When it comes to running a successful business, understanding the various benefits of retained earnings and how to maximize them is essential. Retained earnings are an important source of capital for businesses and can be used to finance a variety of investments and operations. By understanding the benefits of retained earnings and how to maximize them, businesses can ensure that they are using their resources in the most effective way possible.

Retained earnings refer to the portfolio of net income that a company has for its business rather than distribute to shareholders. They are typically reported as a separate line item on the balance sheet.

They are an important part of a company’s financial picture. Companies should carefully consider their retained earnings before making any significant financial decisions.

What Is Retained Earning?

In This Article

ToggleRetained earnings is the cumulative total of all profits (net income) that a company has retained since its inception. It represents the amount of money that has been reinvested in the company after all other expenses, such as taxes, dividends, and operating costs, have been paid.

The statement of retained earnings is typically found on the balance sheet and shows the total amount of retained earnings at the end of a reporting period. It is important to investors because it provides valuable information about a company’s financial health and profitability. It is also used to calculate the company’s return on equity, which is a measure of how efficiently a company is using its retained earnings.

Retained earnings are created when a company makes a profit. The portion of the profit that is not paid out to shareholders is referred to as retained earnings. These funds are reinvested back into the company and can be used to help fund growth and expansion.

Under International Financial Reporting Standards (IFRS), the Statement of Retained Earnings is known as the Statement of Changes in Equity. This statement includes all changes in equity during the period, including changes arising from transactions with owners in their capacity as owners.

The items commonly included in the Statement of Retained Earnings according to IFRS:

- Beginning Retained Earnings: This is the balance of retained earnings at the beginning of the period covered by the statement.

- Net Income: This is the amount of profit or loss earned by the company during the period, after deducting any taxes and other expenses.

- Dividends: This is the amount of money paid to shareholders as dividends during the period.

- Other Comprehensive Income: This includes gains and losses that are not recognized in the income statement but are shown separately. Examples of items included in other comprehensive income are foreign currency translation gains or losses and gains or losses on cash flow hedges.

- Ending Retained Earnings: This is the balance of retained earnings at the end of the period covered by the statement, which is calculated by adding the net income, subtracting dividends, adding or subtracting other comprehensive income, and making any necessary adjustments.

It’s important to note that the specific items included in the Statement of Retained Earnings can vary depending on the company and the reporting requirements of the relevant accounting standards.

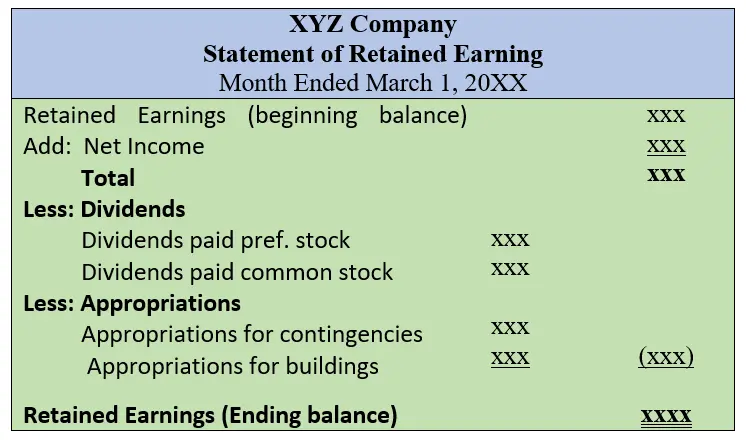

Statement of Retained Earning Format

Purpose of Statement of Retained Earning

The purpose of the Statement of Retained Earning is to show the changes in a company’s retained earnings over a specific period of time. Retained earnings represent the portion of a company’s profits that are not distributed to shareholders as dividends but instead are kept by the company for reinvestment in the business or other purposes.

The Statement of Retained Earnings is a component of a company’s financial statements and is typically prepared on an annual basis. It is used to provide information to investors, creditors, and other stakeholders about the company’s financial performance and its ability to generate profits that can be reinvested in the business.

The Statement of Retained Earning also helps to reconcile the beginning and ending balances of retained earnings, and provides a detailed breakdown of the components that make up the change in retained earnings over the period. This information can be useful in assessing the financial health of the company, and in making investment decisions.

How to Prepare Statement of Retained Earning?

Preparing a statement of retained earnings involves several steps. Here is a general outline of the process:

- Gather Financial Information: Collect the financial statements for the period you are reporting on, including the income statement, balance sheet, and statement of cash flows. You will need this information to calculate the beginning and ending balances of retained earnings.

- Calculate Beginning Retained Earnings: Determine the balance of retained earnings at the beginning of the period by reviewing the previous period’s retained earnings balance.

- Calculate Net Income: Calculate the net income for the period by subtracting all expenses from revenues. You can find this information on the income statement.

- Calculate Dividends: Determine the amount of dividends paid to shareholders during the period, which can be found in the cash flow statement or in the notes to the financial statements.

- Calculate Other Comprehensive Income: Determine the amount of other comprehensive income for the period, which can be found in the statement of comprehensive income or in the notes to the financial statements.

- Make Adjustments: Make any necessary adjustments to the beginning balance of retained earnings for errors or changes in accounting policies.

- Calculate Ending Retained Earnings: Calculate the ending balance of retained earnings by adding the beginning balance of retained earnings, net income, any adjustments, and other comprehensive income, and then subtracting dividends.

- Prepare The Statement: Finally, prepare the statement of retained earnings by presenting the beginning balance of retained earnings, the net income, dividends, other comprehensive income, adjustments, and ending balance of retained earnings in a clear and concise format.

It’s important to note that the specific requirements for preparing a statement of retained earnings can vary depending on the relevant accounting standards and the reporting requirements of the company. It’s always a good idea to consult with a qualified accountant or financial professional to ensure that you are following the appropriate guidelines and procedures.

Retained Earning Example Question

Style Zone is a shoe manufacturing Company. In 2022, the company’s revenues and expenses are $1,000 and $400, respectively & declared cash dividend $200. From the following Balance sheet of Style Zone, Calculate retained earnings for the year ended December 31st 2022.

Calculate retained earnings for the year ended December 31st 2022.

Style Zone Balance Sheet As on Dec 31, 2021 | |||

Assets | $ | Liabilities & Equity | $ |

Current Assets | Current Liabilities | ||

Cash | 200 | Accounts Payable | 300 |

Account Receivable | 400 | Short term loan | 400 |

Merchandise Inventory | 700 | Non-Current Liabilities | |

|

| Long term loans | 700 |

Total Current | 1,300 | Total Liabilities | 1,400 |

Non-Current Assets | Equity | ||

Furniture & Fixture | 900 | Capital | 1,200 |

Equipment | 400 | Retained Earnings | 400 |

Long term investments | 400 | ||

Total Non-Current Assets | 1,700 | Total Equity | 1,600 |

Total Assets | $3,000 | Total Liability & Equity | $3,000 |

First calculate net income for the year 2022:

Revenues $1,000

Less: Expenses (400)

Net Income $600

Style Zone Statement of Retained Earning For the year ended Dec 31, 2022 | |

Retained Earnings (Beginning balance) | $400 |

Add: Net Income | 600 |

| 1,000 |

Less: Dividend Paid | (200) |

Retained Earnings (Ending balance) | 800 |

Benefits/ Uses of Retained Earnings

The first benefit of retained earnings is that they can be used to finance the growth of a business. Retained earnings are a form of internal financing, meaning that they come from within the company itself. This is beneficial as it allows businesses to use their own funds to finance growth and development, rather than having to rely on external sources of capital, such as debt or equity. This can help a business maintain control over its own destiny and ensure that it is always in a position to take advantage of new opportunities as they arise.

Retained earnings can also be used to pay off debt. A company can use its accumulated profits to pay off loans, leases, or other forms of debt, which can help to improve its balance sheet and reduce its overall debt burden. This is especially beneficial for companies that are highly leveraged, as it can help to improve their credit ratings and make them more attractive to potential investors.

Retained earnings can also be used to pay dividends to shareholders. This is beneficial as it allows shareholders to benefit from the company’s growth and development, while also providing a steady stream of income. This can help to increase the value of a company’s stock and make it more attractive to potential investors.

Finally, retained earnings can be used to finance research and development. This is beneficial as it allows a business to stay ahead of the competition and develop new products and services that can help to increase its market share and profitability.

How to Maximize the Benefits of Retained Earnings?

Now that we have discussed the benefits of retained earnings, let’s take a look at how to maximize them. The first step is to create a comprehensive budget that takes into account all of the company’s income and expenses. This will help to ensure that the company is able to maximize its profits and retain as much of them as possible.

Another way to maximize retained earnings is to invest in projects that have a high return on investment. This means that the company should look for projects that will generate a high rate of return over a short period of time. This could include investing in new equipment, expanding into new markets, or even launching a new product.

Retention Ratio

The retention ratio is a financial metric that measures the percentage of a company’s earnings that are retained by the company for reinvestment in the business, rather than being paid out as dividends to shareholders.

The retention ratio is closely related to retained earnings, as the amount of earnings retained by the company is added to the beginning balance of retained earnings to determine the ending balance of retained earnings for the period.

The retention ratio is calculated by dividing the amount of earnings retained by the company by the total earnings for the period. The resulting percentage represents the portion of earnings that are being reinvested in the business.

For example, if a company has earnings of $1 million for the year, and retains $600,000 of those earnings for reinvestment in the business, the retention ratio would be 60% ($600,000 / $1,000,000). The $600,000 would be added to the beginning balance of retained earnings to determine the ending balance of retained earnings for the year.

The retention ratio is an important metric for investors, as it provides insight into a company’s growth prospects and its ability to generate future profits. A high retention ratio suggests that the company is reinvesting a significant portion of its earnings back into the business, which may lead to future growth and increased profitability. However, a low retention ratio may indicate that the company is paying out a large portion of its earnings as dividends, which may be attractive to investors seeking income but may limit the company’s ability to grow and expand.