For any type of bussiness, working capital is considered as backbone and play’s crcial role in its financial progress. Working capital is simply a capital that company’s nees to operate its bsusiness.

For students, this article will be beneficial becuase students can find some practice questions, and can get answers by just directly messaging at [email protected].

Practice Questions

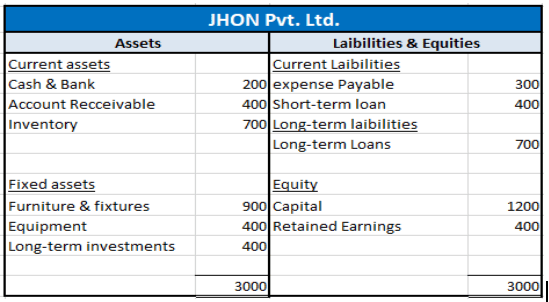

Question: 1

John Pvt. Ltd. has the following Balance Sheet at the end of its financial year 2020. Find how much working capital does it need to meet its operating needs?

Question: 2

Digital Systems has current assets of Cash of $20,000, Accounts Receivable of $50,000, and Inventory of $40,000. The total of its current liabilities is $80,000 and its total liabilities are $190,000. Calculate the working capital of the company.

Question: 3

Appen Global is starting a new project that will decrease inventory by $6,000, increase fixed assets by $30,000, increase Accounts Payable by $19,000 and increase Accounts Receivable by $20,500.

Determine how much cash should the firm use for covering the initial working capital of this project?

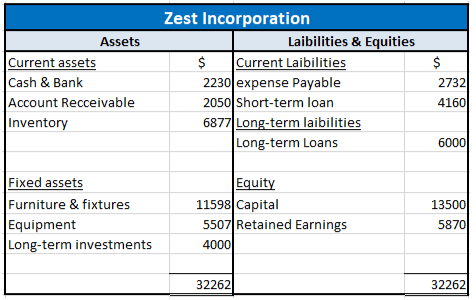

Question: 4

Zest Incorporation has the following balance sheet at the end of the year. Calculate how much working capital it needs for the coming year.

Question: 5

The balance sheet of Johnson’s Ltd. is showing current assets of $4,000,000 and current liabilities, including:

- Accounts Payable of $8,00,000

- 5% Short-term Notes Payable of $500,000

- Accrued wages & taxes of $2,50,000

How much working capital Johnson’s Ltd. requires to meet its operating cash flow needs?

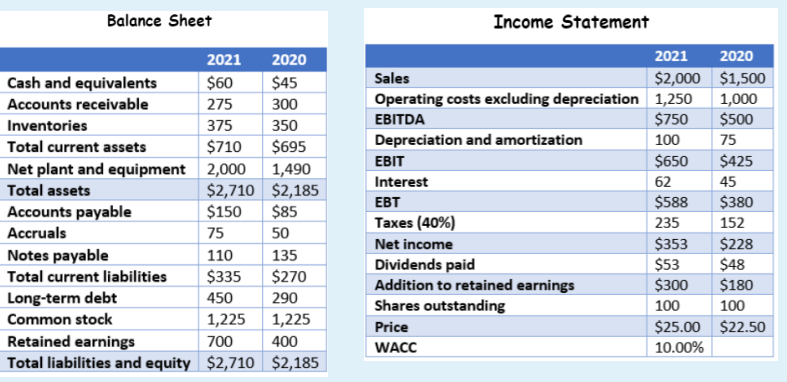

Question: 6

Dope Tech Pvt. Ltd. has the following Balance Sheet and Income statement at the end of its financial year 2020 and 2021.

Calculate Dope Tech’s net working capital for 2021.

Question: 7

Trion Co. has the following accounts and balances at the year-end balance sheet, calculate the gross working capital and the net working capital.

- Accounts Payable: $ 2,500

- Accounts Receivable: 4,500

- Cash: 3,000

- Marketable Securities: 1,500

- Merchandise Inventory: 7,500

- Notes Payable in Three Years: 6,500

- Property, Plant, and Equipment: 20,000

- Common Stock: 24,000

Question: 8

Following are the Income statement and Balance sheet of Fiscal Analytics for the year ended 2020 and 2021.

- Calculate the change in cash in the year 2021.

- Calculate the gross working capital for 2020 & 2021.

- Calculate the net working capital for 2021.

| Revenue | $890 |

| Expenses | 635 |

| Depreciation | 104 |

| Net income | 151 |

| Dividends | 131 |

| Balance Sheet | ||

| 2021 | 2020 | |

| Assets | ||

| Cash | 93 | 69 |

| Other Current Assets | 198 | 179 |

| Net Fixed Assets | 404 | 384 |

| Total Assets | 695 | 632 |

Liability & Equity | ||

| Accounts Payable | 153 | 129 |

| Long-term debt | 173 | 154 |

| Stockholders equity | 369 | 349 |

| Total Liability & Equity | 695 | 632 |

Question: 9

Macro Mobiles has the following account balances inventory of $35,100 equipment of $94,400 accounts payable of $16,000 cash of $6500 and Accounts Receivable of $23,600.

How much net working capital does the firm need?

Question: 10

Neft corporation has estimated that it requires 40% of sales in net working capital. In year 1, sales were $1 million and in year 2, sales were $2 million.

Is the change in net working capital from year 1 to year 2 is:

- Cash inflow of $400,000.

- Cash outflow of $400,000.

Answers

To get the answers to these questions just message at [email protected].