While calculating working capital (WC), have you ever found a negative working capital? Or confused between positive working capital or negative working capital: Which is better? If yes, then this is for you. In this post, I have explained with the help of the Wall-Mart case study- all the different positions of working capital: positive, negative, and neutral. What do they mean, and which is better than others?

Let’s dive deep into the topic.

Working capital depicts the true picture of the company’s short-term financial and liquidity position, and operational efficiency at a given time period. It is the leftover amount after paying all short-term debts from current liabilities.

Positive or Negative Working Capital? Let’s Calculate

In This Article

ToggleHow to calculate working capital? Is it difficult?

So, let’s make it simple….

Working capital is calculated by deducting current liabilities from current assets, showing the left-over amount after paying all company’s dues and obligations.

Working Capital Formula

Working Capital= Current Assets- Current liabilities

The standard formula for calculating working capital is to subtract current liabilities from current assets. But many accountants use more narrowed and focused formulas for calculating the exact WC position of a company.

Focused Formula:

- Working Capital = (Current Assets – Cash) – (Current Liabilities – Short-term Debts)

More Focused Formula:

- Working Capital = Account Receivable + Inventory – Account Payable

The working capital of a company can be positive, neutral, or negative depending on the company’s financial position.

Here is a Working Capital Free cheat Sheet for You.

Get Free access to the AD's working capital cheat sheet

Grab your cheat sheet now by clicking the button !!

What is Positive Working Capital?

Positive working capital is the most common position where current assets exceed current liabilities, which means that the company can cover its short-term debts with the available cash resources. Meanwhile, maintaining a positive WC with the same working capital structure requires funding based on an increase in revenue growth. Let’s say, if the company revenue increased by 5%, then to maintain a positive working capital position, WC funding should be increased by 5%.

What is Neutral Working Capital?

Neutral working capital is the position where current assets exactly match with its current liabilities. This means that the company can cover its debts with the available cash resources. Moreover, businesses with a neutral WC position do not require additional funding for business growth and help to eliminate additional annual cash flow expenses.

What is Negative Working Capital?

Negative working capital is the position where current assets are less than its current liabilities. This means that the company is unable to cover its debts with the available cash resources.

Summary

| Positive working capital position | CA > CL | Here, Current Assets exceed Current liabilities |

| Neutral working capital position | CA = CL | Where Current Assets equal Current liabilities |

| Negative working capital position | CA < CL | Current liabilities exceed Current Assets |

Working Capital Case Study- Wal-Mart Stores, Inc.,

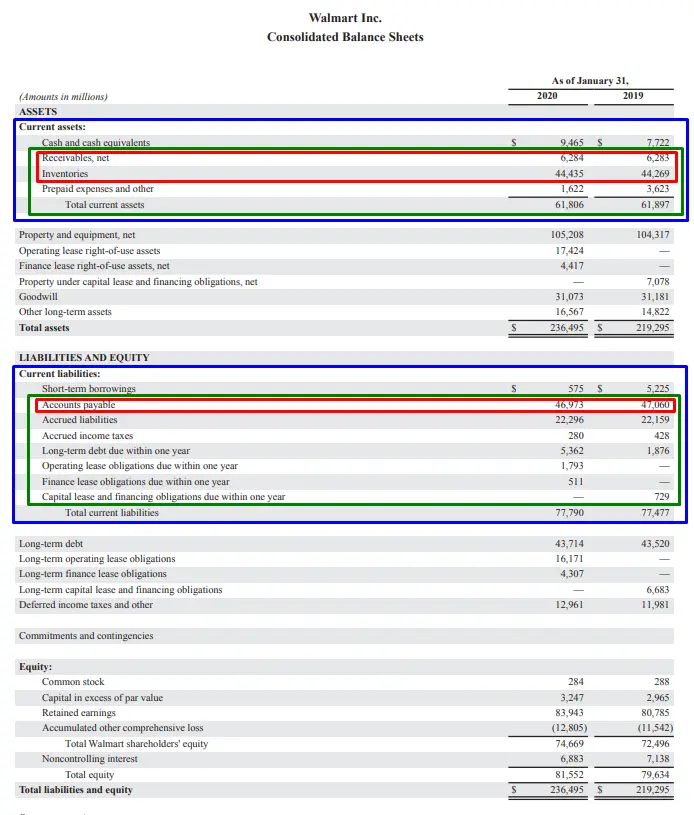

One of the largest global retail stores- Wal-Mart Stores, Inc., has reported $524 billion in revenues with an operating cash flow of $25 billion for the fiscal year 2020. Hence, for gaining practical insight into the working capital concept and its different formulas, let’s calculate the working capital of Wal-Mart Stores, Inc., for the years 2019 and 2020. Below is the consolidated balance sheet of Wal-Mart Stores, Inc.

In the above picture, three boxes are highlighted by using different colors to develop a better understanding of the three different working capital formulas and their respective components.

Let’s first calculate Working Capital by using the standard working capital formula.

Working Capital = Current Assets – Current liabilities

Where:

Current Assets = Cash & cash equivalent + A/R + Inventories + Prepaid Expense

& Current liabilities = Short-term borrowings + A/P + Accrued liabilities + Accrued income taxes + Current Long-term debt + Current Operating lease obligations + Current Finance lease obligations + Current Capital lease and financing obligations.

Calculation of WC by using Working capital Standard Formula Working Capital = Current Assets – Current liabilities Year 2019 Current Assets = $ 7,722 million + $ 6,283 million + $ 44,269 million + $ 3,623 million = $ 61,897 million Current liabilities = $ 225 + $ 47,060 million + $ 22,159 million + $ 428 million + $ 1,876 million + $ 729 million = $ 77,477 million Working Capital = Current Assets – Current liabilities = 61,897 million – 77,477 million = ($ 15,580 million) Negative Working Capital |

Year 2020 Current Assets = $ 9,465 million +$ 6,284 million +$ 44,435 million +$ 1,622 million = $ 61,806 million Current liabilities = $ 575 million + $ 46,973 million + $ 22,296 million + $ 280 million + $ 5,362 million + $ 1,793 million + $ 511 million = $ 77,790 million Working Capital = $ 61,806 million – $ 77,790 million = ($ 15,984 million) Negative Working Capital |

Calculation of WC by using Working capital Focused Formula Working Capital = (Current Assets – Cash) – (Current Liabilities – Short-term Debts) Year 2019 Current Assets = $ 6,283 million + $ 44,269 million + $ 3,623 million = $ 54,175 Current liabilities = $ 225 million + $ 47,060 million + $ 22,159 million +$ 428 million + $ 1,876 million + $ 729 million = $ 77,252 million Working Capital = (Current Assets – Cash) – (Current Liabilities – Short-term Debts) = $ 54,175 million – $ 77,252 million = ($ 23,077 million) Negative Working Capital |

Year 2020 Current Assets = $ 6,284 million + $ 44,435 million + $ 1,622 million = $ 53,341 million Current liabilities = $ 46,973 million + $ 22,296 million + $ 280 million + $ 5,362 million + $ 1,793 million + $ 511 million = $ 77,215 million Working Capital = $ 53,341 million – $ 77,215 million = ($ 23,874 million) Negative Working Capital |

Calculation of WC by using Working capital More Focused Formula Working Capital = Account Receivable + Inventory – Account Payable Year 2019 Current Assets = $ 6,283 million + $ 44,269 million = $ 50,552 million Current liabilities = $ 47,060 million = $ 47,060 million Working Capital = (Current Assets – Cash) – (Current Liabilities – Short-term Debts) = $ 50,552 million – $ 47,060 million = $ 3,492 million Positive Working Capital |

Year 2020 Current Assets = $ 6,284 million + $ 44,435 million = $ 50,719 million Current liabilities = $ 46,973 million = $ 46,973 million Working Capital = 50,719 million – 46,973 million = $ 3,746 million Positive Working Capital |

Both, the standard and focused working capital formulas yield a negative working capital position in both years. While the more focused working capital formula brings a positive working capital position.

What does it mean? Negative or positive working capital, which is better? And how does it affect Wall-Mart operations?

Let’s explore the answers.

Positive or Negative Working Capital? Let’s Find Which is Better?

At first sight, the negative working capital position of a company shows that its liquidity position is not good enough to meet its day-to-day obligations. Thus, it could be seen that Wal-Mart Stores, Inc.’s current liabilities are greater than its current assets. This indicates that the company is not financially sound enough to pay its debts and eventually may face a serious financial crisis because of the unavailability of liquid assets.

On the other side, positive working capital looks more beneficial for a company because it can cover all company’s dues and obligations effectively. In addition, the remaining amount in positive working capital brings several ample opportunities for businesses to invest, such as starting a new project, purchasing new equipment, or pursuing any expansion plan. In short, positive working capital shows that the company’s short-term financial health is good.

But wait, is it really good for a business?

Well, not all the time. It depends on the growth, structure, type, and size of a business.

Then, Negative Working Capital is Good or Bad?

Many companies are successfully and skillfully maintaining negative working capital by using efficient operating and supply chain management strategies, such as Amazon, McDonald’s, Walmart, and Microsoft.

A negative working capital position is considered the most favorable position- especially for growing companies- when technically and skillfully handled, or otherwise can cause great financial harm to the companies.

Director of Georgia Tech Financial Analysis Lab, Chuck Mulford said that companies with Negative working capital position financed their businesses by effectively borrowing from their customers and vendors.

How to Manage Negative Working Capital? A big question…

A number of companies are effectively managing their business operations by adopting the following strategies:

- Minimizing their inventory levels to free up space

- Shortening customer credit terms to get paid quickly

- Stretching pay time for vendors

Moreover, other strategies include Cash up-front payments from customers and maintaining high inventory turnover rates, which helps to generate cash quickly. Thus, Cash-up-front payments from customers enable the company to pay vendors with customers’ money. Hence to manage working capital, companies have to follow effective Working Capital Management Strategies.

However, the positive effect of a negative working capital position can be eliminated when there is negative growth in the company’s revenues. Thus, at this stage, companies require additional investment or they have to face a serious financial crisis.

Key Points

- Working capital depicts the true liquidity position of the company.

- Positive working capital shows the financially sound liquidity position of the company.

- Negative working capital means the company’s liabilities are greater than its current assets.

- Positive working capital or negative working capital? Both are good, depending on the type and size of the business.

- Negative working capital can be effectively handled and managed by following effective working capital management strategies.

- Effective working capital management strategies allow companies to maintain high inventory turnover levels, cash-up-front collection from customers, strong credit collection policy implications, and generate cash quickly to meet liquidity demand.

Was this post helpful? Comment below.

Tell me what you want to learn more about.