So, here is a question that raises in my mind- why do professional accountants prepare a cash flow statement, and how one can prepare and interpret it?

So, to get the full insight and better understand the basic concepts of the Cash Flow Statement (CFS) you have to read the full article. Because, it is very important for everyone- business owners, managers, or investors to better understand the cash flow position of a company to make better strategic future decisions.

What Is a Cash Flow Statement?

In This Article

ToggleFirstly, let’s start by understanding the underlying concept of the cash flow statement (CFS)- what exactly is CFS? So, the Cash flow statement helps to analyze the cash flow position of an organization in a given time period. Furthermore, Cash flow refers to the movement in cash amount- cash in and out of an organization.

From 1987 onward, the preparation of the CFS became one of the mandatory statements. As a result, International Accounting Standard (IAS 7) is specifically designed to deal with providing guidelines for preparing the CFS.

IAS 7

- In short, a Cash Flow Statement is a financial statement that traces the cash inflow and outflow (Cash in and out) of an organization. It provides a detailed overview of how well the cash is utilized during an accounting period.

Step by Step Guide For Preparing Cash Flow Statement

Nowadays, it’s become very challenging for managers to manage cash effectively. Therefore, the CFS is considered an effective tool to trace your working capital requirement or flow of funds- cash in and out. Thus, CFS should prepare frequently- as soon as possible- let’s say quarterly or monthly basis. ASC 230 and IAS 7 provides guidelines for the preparation of statement of cash flow prescribed by US GAAP and IFRS, respectively.

Cash flow statement is very different from the balance sheet and income statement because it includes only current cash inflows and outflows (not includes any credit sales or future payments). Therefore, net income is also different from ending cash balance.

CFS vs net income

Cash Flow Statement Format

Secondly, how to prepare a cash flow statement? seems difficult!!!!

No! It’s not. Because it’s quite simple. Let’s explore with me.

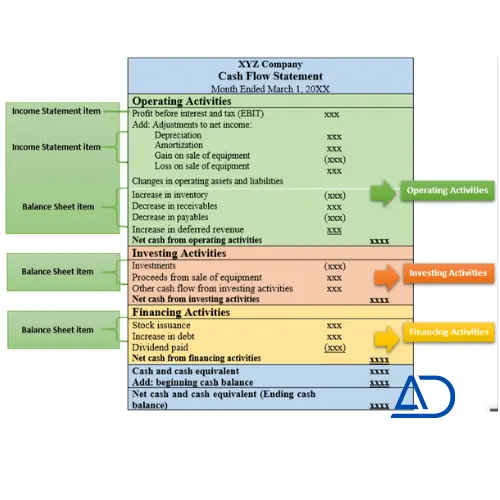

So, the preparation of a Cash flow statement in accounting is divided into three main steps:

- Operating Activities

- Investing Activities

- Financing Activities

Let’s discuss each step in detail.

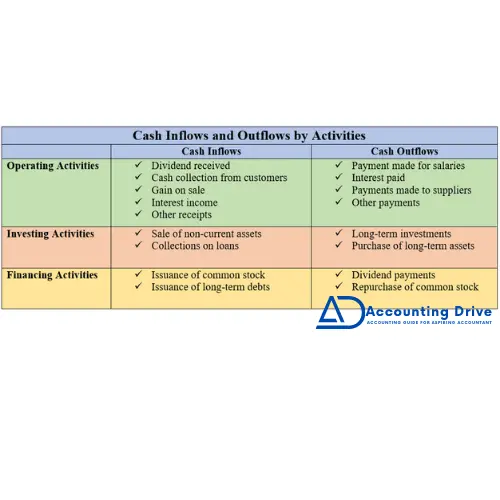

Operating Activities

Firstly, here the first step in the preparation of a CFS is the identification of cash inflows and outflows from operating activities. Operating activities includes only revenue-producing activities or direct cost incurred during production: such as the purchase of raw material, cash received from customers, salaries paid to employees, and other operating cash inflows and outflows.

So, how to calculate operating activities? In accounting, there are two procedures for calculating operating activities, to clarify, the first one is the Direct method and the second one is the Indirect Method. Above all, there is no hard and fast rule to follow one specific method. It’s up to you. But preferably indirect method (IAS 7.18) is most viable and most preferable by professional accountants.

What is this direct and indirect method? What are the differences? Are they totally different or somewhat related?

So, dive straight into the topic with me.

Cash Flow Statement- Direct Method

The first method for calculating operating activities is the direct method. The direct method is very simple because it is based on only transactional data. It just requires adding up all gross cash receipts and then subtracting all the gross cash payments made during the period.

Here is the format of CFS using the direct method.

| XYZ Company Cash Flow Statement Month Ended March 1, 20XX | |||

| Operating Activities | (in millions) | (millions) | |

| Cash received from customers | $ 20,000 | ||

| Employees’ salary (Cash paid) | (5,000) | ||

| Payment to Suppliers | (7,000) | ||

| Net cash from operating activities | $ 8,000 | ||

| Investing Activities | |||

| Purchase of equipment | (5,000) | ||

| Net cash from investing activities | (5,000) | ||

| Financing Activities | |||

| Issuance of stock | 2,000 | ||

| Net cash from financing activities | 2,000 | ||

| Cash and cash equivalent Add: beginning cash balance | 5,000 2,000 | ||

| Net cash and cash equivalent (ending cash) | 7,000 |

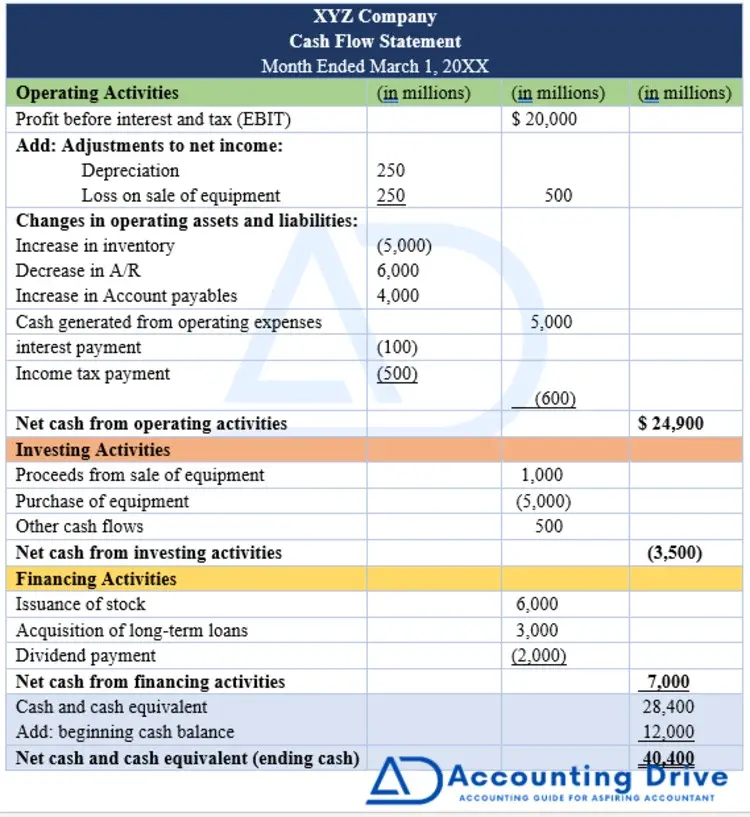

Cash Flow Statement- Indirect Method

The second method is the indirect method– above all, it is the most preferable method. In this method, accountants undo all the impact of accruals by eliminating non-cash items from net income. Because the net income is calculated by using an accrual accounting basis which reported each revenue and expense in the period in which they incurred. Consequently, the adjustments are made by subtracting all non-cash expenses and revenues from net income.

Therefore, the below format of CFS is designed by using the direct method.

| XYZ Company Cash Flow Statement Month Ended March 1, 20XX | |||

| Operating Activities | (in millions) | (millions) | (in millions) |

| Profit before interest and tax (EBIT) | $ 3,000 | ||

| Add: Adjustments to net income: Depreciation Loss on sale of equipment | 250 250 | 500 | |

| Changes in operating assets and liabilities: Increase in inventory Decrease in A/R Increase in Account payables | (5,000) 6,000 4,000 | ||

| Cash generated from operating expenses | 5,000 | ||

| interest payment | (100) | ||

| Income tax payment | (400) | (500) | |

| Net cash from operating activities | $ 8,000 | ||

| Investing Activities | |||

| Purchase of equipment | (5,000) | ||

| Net cash from investing activities | (5,000) | ||

| Financing Activities | |||

| Issuance of stock | 2,000 | ||

| Net cash from financing activities | 2,000 | ||

| Cash and cash equivalent Add: beginning cash balance | 5,000 2,000 | ||

| Net cash and cash equivalent (ending cash) | 7,000 |

Direct and indirect methods- both yield the same amount in the operating activities.

Investing Activities

Secondly, the second step in the preparation of CFS is the calculation of investing activities. SO, Investing activities are associated with the buying and selling of non-current assets. Therefore, it includes changes in cash position made due to purchasing and selling of long-term assets- purchase or sale of equipment, contracting new building, or buying of vehicles.

Financing Activities

Thirdly, the third step is the calculation of financing activities. So, Financing activities deal with the equity and borrowing structure of the company. Thus, any increase and reduction in the company’s capital or long-term liabilities are reported in the financing activities. Moreover, it includes issuance or repurchase of common stock, any dividend paid, and borrowing or repayment of debt. Further, non-cash financing activities such as discounts made should not be included in the financing activities because it has no cash effect.

Cash Flow Statement Example

Are you unable to get a practical insight about the topic yet? Not a big issue.

For instance, now get practical insight into the cash flow statement by practically performing an example of preparing the CFS.

Cash Flow Statement Analysis

When you are done preparing the CFS, then what comes next?

So, What exactly does CFS tell its readers?

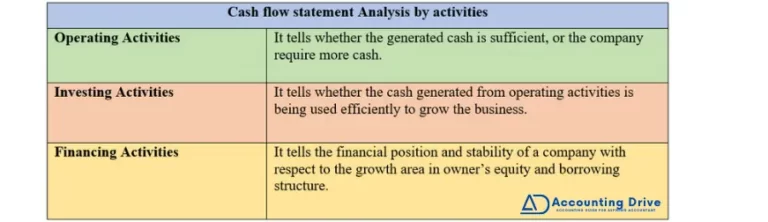

Here, the cash flow statement is basically prepared to tell its reader the overall cash position of a company- From where cash comes and where it spends out. Moreover, with the help of CFS, one can analyze which state the company is in whether in a profitable, growing, or startup phase, or whether in a declining position. Investors can also make better strategic decisions based on the performance of each activity.

Key Points

- To sum up, the Cash flow statement tells its readers about cash- where it comes from and where it goes.

- It became a mandatory part of financial statements since 1987.

- Above all, the Cash flow statement is subdivided into three main parts- operating, investing, and financing activities.

- Subsequently, Operating activities can be calculated by two methods- Direct and Indirect methods.

- The direct method is most preferable because it removes the impact of non-cash items.

Recommended Articles

Get Free access to the AD's working capital cheat sheet

Grab your cheat sheet now by clicking the button !!