Before we begin, I have some questions to ask you. Doing a job in a company? Provided services the whole month? But wait! have you got the salary before the month ends? No! this is what accrued revenue is, when a company provides its services or delivers its goods before the payment is received is called accrued revenue.

Quick Through (One-word answer)

In This Article

Toggle- Is accrued revenue an asset? Yes

- Accrued revenue asset or liability? Asset

- Accrued revenue debit or credit? Debit

- Is unearned Revenue Accrued Revenue? No

What Is Accrued Revenue?

It is the revenue that is recognized but not actually received. Moreover, it is also called unbilled revenue. In the accrual basis of accounting, revenue is recognized when it is earned. Therefore, it doesn’t take into account whether cash is received or not.

- Revenue due but not received.

- Worked in advance.

- An asset for the company which will benefit later.

- Unbilled revenue.

Accrued Revenue Example

For instance, you sell goods to a customer. Whenever you sell goods you send an invoice to your customer to get paid. And in return, the customer sends you cash. In accrued revenue, you sell goods or provide services to the customer, but you have not billed the client as yet.

Let’s understand what is it through example.

For example, ABC company sells raw materials to XYZ company. In the month of May, the ABC company sold $50,000 worth of raw materials to XYZ company. The ABC company didn’t bill the XYZ company even after the goods are delivered. In this case, the ABC company will record its revenue as accrued which means the revenue is earned but not received.

How To Record It?

In accounting, nothing can be done without recording. To run a business, we need to record each and everything in order to work properly and effectively.

Journal Entry

How do we pass accrued revenue journal entry? let’s understand this with the help of an example. For instance, you sold goods to the customer on credit. According to which you have done the work, but you haven’t sent an invoice to the customer.

| Date | Particular | Debit | Credit |

| XXX | Accounts receivable | **** | |

| Service revenue | **** |

Adjusting Entry

In accrued revenue, revenue is earned, but the invoice is not sent to the customer. Therefore, the revenue will not be recognized until the invoice is sent and then revenue/cash is received. So, in this case, we need to pass accrued revenue adjusting entry.

For instance, I hire you to develop a website for me in the month of June, and you did the work the whole month and deliver it at the end of the month of June. Now, as you can see that you have delivered the work, but you are not paid as yet. So, you will record it as accrued revenue as you have not received the cash as well as not billed the customer as yet.

Let’s make an adjusting entry from your point of view. You earned the revenue but haven’t sent an invoice. Your revenue is going up so you will credit it to your income statement. The increase in revenue is credit while a decrease is a debit. While accrued revenue is an asset. How is it an asset? it is an asset because it is an amount that you are going to receive in the future. Furthermore, you will get benefit from it in the future. The increase in assets is debit. So, you will debit your accrued revenue account.

| Date | Particular | Debit | Credit |

| June 30th | Accrued revenue | ***** | |

| Revenue account | ***** |

This journal entry has allowed you to recognize the revenue in your income statement in the month of June. When you earned it.

Further Adjustments

Let’s move to July. What happens when you send an invoice to the customer? You need to post another journal entry.

In this transaction. You are the seller; you need to send a sales invoice. Sales invoices are recorded in accounts receivable. Accounts receivable is an asset. So, the increase in assets is debit. In order to record your sales invoices, you need to debit your account receivable. Now you need to decrease your accrued revenue account, which is an asset, so the decrease in it will be credited.

| Date | Particular | Debit | Credit |

| July | Accounts receivable | ***** | |

| Accrued revenue | ***** |

After a few days when you will receive the cash from the customer. You need to record another journal entry. As you have received the cash which is an asset. Therefore, the cash account will be debited. Moreover, you will credit your account receivable account.

| Date | Particular | Debit | Credit |

| August | Cash | **** | |

| Accounts receivable | **** |

Is Accrued Revenue an Asset?

Whether it is an asset or not? Are you searching for the answer to these questions? Then, here we have clarified all these queries.

As mentioned above it is the amount that a company will receive in the future for the delivery of goods or services. So, the company records this amount as accrued revenue in its books. Moreover, it is an asset (an asset is something that gives us benefit in the future). Similarly, this is going to give a benefit to the company when received.

In addition, as the company has delivered its services. Now it has the right to record it as an asset. Moreover, the increase in it is debit while a decrease in it is credit. This also signifies that it is an asset as it is the normal balance of the asset account.

Differences

Accrued Revenue Vs Account Receivable

There is a slight difference between these two. Both records revenue which we are going to receive in the future. The difference lies in whether the invoice is sent or not.

You record your revenue as accrued when you have done the services and waiting to get paid. But you haven’t sent an invoice to the customer as yet because of some reasons.

On the other hand, revenue is recorded in account receivable when you have done the services, goods are delivered to the customer. In addition, you have sent the invoice to the customer as well.

So, this is the basic difference between both. One is recorded after the goods are delivered but the invoice is not sent. The other one is recorded when goods are delivered, and an invoice is sent. Accrued revenue is unbilled while accounts receivable are billed.

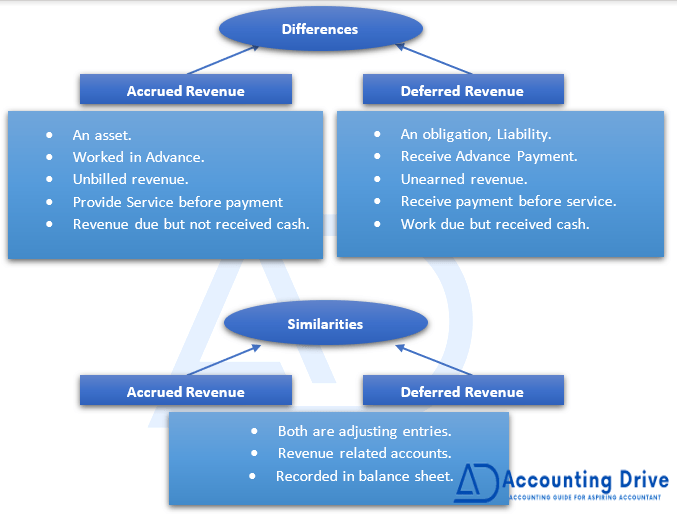

Accrued Revenue Vs Deferred Revenue

If we look into the difference between accrued revenue and deferred revenue. We will get to know that both possess entirely two different ideas. There is a stark difference between the two. First of all, Prior is an asset while the latter one is a liability. Therefore, one is recorded under asset accounts on the balance sheet while the other one goes into the liability side of the balance sheet.

One is unearned revenue while the other is unbilled.

Deferred revenue is also known as unearned revenue as long as goods are not delivered. The company has received the payment from the customer. Now it is obliged to deliver its goods and services. Once the goods are delivered the unearned revenue becomes earned. After that, it will be recorded as revenue in the income statement of the company.

Most importantly, deferred revenue is recognized when the company receives the cash, regardless of the delivery of services. On the other hand, accrued revenue is recognized after the delivery of the goods without taking into account whether cash is received or not.

After reading the difference it must have become quite evident that both are completely different.