Are you looking for a step-by-step guide for calculating changes in net working capital (NWC)?

Then you are at the right place. In this post, you will get a detailed step-by-step procedure for calculating changes in working capital. First of all, let’s discuss changes in working capital.

So, the changes in NWC are the difference between net working capital of two accounting periods (years, months, or quarters). The cash flow statement provides the true information for calculating changes in NWC.

- Change in Net Working Capital is the difference between the current accounting year’s working capital with the working capital of the previous accounting year.

Difference Between Net Working Capital and Changes in Net Working Capital

In This Article

ToggleNet Working Capital is different from changes in net working capital. Because NWC is simply the amount required by the company to run its business operations smoothly. Thus, NWC is calculated by subtracting current liabilities from current assets.

Net Working Capital Formula

Net Working Capital = Current Assets – Current Liabilities

Get Free access to the AD's working capital cheat sheet

Grab your cheat sheet now by clicking the button !!

On the other side, Changes in Net Working Capital determine the true value or position of the business on the working capital cycle- where the company stands right now.

- Positive Change in NWC: If WC is positive, it indicates the healthier financial position of the company. But when the change in working capital is positive, it indicates the cash outflow- the purchase of current assets.

- Negative Change in NWC: If WC is negative, it indicates the weak financial position of the company or not really. But when a change in working capital is negative, it indicates the cash inflow- an increase in current liabilities.

Changes in Net Working Capital Formula

Changes in Net Working Capital = Current Year Working Capital – Previous Year Working Capital Changes in Net Working Capital = (Current Year Current Assets – Current Year Current Liabilities)- (Previous Year Current Assets – Previous Year Current Liabilities)

Step-by-Step Calculation of Changes in Net Working Capital

How to calculate the change in net working capital is pretty simple; it requires only four steps to follow.

- Step #1 = Calculate the total current assets of the current year and previous year.

- Step #2 = Calculate total current liabilities of the current year and previous year.

- Step #3 = Calculate working capital for the current year and the previous year.

- Step #4 = Calculate changes in net working capital.

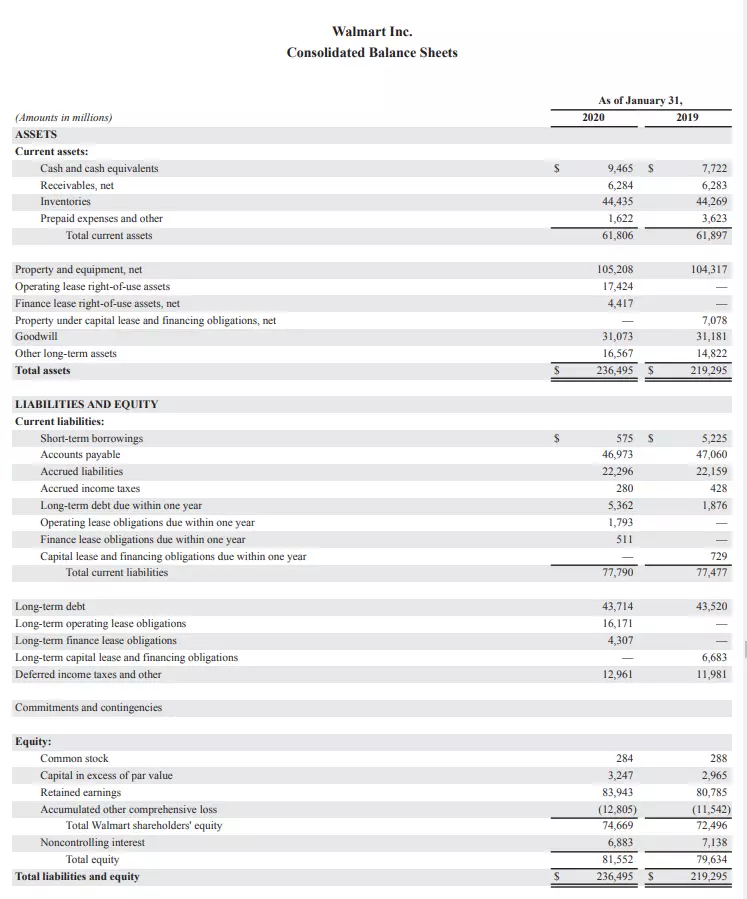

So, let’s perform these four simple steps one by one with me for calculating changes in the NWC of Walmart Inc. Below is the Consolidated balance sheet of Walmart Inc.

Step #1 = Calculate the Total Current Assets of the Current Year and Previous Year

So, the first step for calculating the changes in NWC is the calculation of the Current assets of the current year and previous year (2020 and 2019). Current assets are short-term assets that can easily be converted into cash within a one-year time duration. The Current assets include cash & cash equivalents, prepaid expenses, account receivables, inventory, and other short-term assets.

In the above picture, the highlighted part represents the total current assets of Walmart Inc. Here, by summing up all the current assets, we get the total current assets for the years 2020 and 2019 are $61,806 million and $61,897 million respectively.

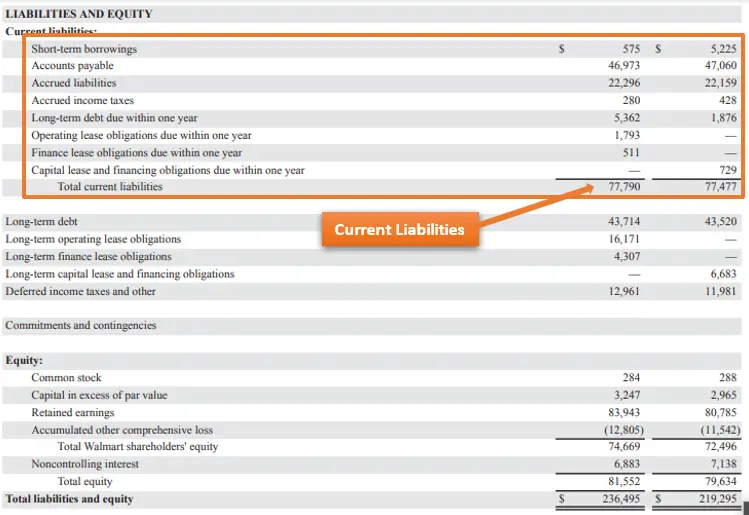

Step #2 = Calculate Total Current Liabilities of the Current Year and Previous Year

The second step is the calculation of total current liabilities for the current and previous year (2020 and 2019). Current liabilities are short-term obligations that become due within a one-year time duration. Current liabilities include Account payable, deferred revenue, short-term borrowings, and current maturity of long-term debts

In the above picture, the highlighted part represents the total current liabilities of Walmart Inc which are due within a one-year time duration. Here, the total current liabilities for the year 2020 and 2019 is $77,790 million and $77,477 million respectively.

Step #3 = Calculate Working Capital for the Current Year and the Previous Year

It’s quite easy to calculate working capital when you have already calculated total current assets and total current liabilities. Because WC equals current assets minus current liabilities. So, in the table, you can see the calculated working capital for the years 2020 and 2019.

| 2020 | 2019 | |

| Current Assets | $61,806 million | $61,897 million |

| Current Liabilities | $77,790 million | $77,477 million |

| Working Capital | ($61,806 – $77,790) ($15,984 million) | ($61,897 – $77,477) ($15,580 million) |

Step #4 = Calculate Changes in Net Working Capital

Now, let’s move toward our final step that is the calculation of changes in working capital. Its calculation is also very simple. You just have to subtract the previous year’s working capital from the current year’s working capital which we have just calculated in the bellow table.

| 2020 | 2019 | |

| Current Assets | $61,806 million | $61,897 million |

| Current Liabilities | $77,790 million | $77,477 million |

| Net Working Capital | ($61,806 – $77,790) ($15,984 million) | ($61,897 – $77,477) ($15,580 million) |

| Changes in Net Working Capital | ($404 million) |

So, we get the negative change in net working capital. But wait what does it actually means and how we can interpret these results?

Interpretation of Changes in Net Working Capital

Let’s interpret these results.

So, the change in net working capital is the negative amount of $404 million. It indicates that Walmart’s current liabilities increases or the company have successfully stretched its account payable days. Moreover, you can see in Walmart’s balance sheet that the company’s account payables are much higher than its account receivables, which indicates the policy of using customers’ and suppliers’ money for business purposes.

Furthermore, if you calculate changes in NWC from the balance sheet, it would provide you with a general understanding of the company’s current position. But from an owner’s point of view, you must have to calculate changes in working capital based on the cash flow statement approach. Changes in NWC are directly related to the cash outflow and cash inflow and hence the cash flow statement so. Thus, the second post provides you with a detailed understanding of how to calculate changes in net working capital from the cash flow statement.

Key Points

- Changes in NWC is different from Working Capital.

- The need to maintain the sufficient amount of cash inflow and outflow is determined by analyzing the Changes in NWC and it also reduces the chances of shortage of cash for future business transactions.

- Negative balance in changes of NWC is good because it indicates the cash inflow or the capability of the compnay to generate cash quickly.

- While negative balance of changes in NWC indicates the cash outflow.