As an accounting student or professional, you must be well aware of the complete accounting cycle. The whole accounting revolves around the Accounting Cycle. It is a complete process where an accountant or the bookkeeper performs accounting tasks.

What is Accounting Cycle?

In This Article

ToggleThe Accounting Cycle is the complete accounting process that starts with the identification of financial transactions and ends with the preparation of financial statements and the closing process.

Steps in the Accounting Cycle

The accounting cycle comprises eight important steps. They are:

- Identifying and analyzing the transactions

- Recoding these transactions into the general journal

- Posting to the General Ledger

- Preparing a trial balance

- Making adjusting entries

- Preparing an Adjusted Trial Balance

- Preparing financial statements

- Closing accounts

Let’s take a closer look at each individual step of the accounting cycle:

- 1st Step: Identifying and Analyzing Transactions

The cycle starts when a financial transaction occurs such as the purchase of an asset or sale of an inventory. A transaction is a business event that involves two things: monetary value (money) and an exchange of goods or services. For example: Mr. John purchased office equipment from Mr. Alison for $50,000 on the 10th of July. Here, $50,000 is the monetary value, and two persons Mr. John & Mr. Alison exchange Office Equipment for money.

- 2nd Step: Recording these transactions into the general journal

After analyzing transactions, now is the time to record these transactions in the general journal. A general journal records all financial transactions in chronological order. The general journal format includes the date, accounts affected, amounts, and a brief description of the transaction.

For Example: Mr, Ahmed made a purchase of equipment worth $1200, then the transaction would be Debit Equipment with the amount of $1200 and credit cash with the same amount of $1200.

3rd Step: Posting to the General Ledger

When you record all transactions in the general journal, now, is the time to post these all transactions in the appropriate T account (General Ledger). The accounting cycle is a very easy step-by-step process.

For example, you have made an entry where you debited the Entertainment account for $40 and credited cash $40. Now, this transaction will affect the Cash and Entertainment account only, where, on the Cash T Account, you will decrease or put his $40 amount on the right side of the T account.

- 4th Step: Preparing a Trial Balance

This step will tell you whether your all debits and credits are equal or not. Trial Balance has 3 columns: Particulars, Debit, and Credit. The total of all debits should equal the total of all credits.

- 5th Step: Making Adjusting Entries

Adjusting entries are made at the end of an accounting period to adjust those accounts that need to be updated or adjusted. Adjustments include the recording of depreciation expense, the gradual release of prepayments, and the recording of earned revenue from unearned revenues at the end.

- 6th Step: Preparing an Adjusted Trial Balance

After adjustments, there is a need to prepare a trial balance again that ensures that all credits and debits are equal. This new trail balance is termed an adjusted trail balance.

- 7th Step: Preparing Financial Statements

The seventh step requires to prepare financial statements including the income statement, balance sheet, Statement of Retained Earnings, and cash flow statement. These statements are helpful and show the company’s current financial position and performance.

- 8th Step: Closing Accounts

Closing accounts is the last step, where you have to close all temporary accounts such as expenses and revenues (mostly income statement items) to retained earnings and owner’s equity account. This is very essential step to restarting your accounting cycle for the next accounting period.

Step-by-Step Example of Accounting Cycle

1. Identifying and Analyzing Transactions

Now, let’s have a closer look on the complete accounting cycle process by performing the following example step by step.

During the month of January, Haram’s Company process the following transactions.

TRANSACTIONS

- 02/01/2023. Salim started business with cash investment of $20000.

- 02/01/2023. Purchased Office building worth $35,000 and land costing $15,000. The Office building will have estimated salvage value of $5,000 with a useful life of 25 years.

- 03/01/2023. A promissory note of $30,000 was executed at a State Bank. Both the principal and interest will be paid on the maturity date of January 3, 2019.

- 04/01/2023. Furniture was purchased with a cost of $15,000, paid in cash. It has a useful life of ten years and is not anticipated to have any salvage value.

- 05/01/2023. A property insurance policy, spanning 24 months, was acquired in cash $6,000.

- 06/01/2023. The company placed an advertisement in the local newspaper, making a cash payment of $450 for the ad, which will run throughout the month of January.

- 07/01/2023. Cleaning supplies purchased on credit, with a total cost of $950. The invoice is payable within a 30-day period.

- 15/01/2023. Total of $4,230 in wages for the first half of the month was paid in cash.

- 16/01/2023. A guest paid a cash deposit of $980 for a two-week stay. The guest plans to stay from the last week of January through the first week of February.

- 31/01/2023. Total cash receipts from room rentals for the month amounted to $8,300.

- 31/01/2023. The cash receipts from the operation of the restaurant for the month totaled $6,600.

- 31/01/2023. Each stockholder received a cash dividend payment of $200.

2. General Journal

The 2nd step in the Accounting Cycle is to prepare the General Journal. Now it’s time to record the above transaction in the general Journal. Let’s get started.

General Journal | |||

| Date | Description (Account Name) | Debit | Credit |

| Jan 2. 2017 | Cash | 60,000 | |

Capital Stock | 60,000 | ||

| Jan 2. | House | 35,000 | |

Land | 15,000 | ||

Cash | 50,000 | ||

| Jan 3. | Cash | 30,000 | |

Notes Payable | 30,000 | ||

| Jan 4. | Furniture | 15,000 | |

Cash | 15,000 | ||

| Jan 5. | Prepaid Insurance | 6,000 | |

Cash | 6,000 | ||

| Jan 6. | Advertising Expense | 450 | |

Cash | 450 | ||

| Jan 7. | Cleaning Supplies | 950 | |

Account Payable | 950 | ||

| Jan 15. | Wages Expense | 4,230 | |

Cash | 4,230 | ||

| Jan 16. | Cash | 980 | |

Rent Received in Advance | 980 | ||

| Jan 31. | Cash | 8,300 | |

| Revenue- Rental of Rooms | 8,300 | ||

| Jan 31. | Cash | 6,600 | |

Revenue- Restaurant | 6,600 | ||

| Jan 31. | Dividends | 600 | |

Cash | 600 | ||

| 183,110 | 183,110 | ||

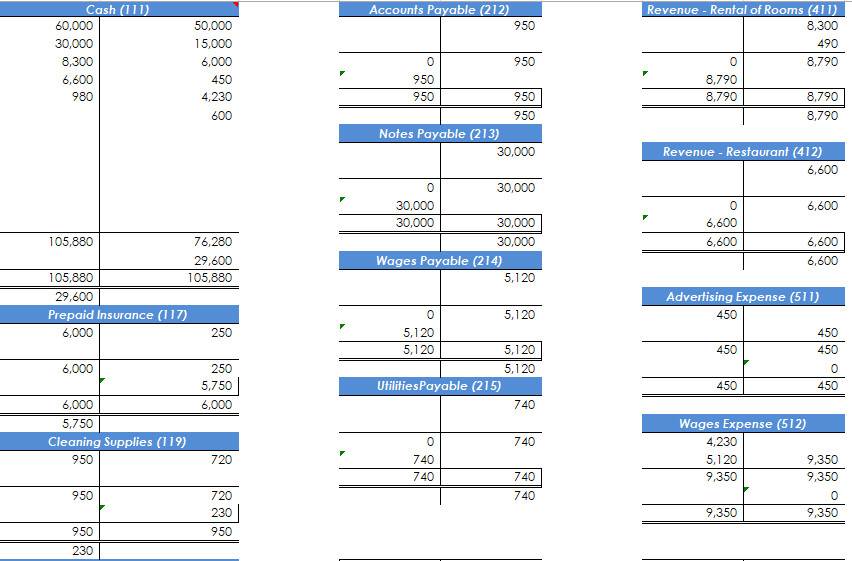

3. Ledger Accounts

4. Preparing a Trail Balance

Haram’s Company | |||

Account | Account | Balance | |

# | Title | Debit | Credit |

111 | Cash | 29,600 | |

117 | Prepaid Insurance | 6,000 | |

119 | Cleaning Supplies | 950 | |

144 | Furniture | 15,000 | |

146 | House | 35,000 | |

148 | Land | 15,000 | |

212 | Account Payable | 950 | |

213 | Notes Payable | 30,000 | |

216 | Rent received in advance | 980 | |

312 | Capital Stock | 60,000 | |

313 | Dividends | 600 | |

411 | Revenue- Rental of Rooms | 8,300 | |

412 | Revenue- Restaurants | 6,600 | |

511 | Advertising Expense | 450 | |

521 | Wages Expense | 4,230 | |

106,830 | 106,830 | ||

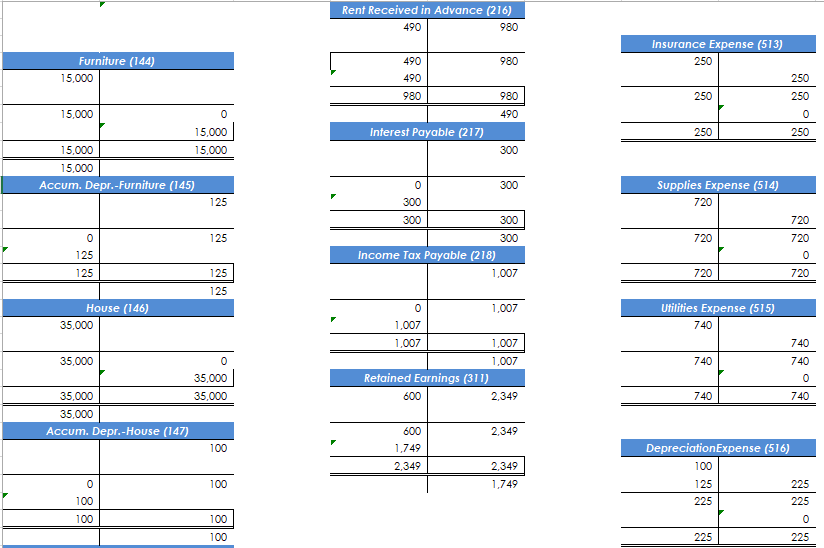

5. Making Adjusting Entries

General Journal | |||

Date | Description (Account Name) | Debit | Credit |

Jan 31. | Depreciation Expense (W-1) | 100 | |

Accucm Dep- House | 100 | ||

Jan 31. | Depreciation Expense (W-2) | 125 | |

Accum Dep- Furniture | 125 | ||

Jan 31. | Interest Expense (W-3) | 300 | |

Interest Payable | 300 | ||

Jan 31. | Insurance Expense (W-4) | 250 | |

Prepaid Insurance | 250 | ||

Jan 31. | Rent Received in Advance (W-5) | 490 | |

Revenue- Rental of Rooms | 490 | ||

Jan 31. | Wages Expense | 5,120 | |

Wages Payable | 5,120 | ||

Jan 31. | Supplies Expense | 720 | |

Cleaning Supplies | 720 | ||

Jan 31. | Utilities Expense | 740 | |

Utilities Payable | 740 | ||

Jan 31. | Income Tax Expense | 1,007 | |

Income Tax Payable | 1,007 | ||

8,852 | 8,852 | ||

Working

W-1

House- 35000 ((35000-5000)/25)/ (1/12))

S.V= 5000

U.L= 25 yrs

W-2

Furniture- 15000 ((15000/10)/ (1/12))

S.V= 10

W-3

Promissory Note- 30000, Rate 12%

(30000*12%)/12

W-4

Prepaid insurance- 6000, years -2

(6000/2)/12)

W-5

Receive in Advance- 980

Used- 980/2

6. Preparing an Adjusted Trial Balance

Haram’s Company | |||

Account | Account | Balance | |

# | Title | Debit | Credit |

111 | Cash | 29,600 | |

117 | Prepaid Insurance | 5,750 | |

119 | Cleaning Supplies | 230 | |

144 | Furniture | 15,000 | |

145 | Accum Dep- Furniture | 125 | |

146 | House | 35,000 | |

147 | Accucm Dep- House | 100 | |

148 | Land | 15,000 | |

212 | Account Payable | 950 | |

213 | Notes Payable | 30,000 | |

214 | Wages Payable | 5,120 | |

215 | Utilities Payable | 740 | |

216 | Rent Received in Advance | 490 | |

217 | Interest Payable | 300 | |

218 | Income Tax Payable | 1,007 | |

312 | Capital Stock | 60,000 | |

313 | Dividends | 600 | |

411 | Revenue- Rental of Rooms | 8,790 | |

412 | Revenue- Restaurants | 6,600 | |

511 | Advertising Expense | 450 | |

512 | Wages Expense | 9,350 | |

513 | Insurance Expense | 250 | |

514 | Supplies Expense | 720 | |

515 | Utilities Expense | 740 | |

516 | Depreciation Expense | 225 | |

517 | Interest Expense | 300 | |

518 | Income Tax Expense | 1,007 | |

114,222 | 114,222 | ||

7. Preparing Financial Statements

- Profit and Loss Statement

Another name widely used for Profit & loss statements is the income statement which represents the company’s expenditures and revenues over a given period of time. The structure of the Profit and loss account is different from the Balance sheet statement which predicts a line-wise reporting style. The main content and items of the Profit and loss account include the revenues, cost of goods sold, gross profit, all expenses, and the year-end income. If the amount is negative, it means that the company had incurred a loss and if the amount is positive, it means that the company had earned a significant profit within the specific time period.

Haram’s Company | ||

Income Statement | ||

For the Month Ending January 31 | ||

Revenues: | ||

From rental of rooms | 8,790 | |

From restaurant | 6,600 | |

Total Revenue | 15,390 | |

Less: Expenses | ||

Advertising | 450 | |

Wages | 9,350 | |

Depreciation | 250 | |

Interest | 720 | |

Insurance | 740 | |

Supplies | 225 | |

Utilities | 300 | |

Income Taxes | 1,007 | |

Total Expenses | (13,042) | |

Net Income | 2,349 | |

Income before taxes | 3,355 | |

- Statement of Retained Earnings

Haram’s Company | |

Statement of Retained Earnings | |

For the Month Ending January 31 | |

Retained Earnings, January 1 | |

Add: Net Income | 2,349 |

Subtotal | 2,349 |

Less: Dividends | (600) |

Retained Earnings, October 31 | 1,749 |

- Balance Sheet Statement

Another name widely used for a balance sheet is the statement of financial position which shows the current financial position of the company. The structure of the balance sheet is designed to distinguish the two major amounts and their balance should represent the same amount. Balance sheets could be prepared by using two methods: T-method or the reporting method. Both represented two sides of the balance sheet including the assets, liabilities, and owner’s equity. The main content and items of the balance sheet include current and non-current assets, current and non-current liabilities, and owner’s equity.

Haram’s Company | ||

Balance Sheet | ||

January 31 | ||

Assets: | Balance | |

Current Assets: | Debit | |

Cash | 29,600 | |

Cleaning Supplies | 5,750 | |

Prepaid Insurance | 230 | |

Total current assets | 35,580 | |

Property, Plant, and Euip.: | ||

Land | 15,000 | |

House, net of accum. Depr. | 34,900 | |

Furniture, net of accum. Depr. | 14,875 | |

Total Property, Plant, and Euip. | 64,775 | |

Total Assets | 100,355 | |

Liabilities and Stockholders’ Equity | ||

Liabilities: | ||

Current Liabilities: | ||

Accounts Payable | 950 | |

Interest Payable | 300 | |

Wages Payable | 5,120 | |

Income Taxes Payable | 1,007 | |

Rent received in advance | 490 | |

Utilities Payable | 740 | |

Total current liabilities | 8,607 | |

Long-term Debt: | ||

Notes Payable | 30,000 | |

Total Liabilities | 38,607 | |

Stockholders’ Equity: | ||

Capital Stock | 60,000 | |

Retained Earnings | 1,749 | |

Total Stockholders’ Equity | 61,749 | |

Total Liabilities & Stockholders’ Equity | 100,355 | |

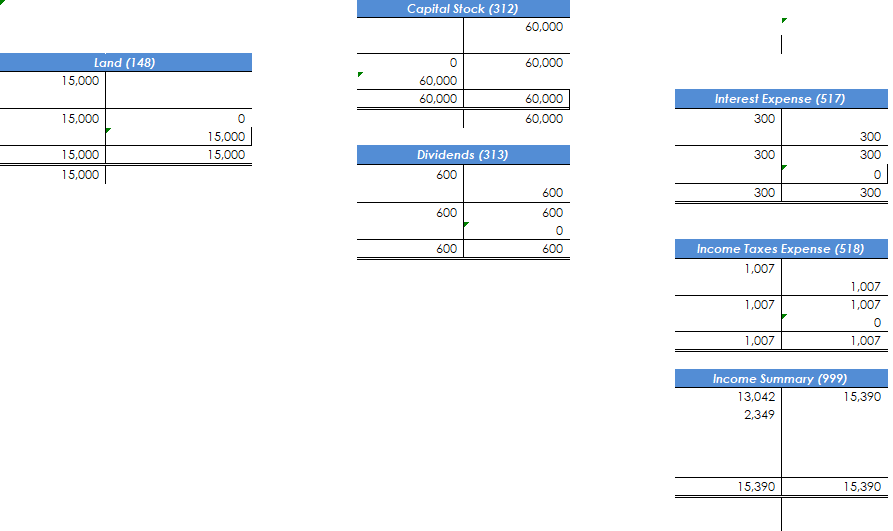

8. Closing Accounts

General Journal | |||

Date | Description (Account Name) | Debit | Credit |

31-Jan | Revenue- Rental of Rooms | 8,790 | |

Revenue- Restaurants | 6,600 | ||

Income Summary | 15,390 | ||

31-Jan | Income Summary | 13,042 | |

Advertising Expense | 450 | ||

Wages Expense | 9,350 | ||

Insurance Expense | 250 | ||

Supplies Expense | 720 | ||

Utilities Expense | 740 | ||

Depreciation Expense | 225 | ||

Interest Expense | 300 | ||

Income Tax Expense | 1,007 | ||

31-Jan | Income Summary | 2,349 | |

Retained Earning | 2,349 | ||

31-Jan | Retained Earning | 600 | |

Dividends | 600 | ||

31,380 | 31,380 | ||

- Preparing a Post-Closing Trial Balance: After the closing entries are made, a post-closing trial balance is prepared to ensure that the closing entries were recorded correctly and that all temporary accounts have a zero balance.

Haram’s Company | |||

Account | Account | Balance | |

# | Title | Debit | Credit |

111 | Cash | 29,600 | |

117 | Prepaid Insurance | 5,750 | |

119 | Cleaning Supplies | 230 | |

144 | Furniture | 15,000 | |

145 | Accum Dep- Furniture | 125 | |

146 | House | 35,000 | |

147 | Accucm Dep- House | 100 | |

148 | Land | 15,000 | |

212 | Account Payable | 950 | |

213 | Notes Payable | 30,000 | |

214 | Wages Payable | 5,120 | |

215 | Utilities Payable | 740 | |

216 | Rent Received in Advance | 490 | |

217 | Interest Payable | 300 | |

218 | Income Tax Payable | 1,007 | |

311 | Retained Earning | 1,749 | |

312 | Capital Stock | 60,000 | |

100,580 | 100,580 | ||

Key Points

Here are the key points for the accounting cycle:

- The accounting cycle is the complete process of recording, analyzing, and tracking all accounting data of a business.

- It starts when a transaction is incurred and ends when the financial statements are published and books of accounts are closed.

- The accounting period could be a month or a year.

- Now, it has become very easy to complete the accounting cycle because of the accounting software that automates the whole process.

- Bookkeeper has to ensure that all transaction are accurately recorded and catagoried.