Cash basis vs accrual basis accounting? Ahh! Confusing- what are they? Why and how Cash basis accounting is different from accrual basis accounting? Which is the most appropriate accounting method- cash accounting or Accrual Accounting?

Looking for the answers to these complicated questions? Then you are at the right place. After reading this article you will clearly understand what is cash basis and accrual basis accounting and how they differ?

Let’s dive straight into it.

Cash Basis vs Accrual Basis Accounting

In This Article

ToggleSimply put, Accrual-based accounting is an accounting method where the revenue & expenses are recognized in the books of accounts when you have become entitled to pay or receive for them. On the other hand, cash-based accounting is an accounting method where the revenue & expenses are recognized in the books of accounts only when payment has been received or made. So, it basically depends on the timing “when to recognize revenue and expenses”.

- Accrual basis accounting provides better financial results for the company. While Cash basis accounting provides a better picture of the company’s cash flows.

Let’s first explore these two terms- cash basis accounting and accrual basis accounting.

What is Cash Basis of Accounting?

Cash basis accounting denotes an accounting method that states that revenue will only be recognized when you will actually receive the cash and expenses will only be recorded when cash has been paid. The cash accounting method is normally used in small-scale businesses as it is simpler to use and management does not require to have advanced accounting knowledge.

What is Accrual Basis of Accounting?

Accrual accounting is another method of financial accounting that helps an organization to recognize its revenue before receiving any payment against sold goods or services and expenses are recorded when incurred before any payment made by the company for them. Or you can say that the earned revenue and incurred expenses should be recognized in the book of accounts regardless of when the cash has been received or paid.

Key Differences Between Cash Basis and Accrual Basis Accounting

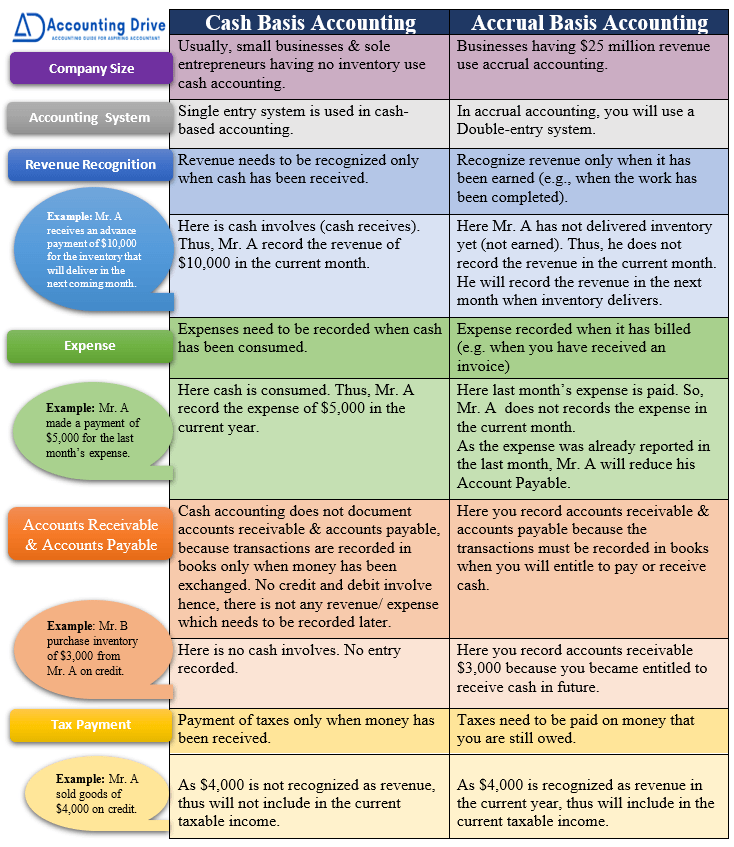

Here you can see how Cash basis accounting is different from accrual basis accounting.

Key difference between cash and accrual basis accounting is timing. When to recognize revenue and expenses?- in which time?

Example- Cash Basis vs Accrual Basis Accounting

let’s have a practical example so that you can understand more clearly the difference between cash basis and accrual basis accounting. For example, XYZ is a janitorial company, which provides a detailed cleaning service to various customers. Mr. A has taken its monthly services and paid $5,000 as annual upfront charges on 1st January 2020 for two years. XYZ pays $100 monthly to its chemical supplier for providing cleaning supplies that they use during the cleaning process.

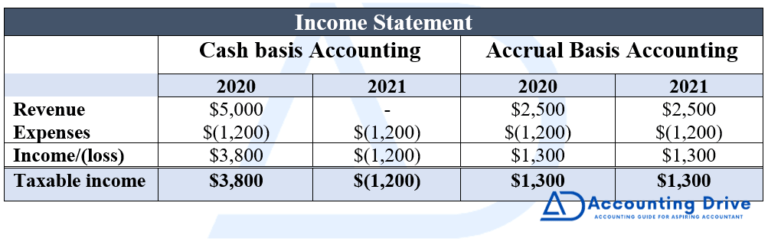

XYZ income and loss for each year are shown below- for both accounting methods:

Cash Accounting

- The XYZ Company reported revenue of $5,000 in the first year of 2020 in which it receives cash.

- XYZ records $100 in terms of expenses for every month (100*12= 1,200).

- It has to pay tax on income of $3,800 for 2020 & shows a loss of $,200 for 2021.

Accrual Accounting

- The company evenly distributes the revenue of $5,000 (5,000/2) cash as $2,500 for each year.

- XYZ Company documented $100 in terms of expenses every month (100*12= 1,200).

- It has to pay tax on income of $1,300 for 2020 and $1,300 for 2021.

Advantages and Disadvantages

| Advantages | Disadvantages | |

| Cash Basis Accounting | A simple and straightforward method Losses offset by future profits Easy cash flow Simple single-entry system | Less accurate accounting results Overstate or understate the performance Does not exhibit a true picture of the company’s current liabilities |

| Accrual Basis Accounting | Provides accurate financial position Comply with GAAP requirements- Matching principle and Revenue recognition principle Provides easy future planning | Does not exhibit a true picture of the company’s cash flows. Pay taxes on revenues that are actually not received. Unappropriated for small business |

Effects of both methods on cash flow & taxes:

Cash flows

The cash flow statement shows the movement of cash. In cash-based accounting, the transaction recorded by the organization is related to this phenomenon where cash comes in and cash goes out, in this case, the cash flow statement shows an exact picture of the company’s cash position at any given time. While In the accrual method organization records the transactions without any regard to the cash flows which means that the cash flow statement does not accurately exhibit a clear cash position of a company and requires necessary adjustments for non-cash items.

Taxes

As you know that the revenue & expense recognition can be varied according to the adopted methodology of cash or accrual accounting, it ultimately impacts when a company has to pay its taxes. Let’s consider the following example under both methods of accounting.

For example, Mr. A invoiced a client for $1,000 on 1st December 2020. The client paid the amount on 31st January 31, 2021.

- Under cash-based accounting:

Mr. A will pay taxes against this transaction on his 2021 income. It is due to the documentation of the sale that happened in 2021 when cash actually received by the customer.

- Under accrual-based accounting:

Mr. A will pay taxes against this transaction on his 2020 income. It is due to the documentation of the sale that happened in 2020 when Mr. A sold the goods & invoiced the customer.

In the cash accounting method, the tax needs to be payable on earned revenue while in accrual accounting tax is payable on cash collected.

Tax Payment

How to Choose the Most Appropriate Accounting Method?

If you consider the cash basis of accounting then the most attractive factor is that it is the simplest form of accounting, but it doesn’t mean that it is the accurate one too. Consider the existing regulations prevailing inside your country because some countries impose a law to use the accrual method. The cash basis of accounting is best to use in small nonprofit organizations which recruited non-paid staff with no set programs, & little to no expansion plans.

While the accrual basis of accounting suits the organizations where they have started their business with a large sum of capital recruited paid staff and tries to expand in the future from large fund donors like govt. entities. If you want an audit done through generally accepted accounting principles, then you must use the accrual basis of accounting.

Other points you may consider:

- Internal vs. External Reporting:

The very first considerable thing is to decide whether you require internal reporting or external reporting. Internal reporting may have more effects on the accounting basis you choose as compared to external reporting. So, if your business is more about cash management, and has cash financials then you must already be dealing with cash flow. On the other hand, if you are auditing a bank, or taking on a Merger & acquisition transaction, then financial statements based on the accrual system will be required.

- What are your growth & Expansion Plans?

If you own a small company that uses cash-based accounting and wants capital for expansion, then you have to shift from cash-based to accrual-based accounting method.

Key Points

- Accrual-based accounting is an accounting method where the revenue & expenses are recognized in the books of accounts when you have become entitled to pay or receive for them rather than when money actually been transferred or received. It is useful for a large organization.

- Accrual accounting provides better financial results for the company.

- Cash-based accounting is the other form of accounting method, where transaction recognizes in the books only when payment has been received or made.

- It suits sole proprietorship and small setup.

- Cash accounting provides a better picture of the company’s cash flows.