most important component of working capital: Cash- the most liquid asset.

Companies should maintain an adequate amount of cash and cash equivalent to meet their business expenses to perform their day-to-day operations. Effective cash management allows companies to meet their daily unexpected cash requirements. However, excessive cash holdings may impact a company’s profitability and increase the opportunity cost of capital because it will remain idle and yield no returns.

Then, what are cash management strategies? To manage cash efficiently, following cash management strategies are a true guide. Let’s explore them.

Projected cash flows: Preparation of a cash budget will allow companies to project future cash inflows and outflows. Companies can then determine the optimal liquidity size by comparing profitability with its associated risk. They can control the upcoming cash gap by reducing outflows and increasing inflows.

Cash collection policy: Increased competition compels companies to sell on credit, which will eventually lead toward a high amount of tied-up cash in bad debts and write-offs (uncollectable accounts). Electronic invoicing, credit cards, automatic debit, and electronic wire transfer technologies can speed up the cash collection process.

Cash flow policy: Companies can track and control cash inflows and outflows by following improved billing cycles, and interest-based and floating policies.

2. Inventory Management

The second most important component of working capital: Inventory- optimum level.

Inventory management is the same as cash management- excessive inventory levels may incur high carrying and shipping costs, while inventory shortfalls result in the loss of sales orders and blockage in the production process. Thus, companies have to determine the accurate required optimum inventory level.

By adopting the following strategies, companies can efficiently operate at optimum inventory levels.

ABC Analysis: ABC analysis helps to prioritize products that are in demand and hence improve overall inventory efficiency. Concerning warehouse space requirements, B-class and C-class inventory levels were kept lower to fulfill the Class A high inventory demand.

Economic Order Quantity: EOQ helps to improve efficiency. Companies can use dynamic systems and advanced computer software to determine accurate inventory levels to reduce carrying and holding costs. Other software includes ERP (Economic Resource Planning) and MRP (Material Resource Planning) software.

Just In Time- JIT: The JIT system is specially designed to reduce the high inventory levels and its carrying cost. It facilitates the control of inventory flow- inventory will only be ordered a few hours before it is required for the sale or production process.

3. Debtor’s Management

Debt management is another crucial area that requires adequate controlling and effective handling.

Companies are compelled to sell on credit because of high prevailing market competition. High credit sales allow companies to attract more customers and increase sales but yield high risk as well- bad debts or write-offs. However, reduced credit sales lower the sales volume and involve risk as well.

Thus, companies can maintain an optimum level of investment in account receivables by adopting the following policies.

Effective credit policy: Prior determination of the creditworthiness of each employee based on 5C’s method will enable the company to reduce the risk of bad debts and write-offs. The credit policy should include credit quality aspects, creative credit terms, discount offers, and credit standards.

Credit collection policy: Effective credit collection policy improves collection payments. Early payment incentives and late payment surcharges will minimize the average collection period. Such as, companies may offer (2/5, n/15) credit terms which means those customers who pay within 5 days will receive a 2% discount or otherwise have to pay the full amount within 15 days. Penal interest- late payment charges- is another effective policy that will boost timely credit collection.

Account receivable Monitoring on a continuous basis: Continuous monitoring of accounts receivable and coordination with the customer help to track the performance of the credit collection policy.

4. Creditor’s Management

Effective creditor management helps to build strong long-term relationships with vendors. To reduce ad hoc payments, companies should schedule cheque and cash payment procedures.

Thus, the following strategies will help to build strong relationships with creditors.

Trade credits by suppliers: Effective trade credits allow companies to reduce supplier lead times by stretching and standardizing credit terms with suppliers.

Managing debts and early payments:

- Early payments: Early payments affect liquidity availability and increase the opportunity cost of productive investments.

- Late payments: Late payments affect commercial relationships and the company’s creditworthiness.

5. Short-Term Debt Management

In order to meet the working capital and liquidity requirements to meet short-term operations, companies have to review their inventory levels, trade receivables, and cash account balances. If there is a shortfall, short-term financing can fill the gap. The steps for short-term financing are:

- Right financing instruments

- Appropriate fund allocation

Sources of financing include collateralized loans, revolving credit agreements, uncommitted lines, regular credit lines, factoring, and discounted receivables.

Let’s grasp more understanding! How these above aforementioned five effective working capital strategies will practically benefit the company?

Which Working Capital Management Strategy is Better?

Assume there are two growing companies with the same nature of operating businesses, let’s say: buy and sell inventories.

| A Company | B Company |

| A company maintains high inventory levels, makes payments to suppliers quicker, and grants extended customer credit term, such as 50 days credit term. | B company is following a “Just In Time” inventory system or maintaining high inventory turnover, improving credit collection policy for customers, and stretching supplier credit terms, such as 50 days credit term. |

| Which is better? | |

| High working capital: requires high financing | Low working capital: requires low financing |

| Cash flow: Low cash flow | Cash flow: High cash flow |

| ROA: Low returns | ROA: High returns |

With low financing, Company B can generate increased returns on assets and high cash flow levels by following effective debt and inventory management strategies.

Key Points

- Working capital management is the management of working capital components (Current assets and current liabilities) where current assets must balance their current liabilities.

- Cash is the most liquid asset- an excessive cash balance may increase the opportunity cost of capital and lower down company’s profitability.

- Optimum inventory levels will reduce the risk of inventory shortfalls and lowers down high inventory carrying costs.

- Maintain a balance between early payments and late payments to improve operational efficiency.

- Low WC requires low financing and yields higher returns.

Was this post helpful? comment below.

Tell me, what do you want to know more about?