Very confusing. Can we consider cash flow the same as profit? Or are they different from each other? Cash flow vs. profit.

Let’s take a full grasp of the topic “Cash Flow vs Profit”.

Is Cash Flow the Same as Profit?

In This Article

ToggleCash flow and profit are the important financial metrics of a business that display the performance and growth of a business. Before establishing any business, an entrepreneur should have proper knowledge about its particulars and the financial statements that can ease the evaluation of the business performance. To know how the business is running, it’s important to consider a few figures, like profit and cash flow. An entrepreneur, as well as an accountant, should also understand the difference between both of the terms.

Our guide will assist you in identifying the difference between cash flow & profit and the importance of both in financial metrics. Let’s get familiar with them to understand more about the topic.

What is Cash Flow?

There is a continuous movement of cash in every business. Sometimes this movement brings the cash in and sometimes out. In technical terms, it is the net amount of cash and cash equivalents transferred in and out from an organization or the cash flow. Cash received shows inflows, while money goes out represents outflows.

- Cash flow refers to the movement of cash flow (in or out) from an organization in a specific time period.

Let’s take an example of a retailer who sells the items from his stock; here, the cash comes in and vice versa if he buys something from the wholesaler. You can also represent this cash movement by negative cash flow and positive cash flow. Hence, a business’s cash flow is crucial for evaluating an entity’s liquidity and overall financial performance in a certain period. Richard Branson truly observed that no cash, no business, he said that:

Never take your eyes off the cash flow because it’s the lifeblood of business.

Richard Branson

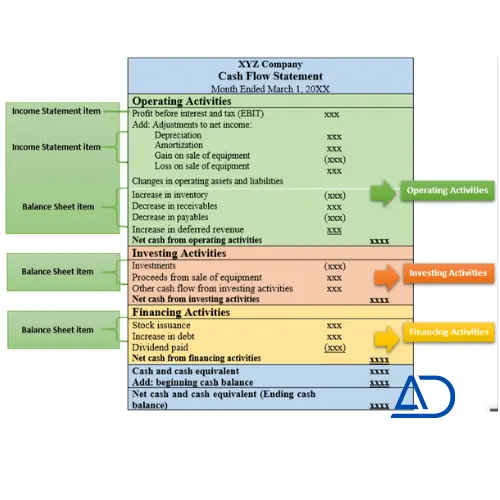

An organization’s cash flow is divided into three major activities of cash movement; cash flows from operations, investing, and financing activities.

- Operating Cash Flow: The operating cash flow belongs to the daily operations of a business. It shows that the organization is producing enough cash, which is necessary for its maintenance and expansion. There should be a net income figure, plus or minus (the working capital changes).

- Investing Cash Flow: It belongs to the occurrence of gains/losses from investments (securities) in the financial market. It also shows the cash flow movement in investments of property, plant, equipment & other assets.

- Cash Flows from Financing Activities: This relates to the increases or decreases in non-current liabilities, owners’ capital, or dividends.

Cash Flow Formula

Calculating the business cash flow is comparatively easier than you may think. Once a business gets all these three figures, it can adjust them with the beginning cash balance to gain the final net cash balance.

Therefore, this can be interpreted as;

Cash Flow Formula

Cash Flow = Cash flow from operating activities +/- Cash flows from investing activities +/-Cash flows from financing activities + Beginning cash flows.

Cash Flow Example

The cash flow statement shows the outflow & inflow of a business’ cash. The cash flow statement cannot start without income statement figures. It starts with the net profit/ loss and moves forward to exhibit how well an organization manages its cash position. Here you see that how cash flow particulars differ from profit:

What is Profit?

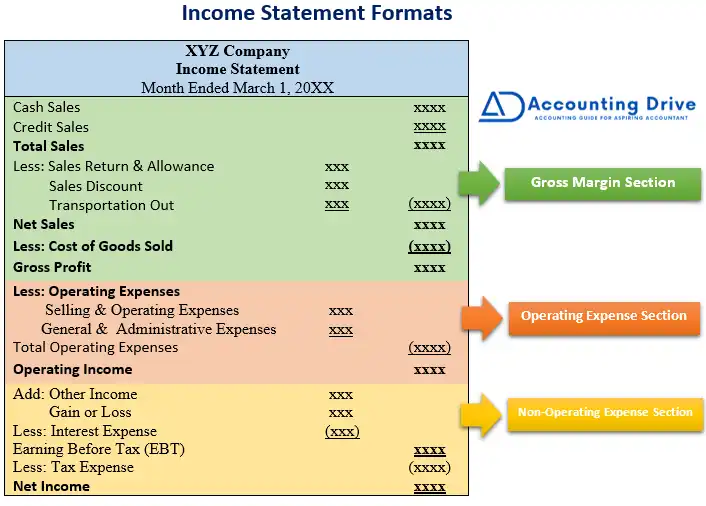

Compared to the cash flows, when you deduct all the costs from the revenue, the remaining amount is termed as the profit (also known as “net income”). The major aim of any business is to get money; while the performance of a business is judged through its profitability, which has various forms. While several stakeholders use this information to make informed, timely decisions depending on their interest in the company, like some are interested in gross profit, some are interested in net profit, same case in profit before interest and tax and profit after interest and tax—these all-profit figures available in the income statement.

- Profit shows the amount of money remaining after all expenses have been paid, which means that increasing profit margin is beneficial for the entity.

There are two major types of profit:

- Gross Profit: Gross profit represents the entity’s profit that a business gets by deducting the cost of sales from the revenue.

- Net Profit: It is the profit made by the organization after deducting all other costs, like taxes & operating expenses (e.g., legal fees, rent, and payroll).

Moreover, if a company wants to evaluate its performance from previous periods or any competitor, these different profit figures represent certain information against those benchmarks. Profit shows the amount of money remaining after all expenses have been paid, which means that increasing the profit margin is beneficial for the entity.

Profit Example

Profit shows the amount left over after all expenses have been paid. Here you will see the particulars of the income statement:- one of the main particulars is profit.

Difference Between Cash Flow and Profit

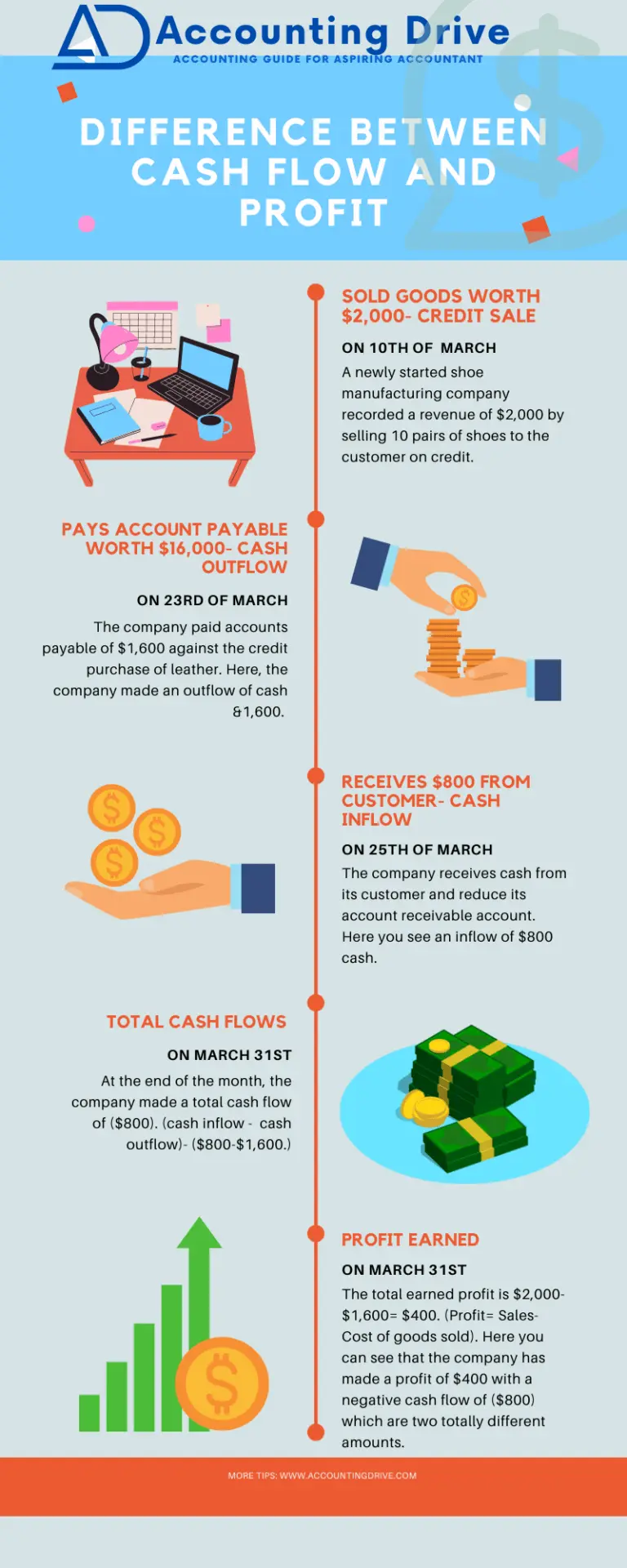

So, the most important question is cash flow and profit identical? So, the answer is No. They are quite different from each other.

Profit and cash flow are basic elements of a successful, expanding business, but they are not similar. The outflow and inflow of cash represent the liquidity of the company. On the other hand, profitability shows the income and expenses of the company. By keeping this view, the major difference between these two terms is time.

The major difference between Cash flow and profit is time because Cash flows represent the liquidity of the company while profitability represents the income and expenses of the company.

Difference between cash flow and profit

Liquidity is a short-term phenomenon; for example, can a company pay its bills, rent, etc.? While profitability is a medium-term judgment like the company is earning money or not? A cash flow statement represents the company’s liquidity, while an income statement represents the company’s profitability. Or by keeping in mind the time factor, profit exhibits the immediate success of the business. At the same time, cash flow may be more inclined toward determining the company’s long-term financial outlook.

Example: Cash Flow vs. Profit

Which is More Important, Cash vs. Profit?

Cash flow & profit, as two important and related financial standards: Which is more important?

The answer to this query is complex. Profit and cash flow both are crucial in their ways. Here, how cash flow is more important than profit? For example, when a company’s money is stuck in accounts receivable or stock; it may not be able to pay its liabilities, such as payroll. Here, cash flow is more important than profit. By the time the company could not come in profitability, which can also affect the cash flows. Here unprofitability is threatening the daily operations, and in this case, we would prioritize profitability as it is important for the company’s existence in the long term.

What is the Relationship- Cash flow vs. profit?

It is possible that a company is profitable but has negative cash flow, making it difficult to pay its expenses and eventually expand & continue its business. Likewise, it’s possible that a company is incurring positive cash flow but could not make enough profit; it happens with new business. Chris Chocola said very well about it.

“The fact is that one of the earliest lessons I learned in business was that balance sheets and income statements are fiction, cash flow is reality.”

Chris Chocola

Hence, Profit and cash flow have many financial terms, standards, and ratios that you must familiarize yourself with to make informed decisions for a business. By acquiring a thorough knowledge of major financial principles, it’s not impossible to advance professionally and become a smart accountant, business owner, or investor.

Key Points

- Cash flow and profit are two distinct terms.

- Cash flow is the movement of cash within an organization- cash comes in and goes out.

- Cash inflow- When you receive payment from customers.

- Cash outflow- when you made payments to your suppliers.

- Profit is the remaining amount after deducting all incurred expenses.

- Cash flow is related to the liquidity of the company, while profit is related to the money earned.