Are you here to learn how to prepare an income statement without any hassle? Then here, after reading this article, you will definitely do it easily. In this article, I will enlist easy steps and will provide step by step guide on how to prepare an income statement from available data. Let’s first explore it with me.

What is an Income Statement?

In This Article

ToggleThe income statement mainly focuses on the revenue, expenses, gains, and losses of a company during a specific time period. Its main focus is to shows the financial position of a company over a specific time period. Moreover, as compared to balance sheet and cash flow statement, an income statement is one of the most important financial statement that depicts a company’s true financial performance over a specific period of time. It is also known as profit and loss statement.

An income statement is a financial report that lists and describes a company’s earnings and outlays over a reporting period and displays the company’s financial position at the time the statement is made.

Income Statement Formula

Gross profit = Net sales – COGS

Operating income/ EBIT = Gross – Operating expenses

Net income = EBIT – (interest expense + Tax expense)

Key Terms

Moving further toward our main topic, you first must understand following terms of income statement. As you know, an income statement is all about earnings and losses, so here are some important terms with its definition and formulas to better guide.

Item | Definition | Formula |

Net Sales | Net sales are the income that a company earned by selling its final goods and services. | Sales – Sales return & allowance – Sales discounts – Transportation Out |

Total Purchases | It depict the total cost after deducting purchase discount and return. | Purchases – Purchase return – Purchase discounts + Transportation In |

Cost of Goods Sold | COGS include all the cost associated to make the product. | Opening Inventory + Purchases – Ending Inventory |

Gross profit | Profit earned the by deducting main/ direct cost. | Net Sales – COGS |

Operating Income | Reduce operating expenses from gross profit. | Gross profit – Operating Expenses |

EBIT | Include other income you received from other sources. | Operating income + Other Income |

EBT | Less interest income from EBIT | EBIT – Interest Expense |

Net Income | Finally you got the income after reducing all expenses. | EBT – Tax Expense |

Income Statement Format

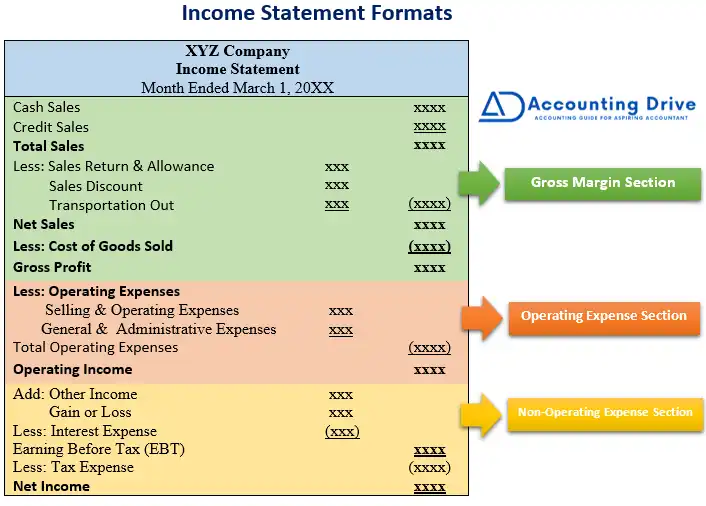

According to the format, there are three main sections: Gross Margin section, Operating expense section, and the non-operating expense section. Each section contains some steps.

Steps of Preparing an Income Statement

Preparing an income statement requires 8 steps to follow.

- 1st Step: Calculate Net Sales

- 2nd step: Calculate Cost of Goods Sold

- 3rd Step: Calculate Gross Profit

- 4th Step: Calculate Operating Expenses

- 5th Step: Calculate Operating Income

- 6th Step: Calculate the Net Income before Interest & Taxes (EBIT)

- 7th Step: Calculate EBT

- 8th Step: Calculate Net Income

If you find it difficult to prepare then NO WORRIES, it’s just a click away. For you, here is the free excel income statement template. Download it and prepare income statement in a minute.

Now let’s discuss each step in detail.

STEP 1: CALCULATE NET SALES

The first step is to calculate the net sales. Net sales is the total earning a company receive after reducing all sales related expenses. You can calculate it by simply following these steps:

Cash sales xxx

Add: Credit sales xxx

Total sales xxx

Less: Sales discount (xxx)

Less: Sales return & allowance (xxx)

Less: Transpiration-Out (xxx)

Net Sales xxxx

To make the process more easy, there are number of online accounting software available that are offering number of built-in functions such as income statement, balance sheet, and cash flow statement templates.

STEP 2: CALCULATE COST OF GOODS SOLD

The next step is the calculation of the COGS (Cost of Goods Sold). COGS is the direct cost that incurred to make a product. In order to calculate it, first take the beginning inventory then add total purchases in it and then less the ending inventory of the company. You should follow the below listed COGS (Cost of Goods Sold) Format.

Opening Inventory xxx

Purchases xxx

Less: Purchase discount (xxx)

Less: Purchase returns & allowances (xxx)

Add: Transpiration-In xxx

Total Purchases xxx

Goods available for sale xxx

Less: Ending Inventory (xxx)

Cost of Goods Sold xxxx

STEP 3: CALCULATE GROSS PROFIT

3rd step requires you to calculate Gross Profit. You can easily find it by subtracting the cost of goods from net sales.

Net Sales xxx

Less: Cost of Goods Sold (xxx)

Gross Profit xxx

STEP 4: CALCULATE OPERATING EXPENSES

In this step, calculate all the operating expenses of your company such as rent expenses, depreciation, maintenance charges, salaries expenses, and other expenses incurred during the period. Unlike COGS, operating expenses are indirect cost hat are required to complete the administrative and selling process.

STEP 5: CALCULATE OPERATING INCOME

It’s very simple step, here you will calculate your operating income as follows:

Gross Profit xxx

Less: Operating Expenses (xxx)

Operating Income xxx

STEP 6: CALCULATE THE NET INCOME BEFORE INTEREST & TAXES (EBIT)

In this step, you will add your other non-operating income: income you receive from other sources such as investment in stock or properties.

STEP 7: CALCULATE EBT

EBT is the earning before tax. To calculate it, just less interest expense from the EBIT.

Earnings before Interest & Tax xxx

Less: Interest Expense (xxx)

Earning before Tax xxxx

STEP 8: CALCULATE NET INCOME

This is the last step in which you can easily find the net income by subtracting all the taxes of company from its income (EBT). Here, you will get your final net income you actually earned.

Earning before Tax xxx

Less: Tax Expense (xxx)

Net Income xxxx

Income Statement Example

Let’s move toward the practical example of how to prepare an income statement.

Below is the portion of adjusted trail balance of the Inshirah Company. On March 1st, the company possess merchandise inventory of $5,000.

Inshirah Company

Trial balance as on March 31st, XXXX

Debit | Credit | |

Sales | $100,000 | |

Sales return & allowance | $1000 | |

Sales discount | 500 | |

Purchases | 70,000 | |

Insurance charges | 6,000 | |

Purchase discount | 600 | |

Freight In | 400 | |

Depreciation expense | 2,000 | |

Salaries Expense | 6,000 | |

Merchandise Inventory | 20,000 | |

Building maintenance | 5,000 | |

Adverting expenses | 1,000 | |

Interest Expense | 1,000 | |

Tax expense | 7,500 |

Inshirah Company

INCOME STATEMENT

For The Year Ending March 31st, XXXX

Sales | $100,000 | |

Less: Sales discounts | $1000 | |

Sales return and allowances | 800 | |

(1,800) | ||

Net sales | 98,200 | |

Less: Cost of goods sold | ||

Beginning inventory | 5,000 | |

Add: Purchases | 70,000 | |

Freight-in | 400 | |

75,400 | ||

Less: Purchase discount | (600) | |

Goods available for sale | 74,800 | |

Less: Ending inventor, Dec 31 | (20,000) | |

Cost of goods sold | (54,800) | |

Gross profit |

| 43,400 |

Operating expenses |

|

|

Adverting expenses | 1,000 | |

Depreciation expenses | 2,000 | |

Building maintenance | 5,000 | |

Salaries expense | 6,000 | |

Insurance Charge | 6,000 | (20,000) |

EBIT (Earnings before interest & tax) |

| 23,400 |

Less: Interest expenses | (1,000) | |

Income before tax |

| 22,400 |

Less: Income tax expense | (7,500) | |

Net income |

| 14,900 |

Here, you can see that company’s net income for the period ended March 32st is $14,900. It depicts that after paying all expenses, Inshirah Company actually earn $14,900. In order to analyze company’s actual performance, you can use vertical and horizontal analysis and well as ratio analysis. Vertical and horizontal analysis will depicts company’s current performance compared to its previous year’s performance. Moreover, ratio analysis will help to identify company’s performance over its competitors.

Key Points

- An income statement depicts a company’s financial performance by listing all of its expenses as well as how much money it has earned during the reporting period.

- It is a most important financial statement among all three statements.

- An income statement can be prepared on monthly, quarterly, and annually basis.

Recommended Articles

Get Free access to the AD's Income Statement Template

Grab your free income statement template now by clicking the button !!