If you are unable to cover your operating business expenses then it’s the right time to maintain a tight grip on your cash conversion cycle. Managing a small business keeping in your limited resources. Ohhh! Quite a difficult job. Keeping in mind the inflow and outflow of cash, cash flow management requires proper attention. Jessie Hagan revealed in his U.S. Bank study that 82% of small businesses failed due to mismanagement of cash.

This article aims to provide the proper understanding of what is cash conversion cycle is, how you can calculate it and what will happen if the balance is negative.

Now being energetic, let’s get start with me.

What Is Cash Conversion Cycle (CCC)?

In This Article

ToggleThe Cash Conversion Cycle (CCC) is a three-tier process that measures the total time period in days a company is required to convert its on-hand cash into more on-hand cash. This three-tier process includes:

- The investment of available cash into inventory.

- Then inventory into sold product or account receivable.

- Lastly, the account receivable into collections or cash received.

So, as long as the CCC metric remains constant, it is possible for you to identify and correct operational weaknesses that reduce the company’s liquidity and free cash flows (FCFs).

- Simply put, CCC is a measure that indicates how long a company must take to purchase and sell its stock, and then convert outstanding accounts receivables (A/R) to cash.

How to Calculate Cash Conversion Cycle?

You can calculate the CCC by following the below-mentioned formula

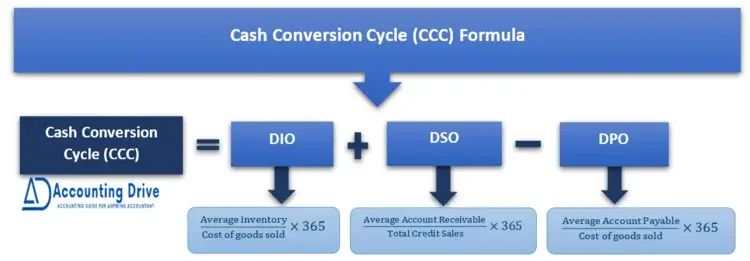

Cash Conversion Cycle Formula

CCC = DIO + DSO - DPO

Where:

CCC stands for Cash Conversion Cycle

DPO stands for Days Payables Outstanding

DIO stands for Days Inventory Outstanding

DSO stands for Days Sales Outstanding

Components of Cash Conversion Cycle

Let’s dive into the deep!

As the above formula shows, the cash conversion cycle consists of these three main components:

Days Inventory Outstanding- DIO

The Days Inventory Outstanding (DIO) represents the time it takes for a company to convert inventory into revenue. Inventory taking a long time to sell would indicate a high figure in DIO. The organization may have inefficient processes for converting inventory into sales. Nevertheless, this isn’t always true since some companies manufacture long-processed products, meaning high DIO is the outcome.

For example, the process of building a car takes a significant amount of time in comparison to the method of manufacturing something simple (e.g., pencils, erasers, pens).

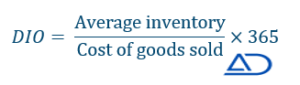

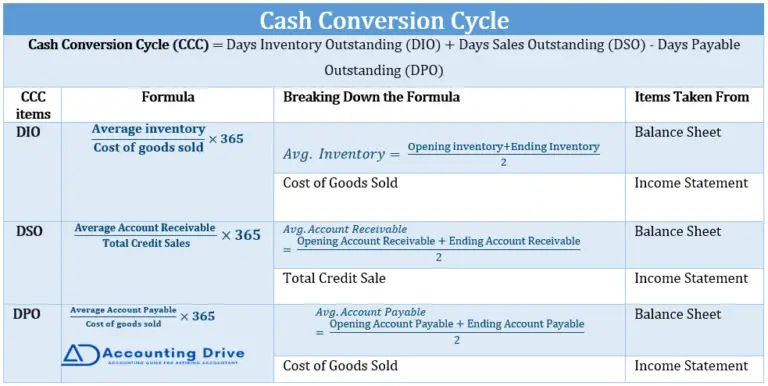

DIO Formula:

Days Sales Outstanding- DSO

Sales on the account and cash sales are two possibilities for a business to clear its stock. The Days Sales Outstanding (DSO) metric represents how long it takes for an organization to collect its accounts receivables and credit sales.

A low DSO figure is ideal. As it indicates, the company is efficient enough to collect its tied-up cash in credit sales quickly. While a high DSO indicates inefficiency in collecting accounts receivables.

Among the things that can lead to this are too long credit terms for credit sales, late payments by customers, or inefficient collection practices by management.

DSO Formula:

Days Payable Outstanding- DPO

Businesses would need to buy inventories prior to meeting the available stock needs. However, it is possible to make purchases either in cash or on credit (accounts payable), as with sales.

It can be considered an indication of how long it takes an organization to pay its bills, and get credit from its suppliers, typically referred to as Days Payable Outstanding (DPO).

The DPO component of the CCC is primarily concerned with managing cash outflows rather than the previous two components, which focus on the efficiency of the conversion of non-cash assets into cash.

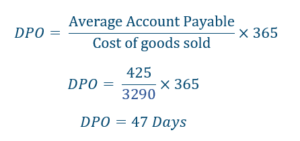

DPO Formula:

Cash Conversion Cycle Formulas

Example: Step-by-Step Cash Conversion Cycle Calculation

Let’s assume Ronald AK is a growing company doing business as let’s say buying or selling inventory. Hence, the required information has been collected from Ronald AK’s financial statements.

| 2020 (in millions) | 2019 (in millions) | |

| Credit Sales | $ 5690 | $ 4590 |

| COGS | $ 3290 | $ 2990 |

| Inventory | $ 320 | $ 300 |

| Account receivable | $ 500 | $ 450 |

| Account Payable | $ 450 | $ 400 |

Based on the above information, you can easily calculate Cash Conversion Cycle by following three simple steps.

- Step #1 = Calculate Average Inventory, Average Account Receivable and Average Account Payable.

- Step #2 = Calculate DIO, DSO and DPO.

- Step #3 = Calculate CCC.

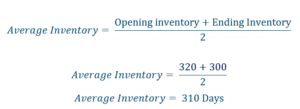

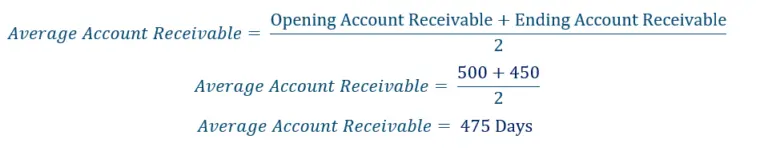

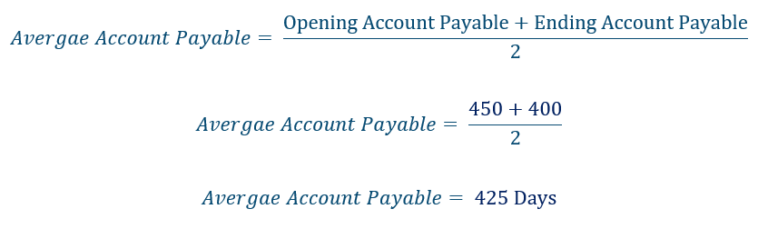

Step #1 = Calculate Average Inventory, Average Account Receivable and Average Account Payable

So, the first step is the calculation of Average inventory, average account receivable, and average account payable.

- An average inventory is typically calculated by averaging the beginning and ending stock levels. The ending balance is taken instead as an alternative to calculate the average inventory value.

- To calculate the average accounts receivable, take averaging a particular period’s start and end balance. Instead of calculating the average, you might consider using the ending proportion of the account receivables.

- Can calculate account payable on average by averaging each account payable opening and closing balance. An alternative approach to calculating the accounts payable is to use the account payable ending balance as an alternative to the average.

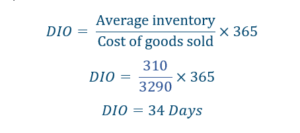

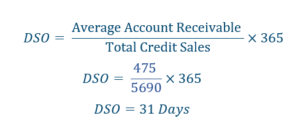

Step #2 = Calculate DIO, DSO, and DPO

The second step is the calculation of DIO, DSO, and DPO. This step is also quite simple just need to put the required information in the formulas.

DIO- Days Inventory Outstanding

- According to the formula, you need three items.

- First is the average inventory which we have already calculated.

- The second is the Cost of goods sold (sales) which can be calculated from the income statement.

- The third is the time period. When calculating the number of days in a period, it is essential to consider how long the period is, whether an entire year, one quarter, one month, or one week. When the period is a year, the number is 365 or 360.

DSO- Days Sales Outstanding

- The same goes with the DSO. Three items are required. Total credit sales can be taken from the income statement.

DPO- Days Payable Outstanding

- DPO calculation also requires only three items.

Step #3 = Calculate CCC

The most easiest third and last step is the calculation of CCC. CCC is calculated by adding up DIO and DSO and subtracting DPO.

Cash Conversion Cycle = DIO+ DSO- DPO

= 34 days + 31 days – 47 days

= 18 days

Ronald AK’s CCC is 18 days indicating it requires 18 days to complete the process from purchasing of inventory, selling, and collecting payment from customers.

What Is A Good Cash Conversion Cycle?

CCC is a liquidity measure that is Lower the better. When your CCC is lower or even indicates a negative figure, then it means that your business can do work efficiently without being tied up with working capital for an extended period.

45 days is an excellent benchmark for CCC.

CCC Best BenchMark

Additionally, a positive CCC shouldn’t be too high. If the CCC is positive, this indicates that your company’s working capital is insufficient and tied up for the number of days in waiting for its account receivables to be clear. On the other hand, your CCC can be high if your company sells products on credit. Typically, your customers will take 30, 60, and sometimes 90 days to pay.

What If Balance Is Negative?

Ohh! You got the negative Cash Conversion Cycle figure. Now what? Is it a bad sign for your company?

The answer is a big No. when your CCC and working capital is negative, it indicates that you take longer to repay your suppliers or pay your bills than the turnover and collections of your inventory. It works like as your suppliers fund your operations. Therefore, it is not necessary to maintain a high operating cash balance to grow your business.

How to Improve CCC?

As a business owner, you can enhance your CCC in several ways. It is important that you understand its components: DI0, DSO, and DPO. Taking a look at your manufacturing process, for example, you may improve your DIO by making improvements.

- Understanding when and how much inventory is ideal for keeping could help boost DIO in a retail business.

- DSO can review by management to determine if credit terms are practical or should be adjusted. Perhaps they should stop credit sales (although this would lead to a lesser overall deal).

- The DPO component’s handling is more complicated than the other two. Delaying payments is not something you can do, and expect the business to be unaffected. Business relationships with suppliers may be damaged if this occurs. To get more favorable terms on your next purchase, building a good relationship with your suppliers is better.

Key Points

- CCC is the time duration for completing the process, whereas working capital is the amount you needed to keep the business solvent.

- CCC has three components: DIO, DSO, and DPO.

- The lower the CCC, the better for business operations.

- Forty-five days of the Cash conversion cycle is the best benchmark for growing a business.

- A larger cash conversion cycle increases the dependence on external capital.