Cash is the lifeblood for your business, as well as Cash, is the king. Cash Book Vs Cash Account? Used for the same purpose or not? Looking for the answer to the questions like what is a cash book? What is a Cash account? And is there any difference between them, so yes, you are in the right place. In this article, you will learn about what is cash account and cash book? And how are they different from each other?

Let’s lift the curtains up. Dive deep into the discussion to get answers to all of your questions. So, let’s start with me to get the answers.

Cash Book Vs Cash Account

In This Article

ToggleCash book and cash accounts are different terms but both work for the same purpose. But what is their purpose? Recording the cash transactions. Every business requires proper cash management. For better cash management a business needs to record its cash transactions. Because it helps to keep a record of cash inflows and cash outflows. You can use both a cash book and a cash account to record cash transactions. A cash book is a book that serves the purpose of both journal and ledger. So, when you record the transaction in the cash book, then there is no need to record the transactions in the journal again.

While a cash account serves the purpose of a ledger only. So, before recording any transaction in the ledger it is necessary to record them in the journal. Thus, when you record a transaction in the journal then you have to record it into a Cash account.

- The difference between Cash book and cash account is that Cash book is prepared daily while Cash account is usually prepared at the end of any particular period of time or at the end of the year.

Let’s first discuss what is the cash book?

What is Cash book?

It is a separate book for recording cash transactions directly in the books of account. So the accountant records transactions directly in the cash book with a detailed description. Thus it will not be wrong if you call the cash book a separate book or a book of the original entry. A book where entries are recorded separately and directly. Cash book has mainly three common types:

Types of Cash book

- Single Column – records only cash-related transactions.

- Double Column – records cash-related and bank-related transactions.

- Triple Column – records cash, bank, and discount received and allowed related transactions.

- Cash book is used to record all cash transactions (receipts and payments as well as all bank deposits and withdrawals) of an accounting period in chronological order.

Examples

Ok, let’s dive into the examples to get things more clear and more understandable. For instance, if you buy something and the payment is made through cash then the transaction will be recorded in the cash book by crediting the account. Similarly, if you sell something and cash is received then the accountant will also record this transaction by debiting the account in the cash book. So it is easy to understand that all the cash-related transactions either it is cash receipts or cash payments you recorded in the cash book.

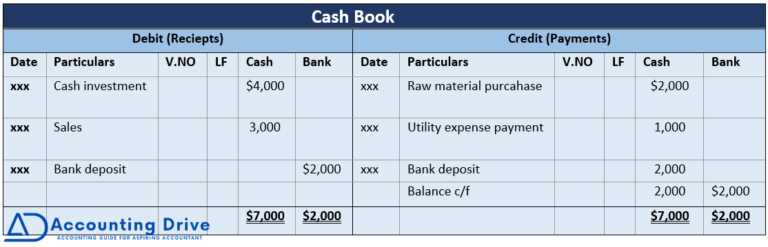

Let’s have a more practical example. Mr. Ahmed started his business with a cash investment of $4,000. During the period, he made the purchase of raw material of $2,000, paid utility expenses of about $1,000, receive cash from the sale of $3,000, and from the sale proceed he deposits 2,000 in the bank account.

Let’s prepare a cash book with me.

What is a Cash account?

A cash account is an account within the ledger in which we record or post from the journal. Moreover, you record all the cash-related transactions. So,It is the summary of cash transactions. Unlike cash books where transactions are recorded directly. Here, first, you need to record them in a journal then you post those entries into the ledger. Furthermore, the Cash account is organized like a ledger with T format having debit on the left and credit on the right side. A cash account is usually created at the end of the year or at the end of a specific period of time.

- A cash account is an account of the ledger which records all the business day-to-day cash transactions.

Examples

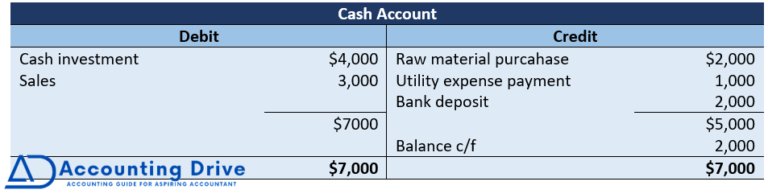

To clarify the picture of something, there is always room for examples. So let’s not wait anymore and get things more clear through example. So, as in journal different kinds of entries are recorded there are cash-related entries, purchase-related entries and sales-related entries, and different other entries. To make a cash account you extract all the cash-related transactions from the journal and post them into a cash account. Thus, a cash account is created in an indirect way. So it won’t be difficult to call a cash book an indirect way of recording transactions.

Continuing with the cash account example. Here, you can prepare a cash account in the T format as I have prepared below.

Cash account and cash book both serve the purpose of recording cash transactions but the main difference between them is the process- how transaction is recorded?

Cash account vs cash book

Difference- Cash Book vs Cash Account

After knowing what is cash book? And what is a Cash account? Now it becomes easier to understand the difference between a Cash book and a cash account. However, there is a slight difference between a Cash book and a Cash account. But no worries here we have made things clearer and easier through examples.

Dependence

If we have to think about who is dependent on whom? Is the cash book dependent on any other book, account, or on the journal for posting transactions in the cash book? Or cash account is dependent on any other book, account, or journal to record the transactions in a cash account? So I am sure you won’t think twice or get confused while answering these questions.

As I said above in the cash book, we record all the cash transactions directly into the cash book therefore, it is not dependent on any other book or account. While in a cash account, we post or record entries from the journal. In the journal, all entries of cash, purchase, sales, etc are recorded. To make a cash account we take out all the cash-related transactions from the journal and record them in a cash account. So cash account is not independent, it depends on a journal for recording entries.

- Cash Book: It is not dependent on any other book or account.

- Cash Account: It depends on the journal for recording entries.

Way of Recording

Hence cash account can be called an indirect way of recording cash transactions. Unlike cash book where you record cash transactions directly.

- Cash Book: It is a direct way of recording cash transactions.

- Cash Account: It is an indirect way of recording cash transactions.

Aspects

When you create a cash account there is only cash-related transaction and there is only one aspect of a cash account that is cash. But when you maintain a cash book, you can see there is a single column Cash book, a double column cash book, and even a triple column cash book. There is a cash column and a bank column. So cash book won’t only tell you regarding cash transactions, but it can also tell you about the bank balance.

- Cash Book: It records cash receipts and payments as well as all bank deposits and withdrawals.

- Cash Account: There is only one aspect of a cash account that is cash.

T Account for Sale and Purchase

Another difference is that you don’t need a cash account or any other account to record entries in the cash book, but you can make the accounts like sales or purchases with the help of a cash book.

- Cash Book: It also shows cash sales and cash purchases during the period. So, no need to maintain T accounts for sale and purchase.

- Cash Account: It only shows the cash balance. So, there is a need to maintain a T Account of sale and purchase.

Comparison Table – Cash Book vs Cash Account

| Cash Book | Cash Account |

| Original book | Second book |

| A separate book | An account within the ledger. |

| Direct recording of the transaction | Indirect recording of the transaction |

| Independent | Dependent |

| No Narration or source of funds required | Narration or source of fund required |

| Ledger folio | Journal folio |

| One aspect- cash and bank balances, also show discounts received and allowed | One aspect- cash balance |

Why We Need Cash Book?

As said before, the cash book records only cash-related transactions. It is easy to assume why we need a cash book because in businesses almost 90% of transactions are dealt with cash. As the business grows, the number of business transactions increases, and recording all the transactions only in a journal becomes inconvenient. Therefore, we need to maintain a Cashbook to record all the cash transactions in one place. With the help of a cash book, you can not only access and determine the daily cash balances but you can also detect your mistakes by verifying balances daily. The cash book gives you an up-to-date cash balance daily while the cash account reports the balance only at the end of the month.

Key Points

- Cash book and cash account are different to some extent but both serve the same purpose- recording the cash transactions.

- It records cash transactions in chronological order and provides daily updated cash balances.

- The cash account records all cash-related transactions and provides a cash balance at the end of the month.

- The key difference between them is the way of recording cash transactions.