Hey, aspiring accountants, small business owners, and entrepreneurs! With having little knowledge of bookkeeping and accounting, are you worried about how you will manage and report your expenses and revenues? Then no worries. Here is a simple cash accounting guide for you to prepare your annual financial reports. Cash accounting is easier than accrual accounting concepts.

So, let’s start with me. It’s very easy and simple.

What is Cash Accounting?

In This Article

ToggleCash accounting is a fundamental method of accounting in which an organization or a business entity records all the revenues when it actually receives the cash, while it records the expenses when it actually pays them. Further, it is commonly famous among individuals & small businesses that keep no inventory and where transactions can easily be traceable. This method only considers two kinds of transactions, i.e., cash inflows & outflows. Simply, to record these transactions, you can use a Single-entry accounting system. There is no counterpart between revenue & expenses in a specific accounting period, so making a current year’s comparisons from previous periods is impossible.

Simply put, Cash accounting is a simple and straightforward accounting method that records revenues and expenses only when cash is involved. Thus, in this method, the company reports revenues only when cash is actually received by the customer and records expenses when actually paid in cas

“IRS (Internal Revenue Service) allowed smaller or incorporated organizations to choose any accounting method -cash accounting or accrual accounting method, based on their ease. But organizations that have annual gross receipts of $25 million or above are required to use the accrual accounting method.”

IRS- Internal Revenue Service

Cash Accounting Advantages & Disadvantages

| Advantages | Disadvantages |

| Future profits help to offset current losses. Easy cash flow Simple single-entry system No trained professional is required No need for complicated accounting software Know much actual cash is available Control the timings of your transactions | Less accurate accounting results Moneylenders refuse to lend money Audit the financial statements Companies cannot issue management reports. Doesn’t have an in-built error checking system Not exhibit a true picture of current liabilities Overstate or understate the performance |

Advantages of Cash Accounting

- Future profits help to offset current losses.

- Easy cash flow- No need to pay taxes on income that the company has not received yet.

- You can easily understand cash accounting despite you don’t have any or little knowledge of accounting & finance. Because it is based on a simple single-entry system.

- As it follows a single-entry system so there is no trained professional to implement & imposed an accounting system.

- You don’t need complicated accounting software in this accounting method. Therefore, you can easily manage a single-entry system in any notebook or on a spreadsheet.

- You would know how much actual cash you have in a certain period, as it follows all the cash inflow and cash outflow.

- By recording the transactions in a period of cash exchange you can easily control the timings of your transactions. Thus, this process will increase the fluctuation of your expenses & decelerate your revenue. By doing so companies may reduce their liability of tax by lawfully increasing their expenses and decreasing their income.

Disadvantages of Cash Accounting

- It shows less accurate accounting results because the cash flows do not exhibit the actual timing which affects the financial condition of a business.

- You can’t get accurate financial statements in cash accounting as a result money lenders refuse to lend money to businesses.

- Most of the time auditors do not accept to audit the financial statements of those companies that follow this type of accounting system.

- Companies cannot issue management reports because their financial statements are mostly inaccurate,

- Cash accounting methods do not give owners & managers crucial information for the assessment of the company’s financial position.

- As it doesn’t have an in-built error checking system, there are chances that the error will go undetected until the firm get a bank statement that has an unexpected low a/c balance or an overdrawn account.

- It does not exhibit a true picture of the company’s current liabilities– incurred liabilities.

- Overstate or understate the business performance because cash receives in advance.

Cash Accounting Example

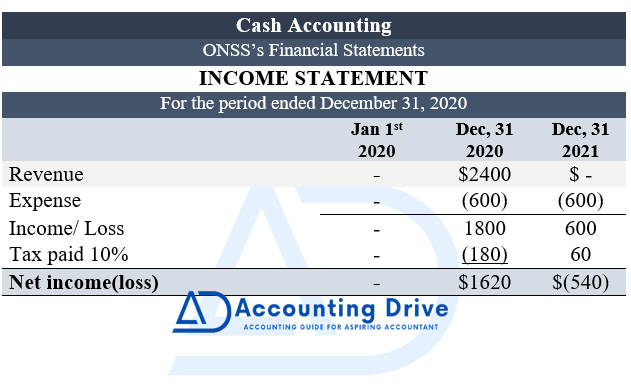

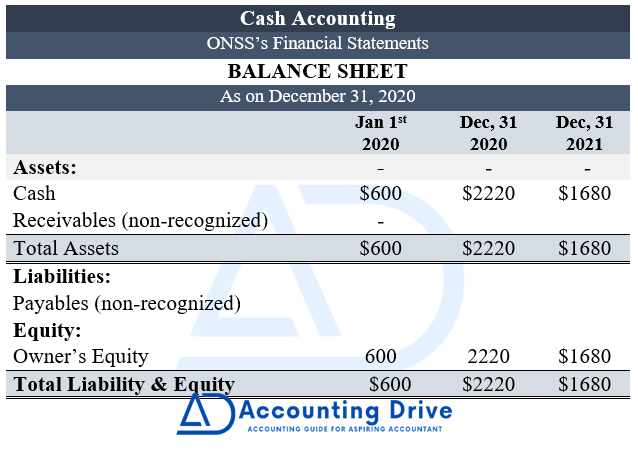

In this example, you will see the income statement & balance sheet perspective of cash accounting.

| Assumptions for Cash accounting |

| The company (ONSS) has $600 cash in hand and the owner’s equity of $600 on January 1st, 2020. A client subscribes to 2 years of online news subscription service (ONSS) on January 1, 2020. He will start to receive the service from January 1st, 2020, till December 31, 2021. The two-year subscription may cost $2,400 and the full payment is made at the start of January 2020. The expense he needs to give to the service every month is $50 or $600 annually and the tax rate is 10%. The payments are remitted back by the Internal Revenue Service at the year-end (unless a loss occurred in a certain year). |

Transaction descriptions for cash accounting by line item has given below in the financial statements for 2 years.

| January 1st, 2020 | January 1st, 2020, Column shows the starting balance for ONSS. No transactions have been recorded except the beginning cash balance & owners’ equity. |

| Dec 31, 2020 | Dec 31, 2020, column shows the ONSS year-end financial statement for the 1st year. ONSS has given the 1st year’s online service and provided related expenses. It got the full payment for the 2-year subscription from the client in January 2020. Therefore, taxes have paid are higher on a cash accounting at the end of the 1st year because the company has recognized the full payment as revenue. |

| Dec 31, 2021 | Dec 31, 2020, Column shows ONSS’s 2nd-year financial statistics. Here, ONSS has given the 2nd years’ online service and provided related expenses. |

The Explanation for Income Statement

| January 1st, 2020 | No revenue and expenses are recognized because it is the opening balance. There is no opening balance of income is present to record without any figure for revenue and expenses. |

Dec 31, 2020 | $2,400 is recognized as revenue in 2020 because of the payment received in January 2020. $600 is recorded as an expense in the 1st year even the revenue for both years has been recognized. Therefore, $1,800 income has been recognized on a cash accounting. $180 taxes have been paid in the first year on a figure of $1,800 (income). After that, $1,620 in income after taxes has been recognized in the 1st year. |

| Dec 31, 2021 | In this method, no revenue has recognized in 2021 because the full $2400 amount was already recognized as revenue in 2020. $600 was recorded as an expense in the current year. To clarify, $600 is recorded as a loss in 2021 because the full payment worth $2,400, is already recognized as revenue in 2020. A $60 is tax refund as carrying back the current years’ loss from the previous years’ income. Consequently, a $540 loss after tax refund has been reported for the current year. |

The Explanation for Balance Sheet

| January 1st, 2020 | $600 cash in hand at the start of the year. No receivables and payables at the start of the year because Cash Accounting would not usually recognize them. $600 owners’ equity at the start of the year. |

| Dec 31, 2020 | 2,220 cash in hand at the end of the 1st year under the cash accounting. (ONSS’s opening cash in hand is $600 & received a one-time payment of $2,400 in January 2020, received $3,000 cash in hand in January 2020. During 2020 paid cash in terms of operating expenses $600 and taxes $180, resulting fig is $2,220 cash in hand at the year-end, ($600 + $2,400 – $600 – $180 = $2,220). The method normally does not recognize receivables/payables. $2,220 owners’ equity at end of the year, full payment of cash was recognized as revenue in 2020. |

| Dec 31, 2021 | $1,680 amount of cash is available at the end of the 2nd year. (*$1,680 owners’ equity, a decrease in the amount of $540 as compared with the end of 2020 due to the loss of $540 is recorded in 2021. At the beginning of 2020, an increase in the amount of $1,680 in owners’ equity.) |

When does a Company Use Cash Accounting?

You find that cash accounting is perfect when most of the business activities are based on cash transactions. If a business sells or buys on credit, it won’t work well. The reason is cash accounting removes what may be substantial assets (accounts receivable) & liabilities (accounts payable). It is also not suitable for businesses that hold an enormous amount of inventory for resale or as raw materials. Inventory with a smaller sum of money can be realized as “non-incidental materials & supplies” which can be written off from the accounts as sold/used.

Now you know that this method is a simple & easy method of recording cash transactions for expenses & revenue. It is suitable for small companies. Because of many shortcomings in this accounting system, which we have discussed above, organizations normally shift their accounting system from cash accounting to the accrual basis of accounting after they move forward from the initial start-up to grow further. Eventually, if a company will use whichever method (cash or accrual), it will use for both accounting & tax purposes.

Key Points

- Cash accounting is an accounting method that records only the inflow and outflow of cash.

- Another name used for this accounting method is cash-basis accounting.

- The method does not recognize account payables and receivables.

- It is suitable for small companies. While large organizations use the accrual accounting system-GAAP (Generally Accepted Accounting Principles).

- Partnerships with C Corporation Partners, Tax shelters, and C Corporations use the accrual accounting method for financial reporting under the Tax Reform Act of 1986.