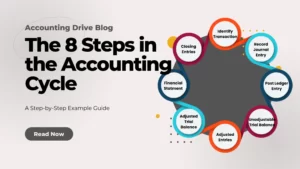

The accounting cycle comprises of eight collaborative steps. They are:Identifying and analyzing the transactions Recoding these transactions into the general journal Posting to the General Ledger Preparing a trial balance Making adjusting entries Preparing an Adjusted Trial Balance Preparing financial statements Closing accounts

Accrual Accounting

When a sole proprietor or the business owner withdraws assets such as goods or cash from business for his personal use, accounting termed it as owner’s drawing.

Reversing entries in accounting records at the beginning of an accounting period to cancel out or reverse the effects of adjusting entries of preceding accounting period.

A business transaction (selling or buying a thing) that does not involve cash is called non-cash transaction.

Account receivable is classified as an asset because it is the amount that the company will receive on behalf of the services that it has provided.

When a company provides its services or delivers its goods before the payment is received is called accrued revenue.

𝐔𝐧𝐞𝐚𝐫𝐧𝐞𝐝 𝐑𝐞𝐯𝐞𝐧𝐮𝐞: 𝐖𝐡𝐞𝐧 𝐈𝐭 𝐁𝐞𝐜𝐨𝐦𝐞 𝐄𝐚𝐫𝐧𝐞𝐝? The questions like what is unearned revenue? How to calculate it and recognize it? When is …

How To Prepare A Control Account? Example and Format What is control account and how does the control account work? And which …

Under the revenue recognition principle, revenue is recognized when it’s earned, not when cash is received.

𝐃𝐞𝐟𝐞𝐫𝐫𝐞𝐝 𝐑𝐞𝐯𝐞𝐧𝐮𝐞: 𝐓𝐫𝐞𝐚𝐭𝐞𝐝 𝐀𝐬 𝐀 𝐋𝐢𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐎𝐫 𝐑𝐞𝐯𝐞𝐧𝐮𝐞? Have you ever got payment for something before delivering services? Or have an online …