Free cash flow vs cash flow? Confused……

Let’s get over it with me. It’s quite easy.

Free Cash Flows Vs Cash Flow

In This Article

ToggleWhat is free cash flow vs cash flow? However, both look like a bit the same financial terms because both serve the same purpose- help to determine the liquidity position of a company. But, they are different. Cash flow tells you the current position of your company in terms of cash in and goes out of the company. While free cash flow is the left-over amount after paying capital expenditures and operating expenses.

- Free cash flow is used for the valuation of an enterprise for its investors while Cash flow is used to calculate an organization’s net cash flows- cash in and goes out.

What is Cash Flow?

Basically, cash flow is the amount of cash a company or an organization generates in an accounting period. Well, you are going wrong! To clarify, cash flow is not a company’s net income or profit, it’s the total cash amount the company has. Moreover, the net income of a company is measured by using the accrual accounting method where all expenses and revenues should be recognized in the same accounting period in which they incur. However, cash flow is an essential part of an organization’s financial statement because it is a financial report that shows how cash is entered & out of an enterprise within a reporting period. To clarify the difference between cash flow and profit, read the full article on Cash Flow vs. Profit: Same or Different Financial Metrics?

- According to the online-based Financial Accounting course, “a cash flow statement aims to exhibit a detailed picture of the movement of an enterprise’s cash within an accounting period.”

While the company’s cash flow statement gives an insight into the various areas where it uses or receives cash. Do you know that a basic cash flow statement is composed of three sections:

Cash flow from:

- Operating activities

- Investing activities

- Financing activities

Let’s discuss them all, one by one.

Cash Flow from operating activities

Companies typically consider this section necessary. Because it shows how much cash was produced from a company’s regular operations.

Cash Flow from Investing Activities:

The cash flow from investing activities comes from the buying & selling of long-term assets, e.g., property, plant & equipment & facilities

Cash Flow from Financing Activities:

This section of the cash flow statement includes cash inflows & outflows related to the financing activities. However, this cash flow comes from both debt & equity financing, or you may say, the cash flows related to raising money & paying back the debts to investors or creditors.

Calculate the ending balance:

While the change in the net figure of cash for a certain period is equal to the cumulative cash flows of operating, investing, & financing activities. So, this value exhibits the total cash an organization got or lost within a reporting period.

Cash Flow Formula

Cash Flow= Net Profit+ Cash Flow from Operating activities + Cash Flow from Investing activities+ Cash Flow from Financing activities + Beginning Cash Balance

What is Free Cash Flow?

In short, free cash flow is the cash generated from a business or an enterprise after taking into account the investment in non-current assets by the organization.

- Precisely, free cash flow refers to the amount a firm generates from its activities after deducting the capital expenditures (fixed assets with long-term life) for instance, real estate or equipment.

In other words, free cash flow is an essential tool that effectively shows how a business can produce money from day-to-day business activities. Similarly, It also represents how cash flow can affect capital expenses. Above all, business analysts and investors look at the free cash flow figure to know that an organization has enough cash to repay creditors, buy back shares, & can distribute dividends.

Free Cash Flow Formula

How to calculate free cash flow? You can compute the free cash flow in an easy way. For example, here you just need to get an operating cash flow & then eliminate the number of long-term capital expenses. Therefore, you can drive an equation as follows: Free Cash Flow = Operating Cash Flows – Capital Expenses

The cash inflow & outflow for a particular reporting year is cash flow, while free cash flow is the money that remains with the company to be distributed among the shareholders.

Free cash flow vs Cash flow

Differences Between Free Cash Flow & Cash Flow

Cash Flow reports the solvency of an organization. However, Free Cash Flow shows the firm’s performance. Moreover, cash flow is an aggregate amount of operating, investing & financing activities. Further, to calculate the Free Cash Flow, you only need cash from operating activities.

Suppose you compare the free cash flow & cash flow. In that case, you can observe that free cash flow is a more strained measure because it is a powerful indicator of the ability of a company to remain in business. Moreover, it also supports the company’s operations while paying for long-term asset enhancements. On the other hand, cash flow is shown on a firm’s statement of cash flows. Because there is no such measure to report free cash flows, as a result, we have to get it from other informational sources.

Let’s further evaluate the key differences between free cash flow and cash flow:

Definition:

- Cash flow is used to calculate the net operating, investing & financing activities.

- On the other hand, free cash flow helps you to calculate the present value of your business.

Purpose:

- However, the primary aim of cash flow is to calculate an organization’s net cash flows.

- While free cash flow is used for the valuation of an enterprise for its investors.

Formula:

- Cash flow = Cash flow from operating activities + cash flow from investing activities + cash flow from financing activities

- Free cash flow= Earnings Before Interest and Tax * (1 – Tax Rate) + Depreciation – Capital Expenditure – Increase in Net Working Capital / (+) Decrease in Net Working Capital

Scope:

- The purpose of using the statement of cash flow is broader than free cash flow.

- While free cash flow’s scope of work is limited.

Consumption of time:

- While a Cash flow statement takes adequate time for preparation.

- On the other hand, free cash flow does not consume time if all the required information is available.

Advantage:

- However, cash flow helps to find out the liquidity of a firm.

- But free cash flow helps to determine the financial health of an organization.

Requirement:

- However, in cash flow, you must need a profit & loss statement to know a cash flow figure.

- But in free cash flow, you also need the company’s profit & loss statement if you want to calculate its free cash flow.

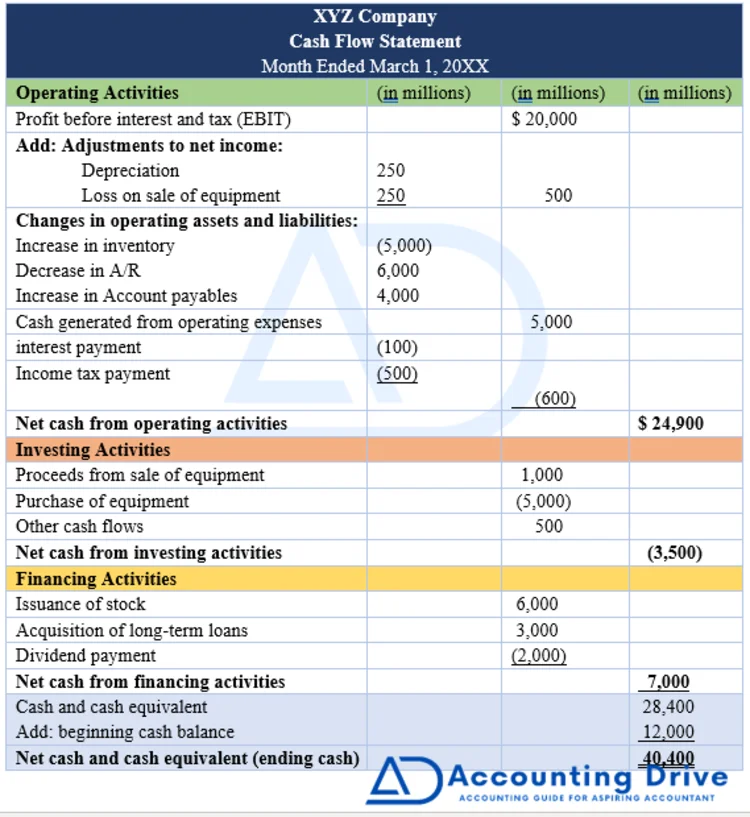

Example- Cash Flow Vs Free Cash Flow

In short, it’s quite easy to identify total cash flow and free cash flow from the cash flow statement of the company. For instance, Here is the cash flow statement of XYZ Company. let’s look at how cash flow and free cash flow differ from each other.

| Cash Flow Example: Here cash flow of XYZ Company is $40,400 million. Cash flow includes all cash that comes in minus all cash that goes out from the company in a given accounting year. As a result, total cash flow includes all cash generated from operating, investing, and financing activities. Beginning cash balance 12,000 Cash flow from operating activities $24,900 Cash flow from investing activities (3,500) Cash flow from financing activities 7,000 Cash Flow 40,400 |

| Free Cash Flow Example: Here free cash flow is $19,900. Free cash flow can be calculated by having total operating cash flow & then eliminate the number of long-term capital expenses. Operating Cash Flow $24,900 Purchase of equipment ($5,000) Free cash flow ($24,900 – $5,000) $19,900 |

Key Points

- Free cash flow is money that a business has left over after taking into account the cash outflows that help expand the assets & above all support the ongoing activities.

- The easiest way to compute the free cash flow is to eliminate the capital expenses from the operating cash flow.

- Cash flow is the net cash figure that a company receives & disburses during a reporting time span.

- Cash flow & free cash flow are both crucial financial indicators used to determine the liquidity of an organization.

- The distinction between these two is that cash flow only tells the inflow and outflow of cash, but free cash flow helps determine the value of a business.