You are looking too puzzled……… How to prepare a cash budget? There are how many different methods of preparing a cash budget? Which method is used when and why? Which method is most suitable for your business? Ahh! No worries…. In this article, you will find all the answers to these questions.

Then, let’s start with me.

What Is a Cash Budget?

In This Article

ToggleSo firstly, what is a cash budget? A cash budget is a business’s forecasted cash flow for a certain period of time. It includes the outflows deductions from inflows to get the required cash figure at a period end. You can get an overview of the cash budget which can be based over a week, month, quarter, or annual. It is mainly used to demonstrate that the cash flows of the entity are sufficient enough to operate within a specified time. In this demonstration, a company gets an insight that how efficiently its management allocates the surplus cash or in case of shortage how they can arrange more cash.

- A cash budget represents a probable movement of cash inflows & outflows over a certain period, or you can say it can be used to forecast the inflows and outflows of cash over a specific period.

Different Methods of Preparing Cash Budget

You can prepare a cash budget by following three different methods:

- Receipt and payment method of cash budget

- Adjusted profit & loss method/Cash Flow Method of cash budget

- Balance Sheet Method of cash budget

Three different methods of preparing a cash budget have been discussed below one by one:

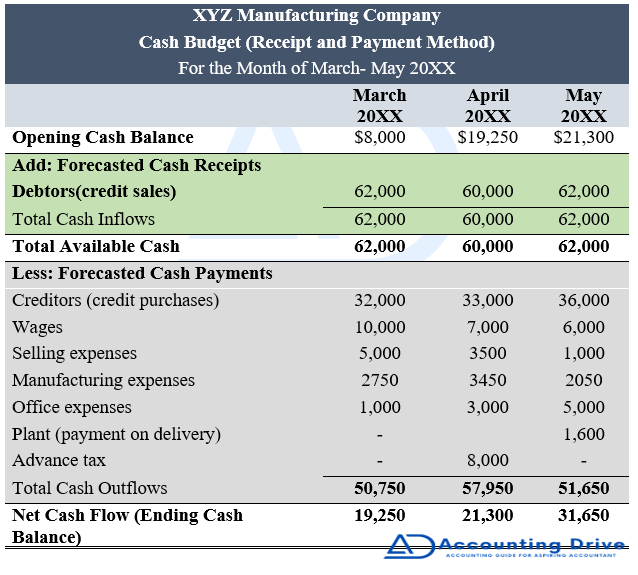

1. Receipt and Payment Method

In this method, the cash receipts and payments of an entity can be forecasted for a specific period. Hence, to get a closing balance all the cash receipts are added to the opening balance of the cash and payments need to be deducted from it. This method is most common and widely used by large organizations for short-term financing.

To prepare the cash budget under receipt and payment method few steps need to be considered:

Specification of Period

Before planning to make a budget, you need to consider the period for which you are making the cash budget, this period can be varied in terms of the week, month, quarter, or annual. Also, if you are developing a cash budget for a seasonal business then it can be made for a specific season.

Forecasting the Cash Receipts

Here you have to consider the options from where you can get the cash and also the cash receipt sources, these can be sales, income from any source, cash collected from the issuance of shares & debentures, and cash received from debtors.

Forecasting the Payments of cash

An entity has to consider the options where it has to make the payments within a certain period of time. The cash payments can be made for purchases, for creditors, for salaries & wages, admin and selling expenses, and taxes.

Cash Budget Formula

The formula to get the receipts and payments of the cash for cash budget is:

- Opening cash balance

- Add: forecasted cash receipts

- Less: forecasted cash payments

- = Closing balance of cash

Cash Budget Example (Receipt and Payment Method)

You need to make a cash budget for the months of May, June, and July 20XX.

| Month | Credit sales | Credit purchases | wages | Selling expenses | Office expenses | Manufacturing expenses |

| January | $68,000 | $38,000 | $80,000 | $4,000 | $2,000 | $3,500 |

| February | 64,000 | 34,000 | 9,000 | 5,000 | 1,000 | 1,000 |

| March | 62,000 | 32,000 | 10,000 | 3,500 | 3,000 | 4,500 |

| April | 60,000 | 33,000 | 7,000 | 1,000 | 5,000 | 2,400 |

| May | 62,000 | 36,000 | 6,000 | 2,000 | 1,500 | 1,700 |

| June | 58,000 | 30,000 | 5,000 | 2,500 | 3600 | 3,000 |

Important points to consider

- The cash balance on 1 March 20XX is $8,000.

- A plant worth $16,000 will be delivered in May 20XX, 10% will be payable on delivery and the balance needs to be paid after three months.

- Advance tax is equal to $8,000 which is payable in January and April 20XX.

- Half payment of Manufacturing expenses amounts is payable after 15 days of occurrence.

- Lag in payment after one month of office and selling expenses.

Office and selling expenses for March will be paid in February and the same case in the following month.

Half of the manufacturing expenses for Feb and March will be paid in May, following the same trend afterward.

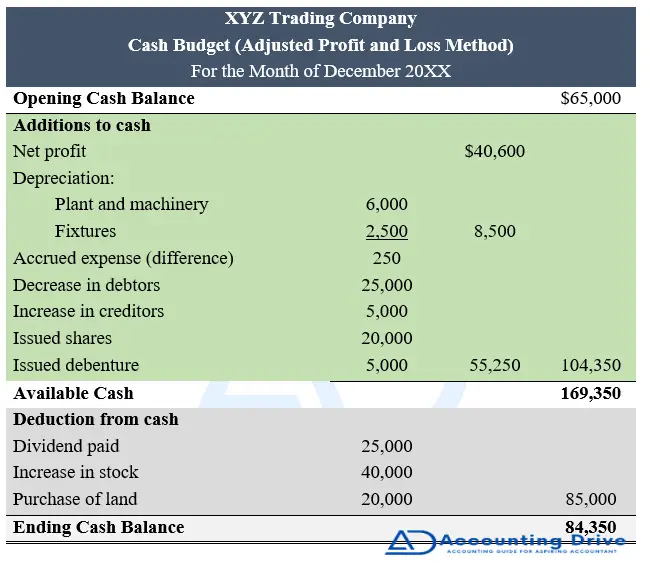

2. Adjusted Profit and Loss Method of Cash Budget

In this method, the forecasted cash budget figure can be achieved by adjusting the profits figure shown in the estimated statement of profit and loss account. The opening cash balance has to be added to the non-cash expense figure, other amounts which have to be added: decrease in current assets, the amount collected from the sale of fixed assets, increased amount of current liabilities amount collected from the issuance of shares, and debentures. The basic non-cash expenses include depreciation, written-off intangible assets, or deferred revenue expenses.

The deduction side of the cash budget amount may include payments made for the purchase of fixed assets, payment of dividends and repayment of loans, the redemption of shares/debentures, an increase in current assets, and a decrease in current liabilities. The final figure is the closing balance. This method is used for long-term forecasting because it gives more accurate figures.

If you want to keep it in the formula, then it may take a form like:

- Opening cash balance

- +Net Profit shown by the forecasted statement of profit & loss

- + Non-Cash expenses

- + Decrease in current assets

- + Increase in current liabilities

- + Sale

- – Increase in current assets

- – Decrease in current liabilities

- – Purchase of fixed assets

- – Redemption of shares and debentures etc.

- = Closing Cash Balance

Cash Budget Example (Adjusted Profit and Loss Method of cash budget):

The following is the Balance Sheet of XYZ Trading Co.:

Forecasted Balance Sheet

As on December 31, 20XX

| Liability & Equity | Assets | ||

| Share capital | $1,50,000 | Building | $80,000 |

| Reserves | 15,500 | Plant | 45,000 |

| P&L account | 23,500 | Furniture | 15,000 |

| Debentures | 25,000 | Stock | 10,000 |

| Creditors | 75,000 | Debtors | 75,000 |

| Accrued Expense | 1,000 | Bank | 65,000 |

| Total | 2,90,000 | Total | 2,90,00 |

Forecasted profit & Loss account

For the year ended 31 December 20XX

| $ | $ | ||

| Opening stock | 10,000 | sales | 1,75,000 |

| purchases | 150,000 | Closing stock | 50,000 |

| Gross profit | 65,000 | ||

| Salary 5250 | Gross profit | 65,000 | |

| O/s salary 1000 | 6250 | interest | 350 |

| To depreciation | |||

| Plant | 6000 | ||

| Furniture | 2500 | ||

| Admin expense | 7500 | ||

| Selling expense | 2500 | ||

| Net profit | 40,600 | ||

| Dividend | 25,000 | Net profit | 40,600 |

| Balance c/d | 39,100 | Balance b/d | 23,500 |

| 64,100 | 64,100 |

Additional information for the year 20XX:

- Issued Shares for $20,000

- Debentures were issued for $5,000

- On 31 December 20XX, accrued expenses were $1,250, debtors $50,000, creditors $80,000, and land & buildings $100,000

This method of making of cash budget by adjusted profit & loss statement is also known as ‘Cash Flow Statement’. The point which differentiates both of them is that the cash flow statement takes the actual figures of an entity while for making a cash budget you have to take the estimated amounts.

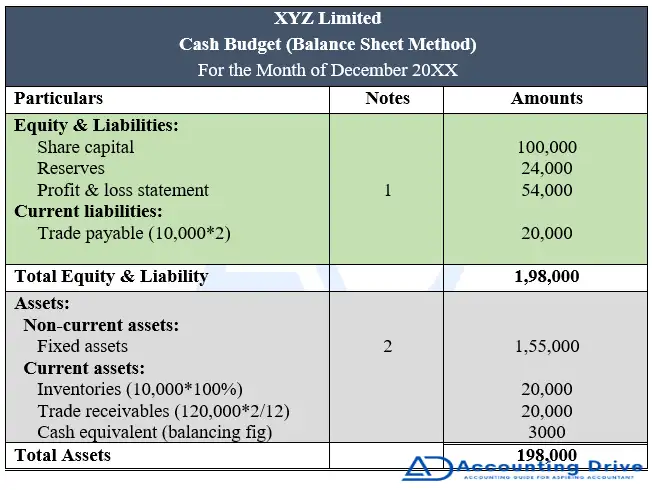

3. Balance Sheet Method

If you are making a cash budget by the balance sheet method, then except for cash and bank amount you have to consider the changes in all the values of assets and liabilities. Through this method, an estimated balance sheet for a period after taking into account the changes on both sides of the balance sheet has been prepared. In case the value of the budgeted liabilities increases from the amount of the budgeted assets, the difference will be the forecasted balance of cash for the budgeted period. On the other hand, if the value of budgeted assets exceeds the amount of budgeted liabilities, the difference will have to be taken as the shortage of cash balance (or bank overdraft). This method is also used for long-term forecasting.

Example (Balance Sheet Method)

- XYZ Limited has share capital worth $1,00,000 and reserves of $24,000.

- $1,50,000 for non-current assets.

- Inventories & receivables were $10,000 and $50,000 respectively

- trade payables $10,000.

- To maintain the increasing trend, the stock is proposed to be exceeded by 100% by the end of the current year. Plant and Machinery amount of $15,000 needs to be purchased during the year.

- The forecasted profit for the year is $40,000 this amount is after setting the $10,000 depreciation and 50% of profit figure for taxation.

- It is possible that trade payables become doubled.

- A dividend of 10% has to be paid.

- 2 months of Outstanding Trade receivables are forecasted.

- Budgeted sales are $120,000.

The budgeted cash position at the end of the period:

1: Statement of profit & loss

Balance: 24,000

Add: profit after tax 40,000

Less: dividend 10% (10,000)

54,000

2: Fixed Assets

Fixed assets: 1,50,000

Add: purchases 15,000

Less: depreciation (10,000)

1,55,000

Which Method to Choose?

From these above-mentioned three different cash budget preparation methods- which is most suitable for your company? or which is to choose?

Well, it depends. If you are looking for short-term forecasting- say as one to two years or months, then Receipt and Payment method is most suitable. And if you are looking for long-term forecasting, for five to six years, then you should go with either the Balance Sheet method or the Adjusted Profit and Loss Method. Both are favorable and will yield accurate forecasting estimates.

Key Points

- A Cash budget is used to forecast the inflows and outflows of cash over a specific period.

- There are three different methods of preparing a cash budget- Receipt and payment method of cash budget, Adjusted profit & loss method, and Balance Sheet Method.

- The receipt and payment method are used for short-term forecasting. While Adjusted profit & loss method and the Balance Sheet method are used for long-term forecasting.

- Depending on the projected cash balances, finance professionals create plans which eventually help in effectively managing those certain situations.