Why do we need to have a contra account? Before, rushing toward the answer. Another question arises is that, can we decrease the balance of any account directly without clarifying the reason? Is it authentic to do? Or will it provide good and authentic results? Obsoletely not!

What a contra account does is the reduction of the balance of the associated account. Moreover, with the help of it, we can have a proper and clear recording of the transaction. As a result, we will not wonder later on about why we minus a certain amount from a certain account. Above all, a contra account let a company recognize the reason for reducing the balance of the associated account.

What Is A Contra Account?

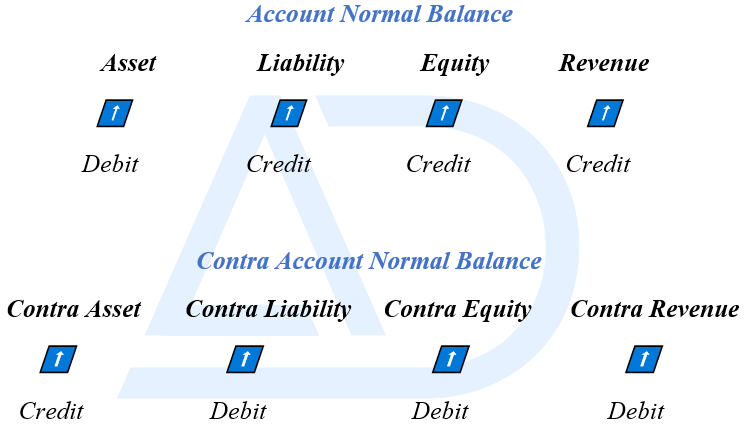

Contra means opposite, a contra accounts balance possesses the opposite balance of linked accounts. In other words, if credit is the natural balance of the associated account then the contra account will hold a debit balance and vice versa. Is Accumulated depreciation a contra account example? YES. For instance, the natural balance of an asset in the balance sheet is debit. Conversely, the natural balance of the contra asset is credit. Thus, the pattern follows is

Gross Value – Contra Account Value = Net Value

- To sum up, the Contra Account possesses the opposite balance of their associated parent accounts.

It is clear evident in the chart above that contra account is following the rule of going in reverse. Either it is asset, liability, or equity what the account do is to have an opposite balance.

| Contra Account | Yes/ No | Associated Account type |

|---|---|---|

| Account receivable | No | |

| Accumulated depreciation | Yes | Asset |

| Premium on bonds payable | No | |

| Expense | No | |

| Dividends | Yes | Equity |

| Sales Discount | Yes | Revenue |

| Credit sales | No | |

| Drawing | Yes | Equity |

Types Of Contra Account

There are various types of contra accounts. All the types of contra account play the same function which is reducing the value of another account with which it is associated. To clarify properly, some major types list of contra accounts are listed below:

1. Contra asset

2. Contra liability

3. Contra equity

4. Contra revenue

Let’s explore these all types in detail with examples.

Contra Asset Account

Any Account that reduces the value of assets is known as the Contra asset account. The natural balance of assets is debit, but the contra asset, as it goes into reverse, has a credit balance. Therefore, the contra asset can be considered a negative balance. Thus, are inventory and Freight in contra accounts? NO

| Asset normal balance | Debit |

| Contra asset normal balance | Credit |

| List of Contra asset accounts | Accumulated depreciation Allowance for bad debts Discounts on notes receivable Reserve for obsolete inventory |

Contra Asset Examples

Accumulated depreciation is a contra asset as it reduces the balance of assets. Moreover, there are some fixed assets on which we calculate depreciation. For instance, a piece of equipment with a cost of $20,000, is depreciated at the rate of $1,000 per year. So, at the end of the year, the contra asset journal entry would be recorded as:

| Date | Particulars | Dr. | Cr. |

| xxx | Depreciation expense | $1,000 | |

| Accumulated depreciation | $1,000 |

Allowance for doubtful debts is another example of a contra asset because it reduces the balance of accounts receivable. As accounts receivable is an asset therefore the natural balance is debit. Contrarily, allowance for doubtful debts has a credit balance. For instance, the accounts receivable have a balance of $9,000, but $1,000 is doubtful to be collected. So, the journal entry of allowance for bad debt in this regard would be recorded as:

| Date | Particulars | Dr. | Cr. |

| xxx | Bad debt expense | $1,000 | |

| Allowance for bad debt | $1,000 |

Contra Liability Account

It is an account that decreases liabilities. Consequently, the balance of the contra liability account goes opposite to that of the liability account. Hence, here a point comes to mind: contra liability account credit or debit? For instance, the natural balance of liability is credit on the balance sheet. Hence, the contra liability normal balance is a debit balance. To elaborate further, the increase in liability is credit and the decrease is debit. As you know that a contra account reduces the associated account. Subsequently, contra liability will automatically have a debit balance. In other words, any account that decreases liabilities is contra liability. Therefore, is the premium on bonds payable a contra liability? NO

| Liability normal balance | Credit |

| Contra liability normal balance | Debit |

| List of Contra liability | Discount on notes payable Discount on bonds payable |

Contra Liability Example

Is a discount on bonds payable a contra liability account? The answer is YES. Here are some examples of contra liability. For instance, a company sells bonds, sometimes bonds are sold at discount. Similarly, a bond of $1,000 is sold at $900, and the remaining $100 is a discount. The contra liability journal entry for this purpose will be recorded as:

| Date | Particulars | Dr. | Cr. |

| xxx | Cash | $900 | |

| Discount on notes payable | $100 | ||

| Account payable | $1,000 |

Contra Equity Account

Are treasury and dividends contra equity accounts? Yes. Drawing is another name for contra equity. So, what does contra equity do? In short, as the name suggests, the contra equity reduces the balance of its associated equity account.

| Equity normal balance | Credit |

| Contra equity normal balance | Debit |

| List of Contra equity | Drawing Dividends Treasury stock |

Contra Equity Example

For instance, the balance of the equity account is $10,000, and the owner of the business withdraws $900 for personal use. Likewise, drawing means to withdraw money from the business for personal use.

Equity $10,000

Drawing ($900

$89,000

In short, in the example above it is distinguishable that the drawing account is reducing the balance of the equity account.

The natural balance of equity is credit in the balance sheet. Thus, it is not difficult to guess that contra equity, holding the opposite balance, will be a debit balance. Therefore, the increase in equity is credit, and the decrease in equity has a debit balance. So, are note-receivable and expense contra equity? NO

Contra Revenue Account

So, what does a contra revenue do? Does it decrease your revenue? But how? Wait! And just keep on reading because all your queries are addressed below.

Contra Revenue Example

Sales or revenue $50,000 (Gross Value)

Sales return ($10,000) (Contra Value)

Net Value $40,000

The sales discount and sales return are Contra revenue accounts, as it decreases the sales revenue. In the example above, before returning goods by a customer sales were $50,000, after reducing $10,000 now sales revenue balance is $40,000. So, the sales return has reduced the revenue by $10,000. Moreover, the natural balance of sales revenue is credit in the balance sheet. Contrarily the sales return balance is debit in the balance sheet.

| Revenue account normal balance | Credit |

| Contra revenue normal balance | Debit |

| List of Contra revenue accounts | Sales discount, Sales return, and Sales allowance |

In short, it is not difficult to understand why the contra revenue has the opposite balance. When revenue increases it is credited and when decreases it is debited. Here, the contra revenue is reducing the sales revenue. Hence, the decrease in revenue will be recorded as a debit to the contra account.

Key Points

- Contra accounts Can’t stand alone because they are associated with and dependent upon their parent accounts.

- Thus, it goes reversed and has opposite balances. In addition, they are useful to preserve the data.

- To sum up, what contra does is reducing the balance of the account with which it is associated.

- Above all, the two most common examples of contra accounts are allowance for bad debts and allowance for depreciation.