Have you heard about free cash flow ?? Bombarded with questions in your mind— what is it? What’s the difference between cash flow and free cash flow? How to calculate it?

Then, stop wondering, and let’s clarify it with me.

What is Free Cash Flow (FCF)?

In This Article

ToggleIn financial terms, free cash flow (FCF) represents the amount of cash left in the company’s account after paying all operational and capital expenses (costs associated with maintaining long-term assets and costs). Using free cash flow, companies can support or grow their business.

- Free cash flow is the leftover amount after paying all firm’s capital and operational expenses. It means that the company is financially sound enough to pay its debts and dividends.

What Does FCF Indicate?

Free cash flow indicates that a company is financially sound, and it has the ability to grow and pay its debts and dividends. It means the annual cash generated by the company does not have to meet obligations within or outside the business. Thus, it is the amount of money that a company can use to invest or distribute among its investors freely. It represents its liquidity.

The investment community generally views a positive FCF number as a positive sign, but it is important to understand the context of the number. Such high FCF is typical of companies with deferred Capital expenditure (CAPEX) costs, and such high FCF generally indicates future difficulties.

Wondering? How to calculate it.

Let’s find out.

How to Calculate Free Cash Flow (FCF)?

The formula of Free Cash Flow:

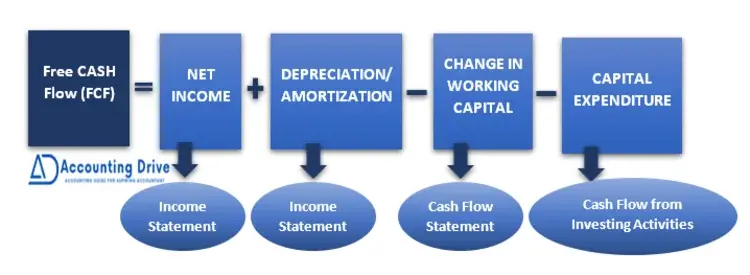

Free Cash Flow = Net Incomes + Depreciation/Amortization - Change in Working Capital - Capital Expenditure

You can calculate FCF in three different ways.

- Free Cash Flow (FCF) = Sales revenue- operating costs and taxes- required capital

- FCF = Net operating profit after tax – Net investment in operating capital

- Free Cash Flow (FCF) = Net cash flow from operations – capital expenditure

Most of the information needed to calculate FCF is in the cash flow statement.

Free Cash Flow (FCF) Example

Consider Company A as having $22 million of cash from operating its business and $6 million from spending capital after adjusting for changes in working capital. So, FCF for Company A would be calculated as follows:

| FCF = $22 – $6.5 = $15.5m |

Here is another example for an in-depth analysis.

Mary owns a hardware Shop where she sells household goods. She wants to expand her business into new areas, but she doesn’t have enough money to do it on her own. Therefore, she approached new investors. The new investors must analyze the store’s free cash flows to decide whether the investment would be worthy of their money or not.

Mary’s income statement exhibits that she earned a net profit after taxes of $200,000 last year. To see the operating cash flow (OCF), she has to add back any non-cash expenses. She also has to adjust the profit by depreciation/amortization and change in working capital. Mary’s financial statements show the following numbers:

- Depreciation: $20,000

- Amortization: $10,000

- Current assets: $200,000

- Current liabilities: $70,000

- Fixed asset purchases: $60,000

So the calculation would be like this according to the other operating cash flow (OCF) formula:

$200,000 – ($200,000 – $70,000) + $20,000 + $10,000 = $100,000

Free cash flow: $100,000-$60,000 = $40,000

Here investors will analyze the result as:

Mary’s operating cash flow of $100,000 is greater than her capital expenditures of $60,000. The $40,000 excess free cash flow can be distributed among investors as a return or reinvested into the business. If in case Mary’s FCF would be less than the capital expenditures, she would have a negative figure, which means she would not have sufficient money to pay for her operations and expansions.

But here the investors can show their interest to invest in her business.

Why FCF is Important for a Firm?

FCF helps in catching new opportunities and growing the business by developing new products, making acquisitions, paying dividends, and eliminating debt that will in turn increase the revenue. Understanding FCF is very important for business owners and accountants.

It is an indicator of the GOOD financial health of a company. Moreover, it shows that the company is capable of increasing shareholders’ returns.

Now let’s explore its benefits.

Benefits of FCF

By measuring the changes in working capital, FCF provides valuable insights into a company’s value and fundamental health.

- Accounts payable (outflow) decreasing trend indicates faster payment requests from vendors.

- If its accounts receivables (inflow) have fallen, the company might be getting cash faster from its customers if its accounts receivables (inflow) have decreased.

- A rise in inventory (outflows) may indicate unsold products are accumulating.

- A measure of profitability that includes working capital adds layers of insight to the income statement.

Limitations of FCF

Although, FCF has many benefits, and it is a great metric to analyze the financial health of a company, but it also has some limitations.

Let’s see what it is.

A major limitation of FCF is that all capital expenditures are accounted for at the time of acquisition instead of overtime in the main financial statements. Thus, FCF makes it easier to misconstrue a company’s cash position during periods when capital acquisitions are made and overstate it during subsequent periods.

How FCF differs from

- Net Cash flow

Net cash flow is the result of operations, investments, and financing. Using FCF, it is possible to determine a business’s present value. To measure the business’s actual net cash inflow, you must figure out its basic cash flow.

- Operating cash flow

FCF is the amount of cash generated by a company’s regular activities before interest payments and after deductible capital expenditures. On the other hand, Cash generated from standard business operations is operating cash flow.

- Net income

Net income and earnings measure profitability; free cash flow, on the other hand, excludes non-cash expenses and includes the cost of equipment and assets, along with the change in working capital.

- EBITDA

When comparing the performance of different companies, EBITDA can be a better measure. EBITDA may also provide a better means of comparing performance between companies.

What is a GOOD Free Cash Flow (FCF)?

Free Cash Flow is a very good indicator when looking at stock trends. In addition, it can also be used in the opposite case.

Good FCF Indicator

You can simplify your analysis by using the trend of FCF.

- Analysts adhere to the theory that actual performance is evaluated over time rather than on absolute values such as sales, profit, or FCF. A positive trend in FCF must correlate with positive trends in stock prices if fundamentals drive stock prices.

- A common approach to determining risk is to resolve it by the trend of FCF. Bullish trends in FCF are less likely to be disrupted in the future if the direction of the stock has been stable over the last four to five years.

- Falling FCF trends, including FCF trends quite different from earnings growth and sales growth, suggest that a company’s price performance will be negative in the future.

Levered vs. Unlevered FCF

Levered FCF is one type of FCF, while unlevered free cash flow is another.

Levered free cash flow represents the remaining funds after debt and interest when the debt has been paid. While the funds leftover, before interest is paid is known as unlevered free cash flow.

Levered FCF is a better measurement to evaluate a business, as the debt levels are a key indicator of potential bankruptcy risk. The smaller the gap between the companies’ levered and unlevered cash flow, the less it will have leftover to meet debt obligations.

Key Points

- Analyzing the financial health of a company using FCF is an important part of investing. After operating expenses and capital expenditures have been accounted for, it looks at how much cash remains.

- An organization with a high FCF, typically known as free cash flow, is healthier, has a better chance of paying dividends, paying down debt, and contributing to growth.

- In addition to FCF, investors use a variety of other financial metrics to assess a company’s health.

- More importantly, to examine the actual performance of a firm, one cannot evaluate it on the absolute values such as FCF or profit. It needs to examine over time to identify accurate results.