The questions like what is unearned revenue? How to calculate it and recognize it? When is it transferred from the balance sheet to the income statement? All these questions are addressed here just read ahead!

Quick Through

- Is unearned revenue a liability? Yes

- Unearned revenue Debit or credit? Credit

- Unearned revenue Is what type of account? Current Liability account.

- Formula? (Total amount/ No. of months)

What Is Unearned Revenue?

Unearned revenue can also be called deferred revenue. It is the revenue that a company receives in advance. In simple words, when a company receives advance payment for the goods or services that are yet to be delivered. For example, let’s assume you are going out of the city for a meeting. You have to book a flight for Monday. You make advance payment for that purpose. In this case, the payment you made is unearned until and unless you avail of the service that is traveling.

- It is the amount that a company receives in advance. For that advance payment, the company has to deliver goods or services in the future.

How can the revenue be unearned? And if it is unearned, how is it revenue? tricky questions? No worries here we are to wipe out all the queries in your mind

Related Terminologies

First of all, what you need to know is what is revenue. The benefit that a company receives after selling its products or after delivering its services is revenue. It is usually in the form of cash. The question is how is it unearned? Let’s understand it with the help of an example.

For instance, in the month of January Ali and sons’ group of the companies sells goods worth $20,000 to the customer. The customer makes an advance payment before receiving goods. In this case, the revenue Ali and sons’ group company received is unearned. When the customer will receive the goods in the future then the revenue will become earned.

Do you know there is one more term used for that? Yes! Another term is what we call prepaid income or prepaid revenue.

Example (Unearned vs Accrued)

Accrued Revenue

You may better understand the term unearned by knowing what is not unearned. For instance, a company performs services worth $30,000 in the month of August. But the services are on account. So here, work has been done to the customer or delivered to the customer, but the payment has not been received as yet. The company will pass the journal entry, by debiting account receivable which is an asset and an increase in the asset is debit. On the other, we will credit service revenue. Why? because we have performed the services, therefore, we have a right to credit our revenue account. And an increase in revenue is a credit to the revenue account. Hence, the revenue account will be credited $30,000. This is an example of accrued revenue.

| Date | Particular | Debit | Credit |

| xxx | Account receivable | $30,000 | |

| Service revenue | $30,000 |

Unearned Revenue

Contrarily, Unearned revenue which you may also call deferred revenue occurs when payment is made in advance by the customer. For instance, a customer subscribes to an online class course worth $2,000 for the month of January. And he/ she made an advance payment. In this scenario, the revenue will not be earned as long as services are not provided fully to the customer. In this case, we are receiving money before and we have to do the work for the customer later on.

Now we have to pass the journal entry, it is evident as we have received the cash, and the rise in cash is debit as it is an asset. But the tricky part is what will we credit? As we have not earned the revenue, we cannot credit our revenue account. Revenue accounts can’t be credited as long as goods are not delivered. So, we will credit the unearned revenue account. You may wonder what is it. Is it a revenue account? No, it is not a revenue account as it doesn’t go into the income statement. This account particularly is a liability account which we record in our balance sheet under current liabilities. It is a liability for the company because the company has received the payment before the delivery of goods.

| Date | Particular | Debit | Credit |

| xxx | Cash/ bank | $2,000 | |

| Unearned revenue | $2,000 |

Deferred revenue: Payment before service.

Accrued Revenue: Service before payment.

- A liability.

- Receiving payment before delivering goods.

- An obligation for the company.

It’s very easy. To calculate it, you first have to divide the total amount received by the number of months you agreed to deliver services. To understand this whole process, let’s have an unnamed revenue example. ABC company is a rental company that provides cars to its customers for rent for personal use. In the month of August, the company receives an advance payment of $10,000 from the client for 4 months’ rent. Now, the ABC Motor Company is bound to deliver the car to the customer for 4 months. In this scenario, the company will record the payment from the customer as a liability on its balance sheet.

Entries

Here the company receives an advance payment. Thus, it is unearned revenue. To record a journal entry for it, we will debit cash and credit unearned revenue under current liabilities.

Unearned Revenue Journal Entry

| Date | Particular | Debit | Credit |

| XXX | Cash | $10,000 | |

| Unearned Revenue | $10,000 |

Now, after one month, the company has to first calculate its first month’s earned revenue. So, to calculate it, divide the total amount by months (10,000/ 4), and the adjusting entry would be:

Unearned Revenue Adjusting Entry

| Date | Particular | Debit | Credit |

| XXX | Unearned Revenue | $2,500 | |

| Earned Revenue | $2,500 |

Then each month, the company will record its earned revenue in the same manner.

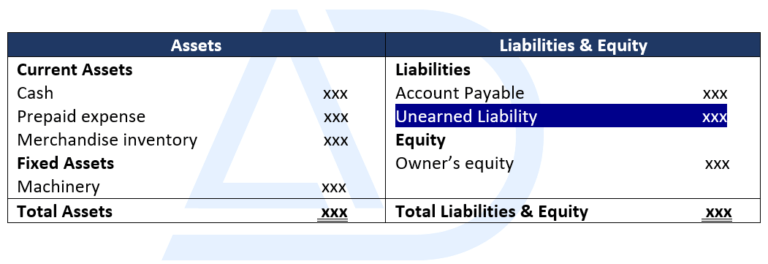

In Balance Sheet

Unearned revenue in the balance sheet is considered a liability as long as goods or services are not delivered. Hence, we record it as a liability on the balance sheet. How is it a liability? It is a liability as the company is obliged to provide services, liability is not always in the form of cash (you have to make payment). In this case, the company is liable to provide services for the amount which it has already received. Moreover, Once the goods are delivered to the customer, it becomes the earned revenue and will be transferred to the income statement.

Unearned Revenue Vs Deferred Revenue

Are you looking for the answer to the question such as: What is unearned revenue? What is deferred revenue? and is there any difference between them? Let’s explore answers to these tricky questions.

Unearned revenue is also known as deferred revenue. In other words, it is another name given to deferred revenue. So, there is no difference between these two terms. Moreover, by hearing the term deferred revenue you may think twice, what is it? Yes? But the term unearned is very clear which is specifically referring to the revenue which is unearned. On the other hand, deferred means to postpone. So, deferred revenue means the revenue which you actually earn later- at some future date.