You must be wondering about the word “asset impairment”. What is it and how does it work in accounting?

So, let’s start learning with me.

If we look for the literal meaning of impairment. The word “ impairment” means damage, destruction, or a loss of functional ability.

Impairment in accounting: Impairment in accounting refers to the reduction of the value of assets- Either fixed assets or tangible assets. But remember that reason behind reduction is always unexpected such as economic casualties that may cause the decline of prices in your asset in the market.

In short, the process in which an asset loses its ability to function or when an asset got damaged due to some reason that particular process in accounting is called impairment of an asset.

What Is An Asset Impairment?

In This Article

ToggleWhen an asset losses its value or there is a reduction in its market value, this reduction in value is referred to as Asset Impairment. In impairment, the market price of an asset is less than the value listed on the balance sheet. Moreover, impaired assets are those whose listed price on the balance sheet is less than the market price. This whole process of fall in the value of assets is called impairment.

- The asset impairment is the reduction or falls in the value of the asset.

Market Value vs Carrying Amount

An asset is said to be impaired when its market price is less than the carrying amount. Market Value vs Carrying amount: Let’s make it easier by understanding the terms “market value” and “carrying amount”. For instance, I bought a bicycle for $1,000 and by selling it I got only $500. So that $500 is the market value. In other words, the amount you are expected to get by selling your asset is the market value. On the other hand, the carrying amount is the amount listed on the balance sheet.

In impairment, the reason behind the downfall of prices or values is usually unpredictable. Therefore, you never know out of nowhere an accident can happen and your asset can lose its ability to function or get completely damaged.

Asset Impairment Examples

The question is why the asset value decreases suddenly? Asset Impairment can occur due to various reasons. For instance, damage, obsolescence, change in economic activities, or some legal factors affecting the business. There are multiple factors that result in a fall in the value of assets.

For example, a company is making typewriters. Yes, in this advanced world if someone is going to open up a typewriter company how does it sound? Strange!! yes, Similarly, that company whose owner thought to get some benefit by producing typewriter will not get the expected amount from his asset. As many people don’t prefer typewriters nowadays. That asset will go obsolete.

Another example, a company meets an accident inside and its machinery got damaged subsequently the value of machines will be reduced. Therefore, it will not pay back the same amount if sold in the market as recorded in the balance sheet.

Another relevant impairment loss example is through which we can understand how the asset is being impaired. Ok, yesterday I bought a new and trendy bicycle for $10,000. I recorded it into my balance sheet. Just after a few days, I meet an accident and unfortunately, my bicycle got totally damaged. Now, if I take it to the market it will only own me scrap value. Hence, the market value of my bicycle is less than the carrying amount; the amount recorded on the balance sheet. So, I would rather say that my bicycle is impaired.

Impairment Of Assets Calculation

IFRS and GAAP provide different guidelines for the impairment of an asset. GAAP provides a two-way approach while IFRS provides a one-way approach in the IAS 36 guidelines. Thus, by implementing IAS 36 rules, you can determine the recoverable amount of an asset as well as ensure that the asset should be reported in the balance sheet at its recoverable value- not more.

Now, I need to record an impairment loss in my books and reduce my carrying amount.

Asset – impairment loss

Now it definitely worth not what it worthed earlier.

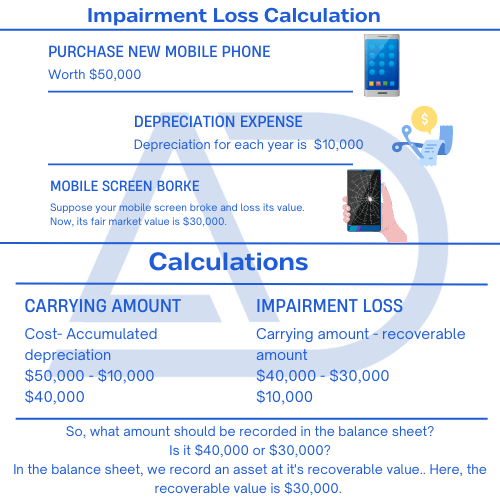

When the carrying amount is greater than the recoverable amount there will be an impairment loss. Moreover, the difference between the two is an asset impairment loss.

To calculate impairment it is necessary to first recognize the market value of your asset. Likewise, if you sell that particular asset in the market how much value it is going to fetch? For instance, the carrying value of your machinery is $10,000 but, if sold in the market the value is $9,000. So, the difference between the two which is $1,000 will consider as an impairment loss.

Carrying amount – recoverable amount = impairment loss

In order to calculate impairment loss, first of all, it is obligatory to identify the factors that lead to an impairment of an asset. For instance, economic conditions, sudden accidents, the arrival of new technology, and many other circumstances can cause a decline in the value of assets. Secondly, you need to reduce your asset value by subtracting impairment loss.

Depreciation is normal wear and tear of the asset- Use of an asset for day-to-day operations. On the other hand, impairment is an unexpected fall in the value of an asset- Due to some casualties or other reasons.

Impairment vs Depreciation

Difference Between Asset Impairment And Asset Depreciation

There isn’t a stark difference between the two. You may remain in grey light while distinguishing between impairment and depreciation. As both of them reduces the value of assets. But no worry here we have tried to make a clear-cut difference.

Let’s first understand what is depreciation. The reduction in the value of an asset is called depreciation. For instance, you bought a new mobile phone worth $25,000. With the passing of each year, the value of mobile phones will decrease. The more you use the product the less its value gets. As a result, your mobile phone will depreciate by $5,000 every year. After four years it will have no value.

Depreciation Expense: $25,000/4 = $5,000

So depreciation is a by-product, as soon as you buy something its value starts to decrease. In addition, you depreciate your asset every year at a fixed rate.

Likewise, impairment is also a decline in the value of assets. In depreciation, we calculate the value of assets ourselves by reducing the value of the asset at a fixed rate. On the other hand, impairment is not in our hands it’s an unpredictable decline in the value of assets due to various reasons.

Let’s have a simple yet relatable example.

You bought an iPhone 10 for $50,000, you depreciate it by $10,000 every year and according to your books, its useful life is 5 years. But suddenly what happened is that the iPhone company launched iPhone 11. As we all are aware that whenever new technology comes the prior one losses its value. Subsequently, the same iPhone which you bought won’t even give you half of its price was bought earlier. Thus, the fair market value of the iPhone 10 is now $30,000. Here, the impairment loss is $20,000. As a result, this sudden fall in the price is referred to as an asset impairment loss.

Impairment vs Depreciation

- Depreciation is an expense. While impairment is a loss.

- Depreciation is recorded on regular basis, unlike impairment which occurs rarely and unexpectedly.

- We depreciate the fixed and intangible assets. While impairment is only on tangible assets.

So, the above difference must have brought up light and made things crystal clear. After identifying the difference between the two it has become easier to understand what impairment is.

Key Points

- Asset impairment is an unexpected reduction of the value of assets.

- It’s certainly a loss.

- Occur occasionally.

- More market price less carrying amount.