What do you think, Making a cash budget is important for any business? For operating businesses, maintaining a healthy cash position is essential to meet unexpected liquidity crises. So, to avoid any future cash mishap, you should know your projected cash requirements and cash position at the end of the month. Here, the solution is simple- Prepare a cash budget and stick to it.

This article aims to provide the proper understanding of what is cash budget, how to prepare it, and what will happen if the balance is negative?

Looks interesting! let’s start with me.

What Is A Cash Budget?

In This Article

ToggleThe main purpose of making a cash budget is to help an organization to find out if its cash balances are sufficient enough to cover its predicted operational needs. It will help you to analyze the cash position at the end of the month. If the ending cash balance is positive or let’s say greater than the required cash requirements then you can use it to invest in any available opportunity or distribute it as a dividend. It is also useful when you have to match their current position and progress with long and short-term goals.

Sometimes cash budget may be prepared for the period covered as little as 1 week, depending on how the cash is critical for your company’s operations. Further, It can be prepared for 1-month, 3-month (quarterly), or 12-month (yearly).

A cash budget represents a probable movement of cash inflows & outflows over a certain period, or you can say it can be used to forecast the inflows and outflows of cash over a specific period.

Cash Budget Formula

Cash Budget Formula

Expected Cash Inflow – Expected Cash Outflow = Expected Cash Balance

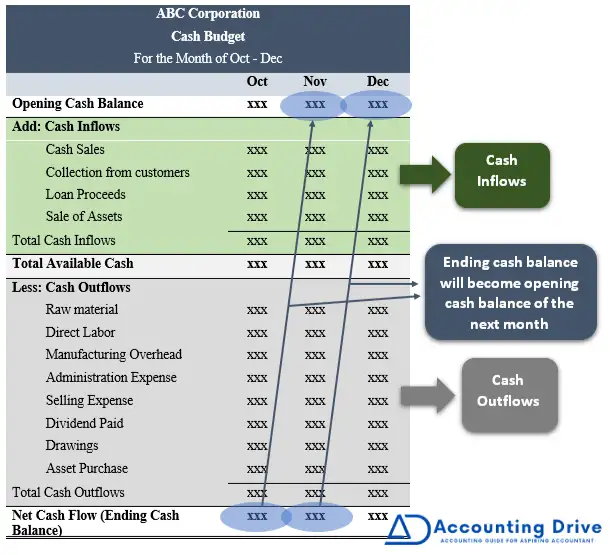

Cash Budget Format

How to Prepare Cash Budget?

It’s very simple. You can prepare Cash budgets by selecting a generalized list of all the available sources of a company and uses of cash in a given period, then rolling it using the current cash balance, making a plan that addresses how to control the net cash position in a period under review.

You can certainly establish it by following four steps for any type of business:

- Define the period

- Decide the desired cash position

- Estimate cash inflows

- Estimate cash outflows

A cash budget of a company takes shape after the preparation of other budgets for example sales, purchases, etc. after having such budgets you can get a clear picture of your cash drivers.

Step-By-Step Calculation

As you have seen in its format and formula, an organization’s cash budget mainly consists of three main parts.

- Projected cash inflows

- Cash outflows- Projected

- Estimated cash balances

let’s first discuss projected cash inflows.

Projected Cash Inflow:

The forecasted cash inflow figure incorporates all the estimated sources from where an organization can get cash over the budgeted period. So, these sources may consist of:

- + Cash sales

- + Cash collected against any accounts receivables

- + Received cash in a budgeted period against the sale of a fixed asset

- + Cash generated from the sale of shares and bonds

- + Cash generated from any other related sources

- + Opening cash balance

You have to add the beginning cash balances to the total cash inflow figure to get a clear picture of the company’s final cash balance over a budgeted period.

Projected Cash Outflows:

Preparing may take into account all the estimated cash outflows during a certain budget period. A company has to anticipate all the cash outflows, for example, the cash budget excludes the following:

- + Cash payments made for buying the raw materials

- + Inputs or semi-finished products

- + Labor payments

- + Consumable

- + Cash to be paid in case of a purchase of fixed asset during the budgeted period

- + Provisions for repairs & maintenance

- + Selling & admin expenses

- + Stationery requirements

- + Distribution of dividends, etc.

Depreciation expense is not included in the cash budget because depreciation expense is a non-cash expense and the cash budget only takes real cash inflows and outflows.

Cash Balance Forecast:

The estimated cash balance is done by the removal of the total cash outflows from the cash inflows over a certain period. A company can perform this activity on a weekly, monthly, quarterly, or yearly basis as its management feels appropriate depending on their need.

If the forecasted budget shows a high surplus of cash balance, the company may use it correspondingly by preparing a financing budget. They take the suitable investment decision for the company. The management may try to invest in property, plant, and equipment, invest in some other fixed asset, or may distribute the surplus funds to other necessary functions within the company as per need.

Cash Budget Example Problem with Solution

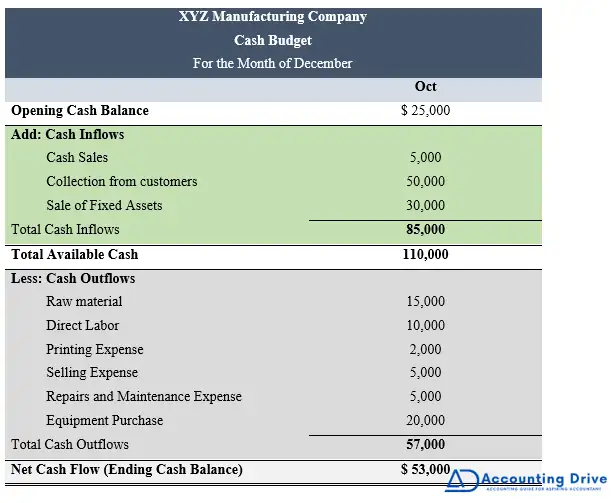

Let’s have an example for a period of one month for XYZ manufacturing company.

XYZ manufacturing company has the following information for the month of December:

The opening cash balance is $25,000. The projected cash inflows over the month include:

| Sales | $5,000 |

| Accounts Receivables Collections | $50,000 |

| Sale of Fixed Assets | $30,000 |

Hence, the total cash over the period will be $110,000.

Its projected cash outflows include:

| Payments for Raw Materials | $15000 |

| Labor (Salaries Expense) | $10,000 |

| Selling Expenses | $5000 |

| Printing Expenses | $2000 |

| Repairs and Maintenance Expense | $5000 |

| Purchase of Equipment | $20,000 |

Hence, the total forecasted outflow amounts to $ 57,000.

Therefore, the forecasted ending budgeted cash balance will be $53,000 ($110,000 – $57,000).

Now let’s put this information into format.

How to comment on Cash Budget? The company’s closing cash balance is more than the starting balance. The management of the company may decide to utilize that surplus amount of the budget for its proposed activities. It’s the company’s management discretion that they may pay the surplus amount as a dividend to its shareholders. Or they may use it in future investments.

What If Balance Is Negative and How to Improve It?

A negative result of the cash balance shows that the organization forecasts to lose money over a certain period. While this negative budgeted cash balance is a potential warning indicator, there are many situations where an organization may plan to lose money for a certain period. For example, new organizations commonly try to pay out more than they put in place when getting started in order to attract more customers needed to form a stable and sustainable organization. Another example you may take is that an organization may forecast short-term losses to spend on its manufacturing or increase its marketing to benefit from the expansion over a long span of time.

In the case of marginal or deficient cash requirements, the management takes suitable actions depending upon the circumstances. These actions may come under the head of:

- Management may have to see the other relevant sources of raising capital

- They may also have to consider the option of increasing the borrowings from the bank

- Cut down the unnecessary expenses

- Delay the expenses

Key Points

- An organization’s main aim in making the cash budget is to predict future cash balances to recognize potential cash deficits and surpluses.

- Depending on the projected cash balances, finance professionals create plans which eventually help in effectively managing those certain situations.

- Controlling a cash budget is rather more important than only preparing it.

- In the case of marginal or deficient cash requirements, the management should take preemptive efficient actions depending on the circumstances.