In order to understand what is account receivable turnover? In the first place, it is necessary to understand what is account receivable- AR?

So, account receivable is the account in which a company records all the amount that it is going to receive in its future. For instance, when a company sells its goods or provides its services on credit, the company records it as an AR.

What is Account Receivable Turnover?

In This Article

ToggleAfter understanding what account receivable is? Let’s now jump toward our main topic without wasting our time. So, what is account receivable turnover? It can be described as how many times in a given year or a period, a company collects its average account receivables.

For instance, a company has sold 1,00,000 goods to its customer on credit. With the help of the Turnover ratio, we can calculate how many times a company has received the respective amount.

Some companies, sell their product to customers on credit. This means they give them some time to pay for the products. This time may vary from days to months. So, the receivable turnover ratio reflects how effectively the company collects its receivables. In addition, the Receivable turnover ratio is calculated for a particular period. It can be monthly, quarterly, or yearly basis.

There are two ratios to check the efficiency of account receivables one is the account receivable turnover ratio while the other is the account receivable days ratio.

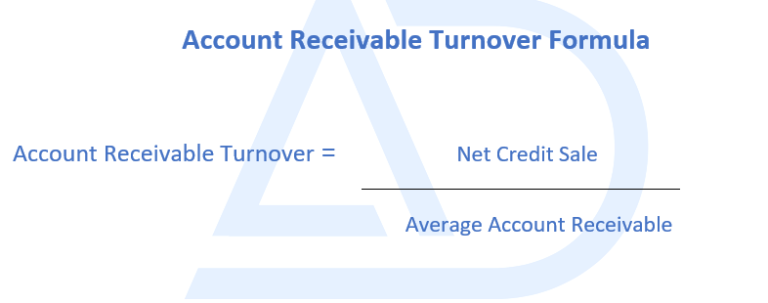

Account Receivable Turnover Formula

To calculate AR turnover let’s understand its formula.

The account receivable turnover ratio is calculated by dividing the net credit sale during a period of time by the average AR during the same period. By net credit sales, we mean the sale that we have done on credit during a given period of time. Moreover, we need to minus all the amount that we have received.

Account receivable turnover formula

Steps to Calculate Account Receivable Turnover Ratio

- Step 1- Calculate net credit sales

- Step 2- Calculate the Average account receivable

- Step 3- Divide net credit sales with the average AR

- Step 4- Analysis and interpretation of the results

Let’s apply these steps to an AR turnover example.

The oil manufacturing company had $5,60,000 in net credit sales and $10,000 in sales return. On the first of January, it had a $50,000 AR (beginning) and on December 31st it had a $52,500 AR (ending). We will calculate the account receivable turnover ratio for the year by using the above-mentioned formula.

Step1- Calculate Net Credit Sales

The first step is to calculate the net credit sales. The net credit sales formula is:

Net Credit Sales = Credit sales – Sales return – Sales discount

So here, if we put the given information in the formula, it would be like this:

Net Credit Sales = 5,60,000 – 10,000 = $5,50,000

So, the net credit sales are $5,50,000.

Step 2- Calculate the Average Account Receivable

So, the average accounts receivable formula would be:

Average Account Receivable = ( Opening Account Receivable + Ending Account Receivable ) / 2

Average account receivable = (50,000 + 52,500) / 2= $51,250

The average AR is $51,250.

Step 3- Divide Net Credit Sales with the Average AR

Now divide the total net credit sales of $5,50,000 by the average AR of $51,250.

Account receivable T.R = 5,50,000 / 51,250 = 10.73 times

Here, the net credit sales of 5,50,000 are received by the company 10 times. Or the company is converting its AR into cash 10 times in a given time period.

Step 4- Analysis and interpretation of the results

The AR turnover ratio indicates the capability of the company and how quickly its receivables are converted into cash. Here, the ratio indicates that the company is converting its receivables into cash 10 times in a given period. Is it a good ratio or bad? You can analyze it by comparing your turnover with the previous year’s turnover. If it is increasing, it means that the company is improving its credit collection capability by applying Strick credit collection policies. Moreover, you can also compare your turnover ratio with the competitor companies. If our ratio is higher than theirs, then it is a good sign (only compare it with similar companies that have a similar business model as you have).

Account Receivable Days (Formula and Calculations)

As we have discussed the AR turnover formula and calculation, now moving toward the account receivable days discussion. Here, instead of looking at the number of times that account receivable turns over in a year or given period. We are going to look at the average number of days for that account receivable to turn over. Therefore, here we will see how many days the company takes to receive its credit sale amount.

Account Receivable Days Formula

Account Receivable Days = Number of Days in the Period / Receivable Turnover Ratio

The result from this calculation will be the average number of days that it takes for a company to receive payments for its credit sales. Furthermore, a Low number of receivable days is better than a higher number of receivable days.

Let’s calculate the AR turnover days ratio by using the above-given formula and example.

Account receivable days = 365 / 10.73 = 34.01 days

This suggests that the company receives its account receivable at the interval of every 34 days. This means after every 34 days, one of the payments for account receivable is received.

What Is A Good Account Receivable Turnover Ratio?

The question above is not very difficult to answer. It is high account receivable which is considered to be good and effective for a company.

- A high account receivable turnover ratio indicates that the company is collecting payments quickly, and effectively. Moreover, it has quality customers who do payments on time.

- A low account receivable turnover ratio suggests that the company is not collecting payments effectively or has been paid more slowly. Furthermore, it also indicates the company’s credit collection process is poor. Or maybe the customer’s financial position is not good.

If the company’s turnover ratio is low, it could mean a few things:

- The company is giving too much credit to its customers.

- It is operating in an industry where customers typically take a longer time to pay.

It is, therefore, necessary for a company to have a high account receivable ratio and use some tips to improve it.

Key Points

- Account receivable is a credit sale.

- It indicates how many times you receive payment for your credit sales in a given period.

- Account receivable turnover days are at what interval of days you receive the amount.