Have you ever got payment for something before delivering services? Or have an online shopping experience? If yes, then you must have heard of advance payments. Similarly, deferred revenue is advance payments that you receive earlier before making delivery of products or services.

Curious to learn about deferred revenue and how you can recognize and differentiate it as liability or revenue? Here you go. In this article, I pinpoint some main points.

What Is Deferred Revenue?

In This Article

ToggleDeferred revenue is the revenue that you earn before services or products are being delivered. So, it is therefore considered a liability. You are liable to deliver services for which you have already been paid.

It is the unearned revenue. To earn this unearned revenue, you first have to deliver goods or services to the customer.

Deferred Revenue Recognition

As far as recognition of deferred revenue is concerned it is recognized as a liability on the balance sheet. Moreover, the company is obliged to pay for earned revenue that is actually unearned. And the company may pay for it in the form of delivering products or services. In simple words, you have earned the revenue as you have received the payment, but it is still unearned in the sense that you need to earn it by delivering services. Once it is recognized it is recorded as a credit to the income statement and debit to the deferred revenue account. Moreover, GAAP provides different methods to recognize it based on the industry size and type.

Is Deferred Revenue A Liability?

Aahh the question is a bit tricky! But no worries no tricks can play you. As long as you are here with us. Here we have clarified all the ifs and buts and made things clearer.

After hearing the term “deferred revenue” you may rush to the conclusion by calling it “revenue”. Wait a bit and take the whole term into account which is “deferred revenue”.

The literal meaning of deferred is to delay, postpone, or prolong. So, deferred revenue is the revenue that is received but not earned, and the services or delivery of products may be delayed, prolonged, or postponed.

Hence it is the amount that you receive from a customer for the services which are still unpaid or undelivered. Thus, it is a liability.

Example

To get a deeper understanding of things there is always room for examples. So, let’s dive into examples.

Let’s have a simplest yet most relatable example, all of us have one common gadget which is the mobile phone life without it is unthinkable. For instance, you subscribe monthly internet package. You need to pay for it in advance. And the company from which you have availed the services is obliged to deliver its services throughout the month. In this case, the company is liable to deliver its services. Hence it is a liability to the company.

Another example is very close to reality and thus to us too. Living in a house where you have to pay? Or getting rent from one of your apartments. So, when you pay rent in advance it is a liability to the owner. You paid in advance now you can avail of the services throughout the month. Contrarily, the owner, who has received the payment, is obliged to pay for its services.

Deferred Revenue Accounting

In accounting, if we look into the balance sheet which includes assets, liability, and equity. The deferred revenue on the balance sheet is recorded as a liability. As it is a payment by customers in advance for the goods, services or products yet to be delivered.

As far as the income statement is concerned, we do not record deferred revenue in the income statement. In other words, it is not an income as long as you have not delivered your services. Once you deliver services, it will record as revenue or income in the “income statement”.

Journal Entry

To record the Deferred revenue journal entry, you debit your assets and credit your liabilities. For instance, a company has received rent in advance in this case the company will debit the bank account and credit rent in advance.

| Date | Particulars | Debit | Credit |

| XXX | Bank Account | $20,000 | |

| Unearned Rent | $20,000 |

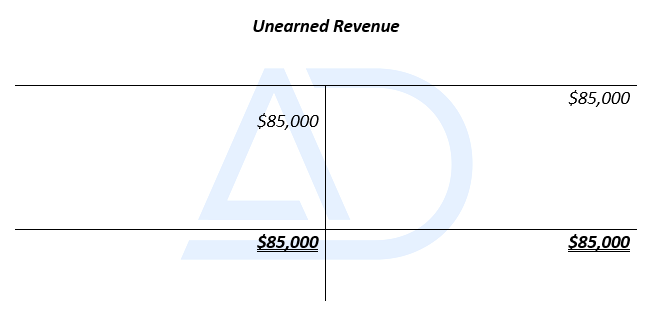

Let’s have another journal entry for receiving cash before the goods are being delivered. For instance, a company sells motor parts throughout the city. Mr. John has already paid for the motor parts before even receiving them. In this case, as we know that whenever cash is received it is debited. So here the company has received cash, but the motor parts are yet to be delivered. Therefore, there will be a debit to the cash side and a credit to the unearned side.

| Date | Particulars | Debit | Credit |

| XXX | Cash | $85,000 | |

| Unearned Revenue | $85,000 |

So, after delivering motor parts to Mr. John, the company will close its unearned revenue account (liability) into earned revenue account by making the following adjusting entry.

| Date | Particulars | Debit | Credit |

| XXX | Unearned Revenue | $85,000 | |

| Revenue | $85,000 |

Moreover, the deferred revenue T Account would be like that:

Deferred Revenue Vs Accrued Revenue

What is the difference between deferred revenue and accrued revenue? Or is there any similarity between them? Looking for the answers to these questions? Here you are just a step away and all your queries will vanish.

In accrued revenue, goods are delivered but the revenue is not received. You record the revenue before receiving the revenue.

On the other hand, in deferred revenue, cash is received, or revenue is received before the delivery of goods or services.

Let’s understand this by looking at two sides of a picture.

For instance, Oliver and sons sell raw materials to Noah steel which is a steel-making company. In the month of October, Noah steels bought raw material worth $2,00,000 from Oliver and sons but did not pay for it. Here Oliver and sons will record a journal entry of accrued revenue. In which it will debit its asset account which is accounts receivable or Accrued revenue and credit the raw material account.

Now let’s have another example, one of the customers of Noah steel has bought motor parts from the company and paid for them beforehand. In this case, payment is made in advance. Therefore, it is a deferred revenue example. Moreover, the company has received the payment in the form of cash before the goods are delivered. As a result, the company will debit its asset which is cash, and credit unearned revenue.

| Deferred Revenue | Accrued Revenue |

| You record after you are paid. Payment is received before the delivery of goods. | You record before you are paid. Goods are delivered before payment. |

Key Points

- Deferred revenue in the simplest words is the payment received in advance.

- It is a liability to you as you need to deliver goods or services for which payment is made.

- In accrual accounting, you record before you are paid. Contrarily, in deferred, you record after you are paid.

- In cash accounting, deferred revenue is not recorded because it only records revenue when you actually receive cash.