Working capital vs current ratio? Isn’t it seems confusing…

Are they inter-exchangeable terms or have different concepts and understandings with respect to liquidity point of view?

So, let’s Explore it with me…

Working Capital vs Current Ratio

In This Article

ToggleWorking capital and current ratio- both are liquidity metrics and use the same balance sheet items- current assets and current liabilities for calculations. Simply put, Working Capital is the leftover amount after paying all the business operating expenses. Whereas the Current Ratio is the ratio or proportion which indicates the efficiency of current assets to pay off current liabilities.

- Therefore Working capital is the total amount available to pay off short-term financial obligations. While Current Ratio is the liquidity ratio which indicates the capacity of current assets to pay off current liabilities.

Let’s first explore these two terms- working capital and Current ratio in detail.

Working Capital

WC- Working capital is the total short-term capital amount you needed to finance your day-to-day operating expenses.

Working Capital Formula

Working Capital = Current Assets – Current Liabilities

Get Free access to the AD's working capital cheat sheet

Grab your cheat sheet now by clicking the button !!

What is good Working Capital?

When current assets are greater than current liabilities- A positive working capital position indicates that the company can cover its short-term debts with the available cash resources.

When current assets are equal to current liabilities- A neutral working capital position indicates that the company can just cover its short-term debts with the available cash resources.

When current assets are less than current liabilities- A negative working capital position indicates that the company is unable to cover its debts with the available cash resources. Sometimes maintaining a negative working capital position is beneficial because, in this position, companies use customers’ and suppliers’ money to run their businesses.

Current Ratio

The current ratio is a liquidity measure that identifies how many dollars of current assets are available to cover each dollar of current liabilities. Moreover, the term working capital ratio is also used for the current ratio, both have the same meaning.

Current Ratio Formula OR Working Capital Ratio Formula

Current Ratio = Current Assets / Current Liabilities

What is a good Current Ratio?

When the current ratio is greater than 1– let’s say around 1.1 to 2, it indicates that the company has enough resources to pay off its current liabilities. It represents a balanced ratio- a healthy financial state.

When the current ratio is equal to 1, it indicates that the company can just pay its short-term liabilities. It represents a normal ratio- a normal financial state.

When the current ratio is less than 1– let’s say around 0.2 to 0.6, it indicates that the company has not have enough resources to pay off its current liabilities. It represents a negative ratio- not-good financial liquidity. Thus, this situation can lead to bankruptcy because of a shortage of cash. While best management strategies can reverse the impact of a negative ratio.

When the current ratio is greater than 2– let’s say around 2.1 to 2.5, it indicates that the company has more than enough resources to pay off its liabilities. Hence, it represents an excess of available current assets which indicates poor utilization of available resources.

Summary (Working Capital vs Current Ratio)

| Working Capital | Current Ratio |

| Working Capital = Current Assets – Current Liabilities | Current Ratio = Current Assets / Current Liabilities |

| Positive Working Capital= CA > CL Neutral Working Capital= CA = CL Negative Working Capital= CA < CL | Balanced Ratio= Ratio greater than 1 Normal Ratio= Ratio equal to 1 Negative Ratio= Ratio less than 1 |

Example- Working Capital vs Current Ratio

Seems very confusing for beginners because both terms use the same balance sheet items for measuring the liquidity position of a company. Thus, to better understand the difference between these two distinct terms, Let’s identify the difference with the help of the following example.

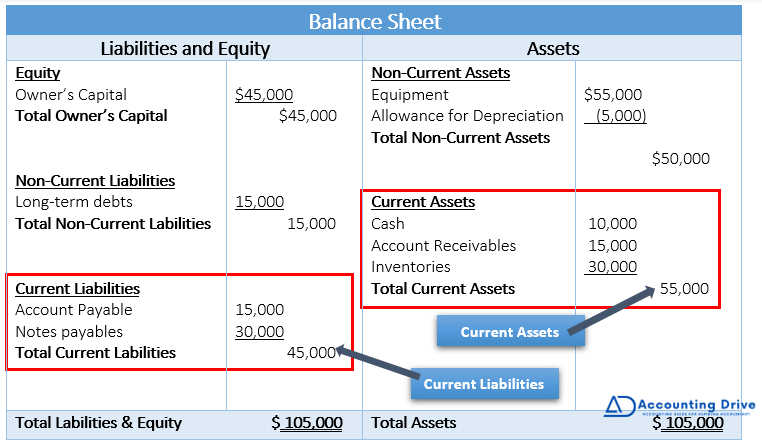

Assume Miss Jena is the owner of Jenna’s Collections. After completing one year, she wants to measure the liquidity position of a company. So, the balance sheet is listed below:

Calculation of Working Capital

Based on the above information, you can calculate working Capital and Current Ratio. First, let’s calculate working capital. So, how to calculate working capital is quite simple. Therefore for working capital calculations, you require two balance sheet items- Current assets and current liabilities. Here, total current assets are $55,000 and total current liabilities are $45,000.

Working Capital = Current assets – current liabilities

= $ 55,000 – $ 45,000

= $ 10,000

So, Working Capital is $10,000 which means that after paying all obligations, Jenna’s Collection has left $10,000 in its short-term Capital. It indicates the healthy financial position of a company with low risk.

Calculation of Current Ratio

Now, let’s calculate the current ratio. How to calculate the current ratio is also simple. The same goes for the current ratio. First, identify the total current assets and total current liabilities.

Current Ratio = Current assets / current liabilities

= $ 55,000 / $ 45,000

= 1.2 : 1

The Current Ratio is 1.2 which is greater than 1. It indicates the healthy financial position of a company and a balanced ratio. 1.2 Ratio indicates that the company has $1.2 of current assets to cover each $1 of current liabilities.

Thus, working capital and the current ratio are two separate terms. Working capital is the amount whereas the current ratio is the proportion or quotient available of current assets to pay off current liabilities. In addition to this, the current ratio is important with respect to the investors’ point of view. The current ratio gives a quick grasp over the liquidity position of a company to investors. Whereas working capital is important with respect to the owner’s point of view. Because working capital tells the financial stability of a company and helps to fulfill short-term goals.

Key Points

- Working Capital and Current Ratio: these two are distinct terms.

- The current ratio is the ratio that identifies the availability of current assets to cover current liabilities.

- Working capital is the leftover amount after paying all current obligations.

- Both current ratio and working capital identify the liquidity position of a company and use the same balance sheet items- current assets and current liabilities.

- The current ratio is the liquidity Metrix for investors. Whereas working capital is the liquidity Metrix for management.