The most crucial thing is to balance it when we are talking about how to prepare a balance sheet. No, it’s not. There are some important points to follow to get accurate results. Here, you go. In this article, you will get clear insights on how to prepare it and easily balance it.

What Is Balance Sheet?

In This Article

ToggleBasically, Balance sheet balances an accounting equation. It tells us what we have in our hands or what we owes at the end of an accounting period. It is also known as Statement of financial position. It shows overall health of the business at a specific point. It can be prepared monthly, quarterly, and annually. More importantly, it is one of the critical financial statement including income statement and cash flow statement.

Simply put, balance sheet is a financial statement that depicts true financial position at a specific point in time.

Balance sheet comprises on an accounting equation:

Accounting equation:

Assets = Liabilities + Equity

What We Have In Our Hands = What We Owes + Shareholder Equity

Not taking your too much time. Let’s strait jump toward our main topic: How to prepare a Balance sheet.

Balance Sheet Format

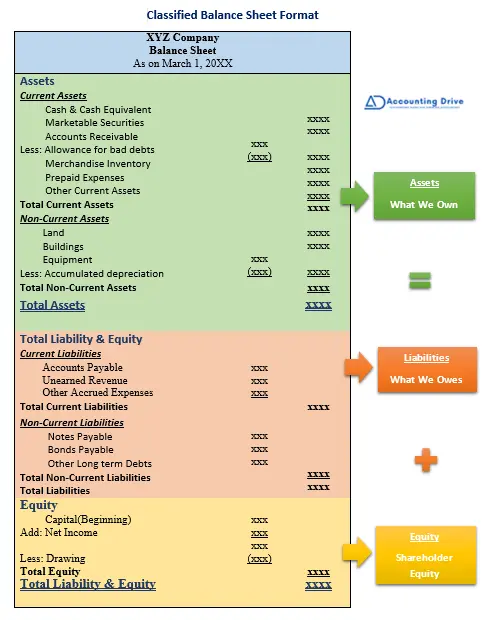

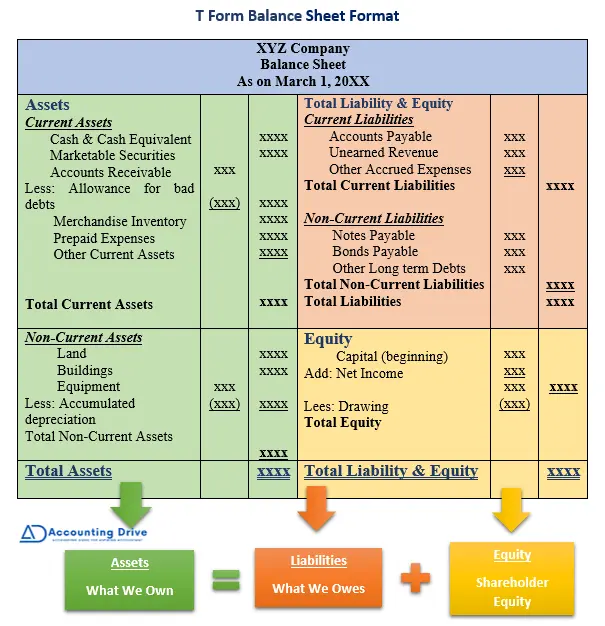

You can prepare balance sheet in two ways: the classified balance sheet or the T Form Balance sheet. Here, you can see both formats. There is no hard or fast rule, you can choose any format to prepare it. It’s up to you.

Classified Format

T Form Format

Steps to Prepare a Balance Sheet

It’s very easy to prepare a balance sheet because it requires only 8 steps to follow:

- 1st Step: Calculate Total Current Assets

- 2nd step: Calculate Total Non-current Assets

- 3rd Step: Calculate Total Assets

- 4th Step: Calculate Total Current Liabilities

- 5th Step: Calculate Total Non-Current Liabilities

- 6th Step: Calculate Total Liabilities

- 7th Step: Calculate Total Equity

- 8th Step: Calculate Total Liability & Equity

A Balance sheet can be divided into three main parts – Assets, Liabilities and equity: just as we have discuss earlier. First three steps will help us to get total assets, and other three steps will tell us how to calculate total liabilities and the last two steps will get us the final results. Now let’s start.

1st Step: Calculate Total Current Assets

The first step is to calculate total current assets. Current assets are those assets that are convertible to cash within a one year. It includes cash & cash equivalents, marketable securities, account receivable, prepaid expenses and more. You can calculate it by simply following these steps:

Current Assets

Cash & Cash Equivalent xxx

Marketable Securities xxx

Accounts Receivable xxx

Less: Allowance for bad debts (xxx) xxx

Merchandise Inventory xxx

Prepaid Expenses xxx

Other Current Assets xxx

Total Current Assets xxx

2nd step: Calculate Total Non-current Assets

The second step is the calculation of non-current assets. Non-current are also known as fixed assets, these takes two or more years to convert into cash. It includes Property, plant and equipment. You can calculate it as:

Non-Current Assets

Land xxx

Buildings xxx

Less: Accumulated Depreciation (xxx) xxx

Equipment xxx

Less: Accumulated depreciation (xxx) xxx

Total Non-Current Assets xxx

3rd Step: Calculate Total Assets

Now, what you have calculated earlier, add them both to get total assets.

Total Assets

Current Assets xxx

Add: Non-Current Assets xxx

Total Assets xxx

4th Step: Calculate Total Current Liabilities

Now, moving toward second main part: calculation of total liabilities. Here, Current liabilities are those liabilities that are payable within one year. It includes accounts payable, unearned revenue and all other accrued expenses.

Current Liabilities

Accounts Payable xxx

Unearned Revenue xxx

Bank overdraft xxx

Other Accrued Expenses xxx

Total Current Liabilities xxx

5th Step: Calculate Total Non-Current Liabilities

The fifth step calls for the calculation of total non-current liabilities. Non-current liabilities are those liabilities that are due after one year. It includes debenture payable, and other long term liabilities.

Non-Current Liabilities

Notes Payable xxx

Bonds Payable xxx

Other Long term Debts xxx

Total Non-Current Liabilities xxx

6th Step: Calculate Total Liabilities

To calculate total liabilities, add current and non-current liabilities.

Total Liabilities

Current Liabilities xxx

Add: Non-Current Liabilities xxx

Total Liabilities xxx

7th Step: Calculate Total Equity

It’s our last main part, calculation for the total equity. Equity is left over amount reducing all liabilities. It shows the overall book value of a company. I is calculated as:

Equity

Capital (beginning) xxx

Add: Net Income xxx

xxx

Lees: Drawing (xxx)

Total Equity xxx

8th Step: Calculate Total Liability & Equity

The last steps requires to add total liability and equity. Pic data from the previous 6th and 7th step, add total liabilities and equity.

Total Liability & Equity

Total Liabilities xxx

Add: Total Equity xxx

Total Liability & Equity xxx

At last, you will get the equal balances on both sides.

Solved Example

Let’s take a simple example first.

Here is the selected data from the trail balance of Haram Enterprises as on December 31 XXXX:

- Cash $45,000

- Accounts payable 32,000

- Equipment 100,000

- Drawing 12,000

- Accumulated depreciation (equipment) 27,000

- Capital 450,000

- Merchandise inventory 27,000

- Bank overdraft 5,000

- Accounts receivable 30,000

- Land 300,000

With the help of this available data, you can easily prepare a balance sheet.

Haram Enterprises

Balance Sheet

As on December 31, XXXX

Assets |

| $ | Liabilities & Equity | $ |

Current Assets |

|

| Current Liabilities |

|

Cash |

| 45,000 | Accounts Payable | 32,000 |

Account Receivable |

| 30,000 | Bank Overdraft | 5,000 |

Merchandise Inventory |

| 27,000 |

|

|

Total Current |

| 102,000 | Total Liabilities | 37,000 |

|

|

|

|

|

Non-Current Assets |

|

| Equity |

|

Land |

| 300,000 | Capital | 450,000 |

Equipment | 100,000 |

| Less: Drawing | (12,000) |

Less: Accumulated Depreciation | (27,000) | 73,000 |

|

|

Total Non-Current Assets |

| 373,000 | Total Equity | 438,000 |

|

|

|

|

|

Total Assets |

| $475,000 | Total Liability & Equity | $475,000 |

Key Points

- Balance sheet depicts the overall position of a company at a specific point in time.

- It tell us what we own and what we owes.

- It has three border categories: Assets, Liabilities and equity.

- It works on accounting equation.